Shares of ride-hailing service platform Uber Technologies, Inc. (UBER) closed up almost 5% at $34.70, after it announced that it was adding New York City yellow taxis to its app.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

After facing stiff opposition from taxi associations for years, this marks a big win for Uber as both parties find common ground. Uber already has taxi services available on its app in other countries, namely Spain, Germany, and South Korea.

NYC Yellow Taxis to be Listed on Uber App

With increased incentives for retaining and attracting drivers since the onset of the COVID-19 pandemic, ride-hailing companies have been hitting their bottom lines. Moreover, the current Russia-Ukraine war-led rise in gas prices has added to the woes, as drivers shy away from driving for the companies.

At such times, winning the NYC taxi drivers’ approval is a positive for Uber as the company was facing competition for rides and space with them over the past several years.

Two of NYC’s taxi-hailing operating companies, Curb and Creative Mobile Technologies, have agreed to incorporate their software with Uber. This will enable riders to even book taxis from Uber’s app. The launch is expected to go live this spring.

Official Comments

Elated with the deal, the Director of Business Development at Uber, Guy Peterson, said, “This is a real win for drivers – no longer do they have to worry about finding a fare during off-peak times or getting a street hail back to Manhattan when in the outer boroughs… And this is a real win for riders who will now have access to thousands of yellow taxis in the Uber app.”

Uber CEO, Dara Khosrowshahi had also stated that the company intends to add more taxis to the Uber app, beyond NYC. “I will tell you we wanna get every single taxi in the world onto our platform by 2025,” she had stated in an interview with CNBC last month.

Analysts’ View

Following the news, Stifel Nicolaus analyst Scott Devitt stated that this deal is a win-win situation for all parties. Further, he believes this will reduce Uber’s competition and will accelerate the company’s growth in one of the most lucrative markets.

Nicolaus reiterated a Buy rating on the UBER stock with a price target of $48, implying 38.3% upside potential to current levels.

Meanwhile, MKM Partners analyst Rohit Kulkarni believes that the deal marks more of a sentimental driver for Uber’s shares. Moreover, the analyst added that the uncertain regulatory headwind for Uber will continue to affect the positive news of the deal.

Kulkarni also maintained a Buy rating and price target of $65 on Uber, which implies 87.3% upside potential.

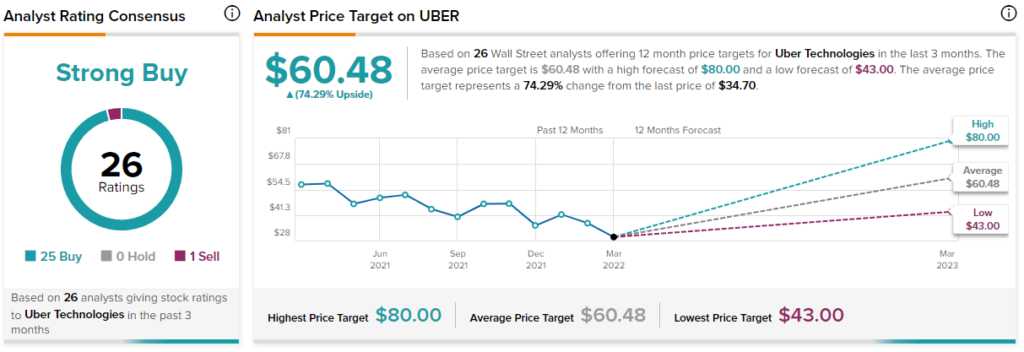

Overall, the UBER stock commands a Strong Buy consensus rating based on 25 Buys and one Sell. The average Uber stock prediction of $60.48 implies 74.3% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Spotify Strikes Billing Deal with Google, Stock Up 3%

Phunware Falls 11% on Mixed Preliminary 2021 Financial Results

GameStop Jumps 14.5% on Cohen’s Stake Increase