Nintendo Co Ltd (JP:7974)

:7974

7974 Stock Chart & Stats

Day’s Range― - ―

52-Week Range¥6,520.00 - ¥11,800.00

Previous CloseN/A

Volume4.68M

Average Volume (3M)N/A

Market Cap

$12.68T

Enterprise Value¥8.68T

Total Cash (Recent Filing)¥1.45T

Total Debt (Recent Filing)¥0.00

Price to Earnings (P/E)39.7

Beta0.75

Next Earnings

May 13, 2025EPS Estimate

30.26Next Dividend Ex-Date

Mar 28, 2025Dividend Yield1.54%

Share Statistics

EPS (TTM)274.64

Shares Outstanding1,298,690,000

10 Day Avg. VolumeN/A

30 Day Avg. VolumeN/A

Financial Highlights & Ratios

PEG RatioN/A

Price to Book (P/B)N/A

Price to Sales (P/S)N/A

Price to Cash Flow (P/CF)N/A

P/FCF RatioN/A

Enterprise Value/Market CapN/A

Enterprise Value/RevenueN/A

Enterprise Value/Gross ProfitN/A

Enterprise Value/EbitdaN/A

Forecast

1Y Price Target

¥11,768.06Price Target Upside10.08% Upside

Rating ConsensusModerate Buy

Number of Analyst Covering8

---

Bulls Say, Bears Say

Bulls Say

Market StrategyThe timing of the NS2 reveal is strategic, coming at a point when Microsoft's focus away from hardware competition with the Xbox series is reshaping the market dynamics, tilting the balance towards Nintendo and Sony.

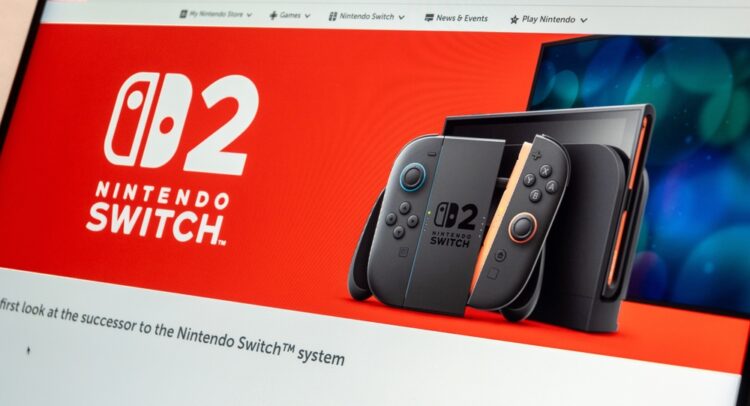

Product LaunchNintendo is set to launch the highly anticipated Switch 2, which is poised to reinvigorate hardware sales.

Software DevelopmentThe Switch 2 launch will catalyze a robust software pipeline from both Nintendo and third-party developers, potentially surpassing the success of its predecessor.

Bears Say

Demand And SupplyThe demand for Switch 2 is likely to outstrip supply for several months or quarters, similar to the original Switch launch.

Financial Performance3Q missed again (OP of ¥126b, -32% YoY).

---

Options Prices

Currently, No data available

---

Ownership Overview

―

Insiders

6.77%

Mutual Funds

<0.01% Other Institutional Investors

84.36% Public Companies and

Individual Investors

7974 FAQ

What was Nintendo Co Ltd’s price range in the past 12 months?

Nintendo Co Ltd lowest stock price was ¥6520.00 and its highest was ¥11800.00 in the past 12 months.

What is Nintendo Co Ltd’s market cap?

Nintendo Co Ltd’s market cap is $12.68T.

When is Nintendo Co Ltd’s upcoming earnings report date?

Nintendo Co Ltd’s upcoming earnings report date is May 13, 2025 which is in 48 days.

How were Nintendo Co Ltd’s earnings last quarter?

Nintendo Co Ltd released its earnings results on Feb 04, 2025. The company reported ¥110.4 earnings per share for the quarter, missing the consensus estimate of ¥121.253 by -¥10.853.

Is Nintendo Co Ltd overvalued?

According to Wall Street analysts Nintendo Co Ltd’s price is currently Undervalued.

Does Nintendo Co Ltd pay dividends?

Nintendo Co Ltd pays a Annually dividend of ¥107.881 which represents an annual dividend yield of 1.54%. See more information on Nintendo Co Ltd dividends here

What is Nintendo Co Ltd’s EPS estimate?

Nintendo Co Ltd’s EPS estimate is 30.26.

How many shares outstanding does Nintendo Co Ltd have?

Nintendo Co Ltd has 1,298,690,000 shares outstanding.

What happened to Nintendo Co Ltd’s price movement after its last earnings report?

Nintendo Co Ltd reported an EPS of ¥110.4 in its last earnings report, missing expectations of ¥121.253. Following the earnings report the stock price went up 2.211%.

Which hedge fund is a major shareholder of Nintendo Co Ltd?

Currently, no hedge funds are holding shares in JP:7974

---

Company Description

Nintendo Co Ltd

Nintendo Co., Ltd., together with its subsidiaries, develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally. It offers video game platforms, playing cards, Karuta, and other products; and handheld and home console hardware systems and related software. The company was formerly known as Nintendo Playing Card Co., Ltd. and changed its name to Nintendo Co., Ltd. in 1963. Nintendo Co., Ltd. was founded in 1889 and is headquartered in Kyoto, Japan.

---

7974 Net sales Breakdown

94.23% Nintendo Switch platform

3.18% Mobile, IP related income

0.35% Playing cards

2.23% Other

---

7974 Stock 12 Month Forecast

Average Price Target

¥11,768.06

▲(10.08% Upside)

Technical Analysis

KONAMI HOLDINGS

―

Capcom Co

―

Sega Sammy Holdings

―

Square Enix Holdings Co

―

Avex Inc.

―

Best Analysts Covering 7974

1 Year

1 Year Success Rate

4/4 ratings generated profit

1 Year Average Return

+23.45%

reiterated a buy rating 15 days ago

Copying Robin Zhu's trades and holding each position for 1 Year would result in 100.00% of your transactions generating a profit, with an average return of +23.45% per trade.

---