California has filed a lawsuit against Amazon (NASDAQ:AMZN) for violating the state’s antitrust law through its pricing model. California’s Attorney General Rob Bonta said that AMZN is blocking third-party sellers on its platform from selling products at lower prices elsewhere. Bonta added that AMZN’s practice pushes prices higher for California consumers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bonta said that Amazon entered into an anticompetitive agreement with third-party sellers and wholesale suppliers on its platform to insulate itself from price competition. He added that due to these agreements, third-party sellers and wholesale suppliers are unable to offer lower prices elsewhere, including its competitors Walmart (NYSE:WMT) and Target (NYSE:TGT).

Though it’s unclear how this lawsuit will impact Amazon, a similar kind of lawsuit was filed against it last year in Washington, D.C., which was later dismissed. However, in all this, one thing that needs investors’ attention is the legal and regulatory risks associated with large tech giants like AMZN.

According to TipRanks’ Risk Factors Tool, AMZN’s legal and regulatory risks account for 25% of the total 24 risks identified for the company. This figure compares unfavorably with the sector average of 15%.

Amid legal and regulatory risks, AMZN is also battling a slowdown in its sales growth. Other than this, cost headwinds from red hot inflation and productivity issues are also taking their toll on the company’s margins.

What Is the Forecast for Amazon Stock?

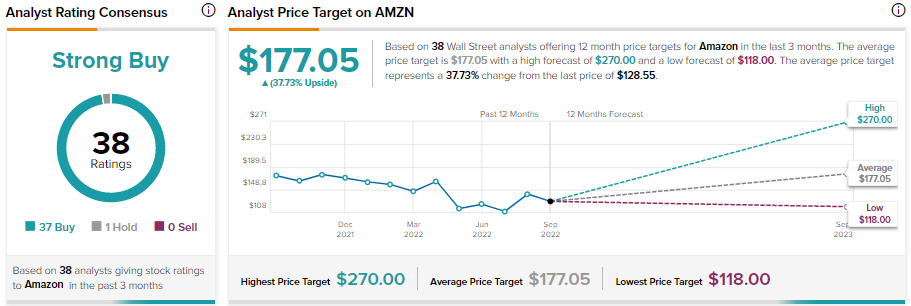

AMZN’s average price forecast of $177.05 implies 37.7% upside potential. Even though AMZN stock has declined nearly 32% from its 52-week high, Street seems to be upbeat about its prospects.

On TipRanks, AMZN stock commands a Strong Buy consensus rating based on 37 Buys and one Hold.

However, AMZN has a Neutral Smart Score of six out of 10 on TipRanks, which indicates that the stock’s performance could be in line with market expectations.

Bottom Line

Amazon is facing several sales and margin headwinds, and this lawsuit adds one more problem for the company and its stakeholders. However, the company’s long-term prospects remain solid, given its market leadership in the e-commerce and cloud businesses. Meanwhile, the easing of macro headwinds and easier comparisons in the coming quarters could give a significant boost to its stock.

Read full Disclosure