The U.S. Trade Representative’s office (USTR) announced on Thursday that it has added Chinese tech giants Alibaba Group Holdings’ (BABA) AliExpress and Tencent Holdings Ltd.’s WeChat to its “notorious markets” list, according to Reuters.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the news, Tencent is down 1.9% and Alibaba is down 3.3% on the Hong King Exchange at the time of writing.

The U.S. and China have been at loggerheads over tariffs, technology, and intellectual property. The USTR started preparing the “notorious markets” list back in 2006 and has added AliExpress and WeChat for the first time.

The list includes names of companies running 42 online platforms and 35 physical outlets, which the USTR believes are engaged in trading counterfeit goods.

Other Chinese companies on the list include Baidu Inc.’s (BIDU) Wangpan, DHGate, Pinduoduo Inc. (PDD) as well as Alibaba-owned Taobao. Moreover, nine physical markets within China continue to be included in the list. The companies included in the list are frowned upon as they are seen to be violating intellectual property rights without any penalization.

Official Comments

On being included in the list, WeChat owner Tencent said, “We strongly disagree with the decision made by the US Trade Representative and are committed to working collaboratively to resolve this matter,” and added that they had “invested significant resources” for protecting intellectual property rights on its platform.

Meanwhile, Alibaba said that it will continue to work with the government agencies to resolve the counterfeit issues across its platforms.

While adding the companies to the list, the USTR office stated that these platforms “engage in or facilitate substantial trademark counterfeiting or copyright privacy.” The U.S. will also consider new strategies to address the domestic trade tools to fight against counterfeit practices and protect American businesses and workers from its ill effects.

Additionally, USTR representative, Katherine Tai said, “The global trade in counterfeit and pirated goods undermines critical US innovation and creativity and harms American workers.”

Alibaba Consensus View

Alibaba is scheduled to report its fourth-quarter earnings report on February 24, before the market opens. Hounded by the Chinese government’s overhaul of its tech sector and overall economic disruption triggered by the pandemic, its shares are down 50.5% over the past year.

Nonetheless, Wall Street analysts have awarded the BABA stock a Strong Buy consensus rating based on 20 Buys and 3 Holds. The average Alibaba price target of $188.79 implies 51.7% upside potential to current levels.

Blogger Opinions

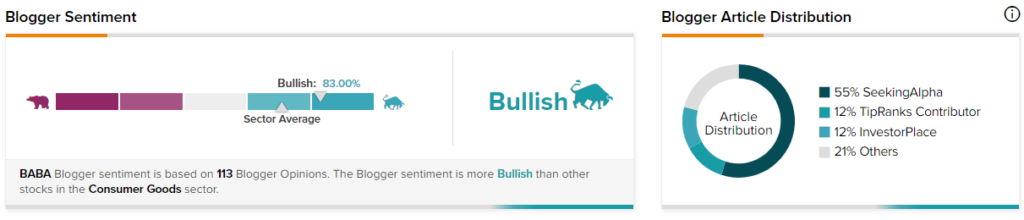

According to TipRanks data, financial blogger opinions are 83% Bullish on BABA, compared to a sector average of 71%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

DoorDash Gains 28% on Q4 Revenue Beat & Solid Order Guide

Wix Drops 23% on Q4 Revenue Miss and Weak Guidance

Analog Devices Exceeds Q1 Expectations; Shares Up 4%