Despite releasing results that exceeded both internal and Wall Street expectations, the day did not end well for eBay (EBAY) stock, which fell about 6.5% during extended trading on May 4.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Based in California, eBay operates an online marketplace where people and businesses can come to shop for a variety of products. The company mostly makes money from seller fees. Another revenue source for eBay is advertising services.

Q1 Numbers at a Glance

Revenue fell 6% year-over-year to $2.5 billion, but still exceeded the consensus estimate of $2.46 billion. Additionally, the revenue surpassed the midpoint of the internal guidance range of $2.43 billion to $2.48 billion. The advertising revenue was about $267 million.

Adjusted earnings per share (EPS) of $1.05 slipped from $1.08 for the same quarter the previous year and beat the consensus estimate of $1.03. It also exceeded the midpoint of the internal guidance range of $1.01 to $1.05.

During Q1, eBay returned $1.4 billion to shareholders, which included $1.3 billion in share repurchases and $129 million in dividends. The company’s next dividend payment of $0.22 per share is planned to be distributed on June 17, to shareholders of record on June 1.

eBay’s Downbeat 2Q Outlook Weighs Down the Stock

eBay’s dip following the Q1 report can be attributed to a downbeat Q2 outlook. The company anticipates revenue in the range of $2.35 billion to $2.40 billion, which even at the high end fell short of the consensus estimate of $2.54 billion. The company’s EPS guidance of $0.87 to $0.97 fell short of the consensus estimate of $1.01. Moreover, eBay issued a 2022 full-year outlook for EPS and revenue that missed the consensus estimate.

eBay CEO, Jamie Iannone, said, “Despite the current macro headwinds, we remain confident in the long-term strategy we laid out during our Investor Day in March. We are building an eBay for the future with an eye toward delivering long-term, sustainable growth.”

Wall Street’s Take

On May 3, ahead of the Q1 report, Evercore ISI analyst Mark Mahaney reiterated a Hold rating on ebay with a price target of $69, which indicates 26.8% upside potential.

The rest of the Street is cautiously optimistic about EBAY stock, with a Moderate Buy consensus rating. That’s based on nine Buys versus 14 Holds. The average eBay price target of $65.71 implies 20.8% upside potential to current levels. Shares have declined about 18% year-to-date.

Blogger Opinions

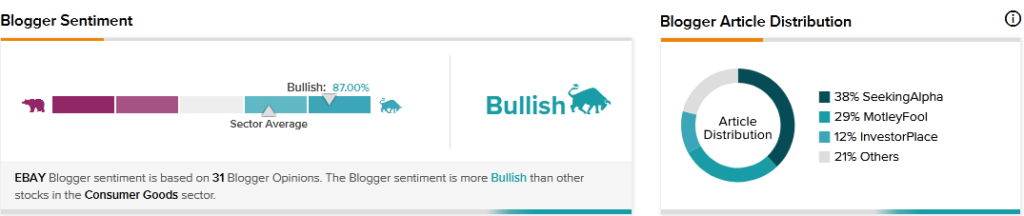

TipRanks data shows that financial blogger opinions are 87% Bullish on EBAY, compared to a sector average of 68%.

Key Takeaway for Investors

Although eBay may have issued a downbeat outlook for the current quarter and year, the stock could soar if the actual results turn out better than expected. While industries across the board are grappling with various macro headwinds, global retail trends generally favor e-commerce businesses like eBay.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Musk to Make Twitter Public Post Turnaround

Universal Technical Acquires Concorde Career Colleges

Hilton Worldwide Stock Falls Despite Q1 Earnings Beat