Tesla (TSLA) has reported strong sales for the first week of December in China, registering 21,900 new electric vehicles (EVs) during the period. This reflects a 17.74% increase compared to the previous week, marking the highest weekly sales in the fourth quarter of 2024.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Importantly, the solid performance comes after it sold over 73,000 vehicles in November in China, 15.5% compared to October. Particularly, the Model Y vehicle has emerged as the best-selling passenger vehicle in the region for the past year, with over 556,000 units sold.

How did TSLA’s Chinese Rivals Perform?

For the week of December 1 to December 8, the company’s major rival, BYD (BYDDF), saw a 13.09% sequential fall in insurance registrations to 85,000 vehicles. Also, registrations for XPeng (XPEV) and Nio (NIO) declined by 25.53% and 9.76%, respectively, in the last week.

On the other hand, Li Auto (LI) saw 12,600 registrations last week, up 5.88% from 11,900 in the prior week.

Tesla Offers Incentives to Boost Demand

To maintain its competitive edge, Tesla is offering a RMB 10,000 discount on two lower-priced Model Y variants through December 31 in China. Also, the company has extended its five-year, zero-interest financing plan for all Model 3 and Model Y variants until the end of the year.

Overall, Tesla’s robust performance in China is a positive indicator of the company’s future growth. As the company continues to expand its presence and offer incentives, it is well-poised to maintain its market position.

Is TSLA Stock a Buy?

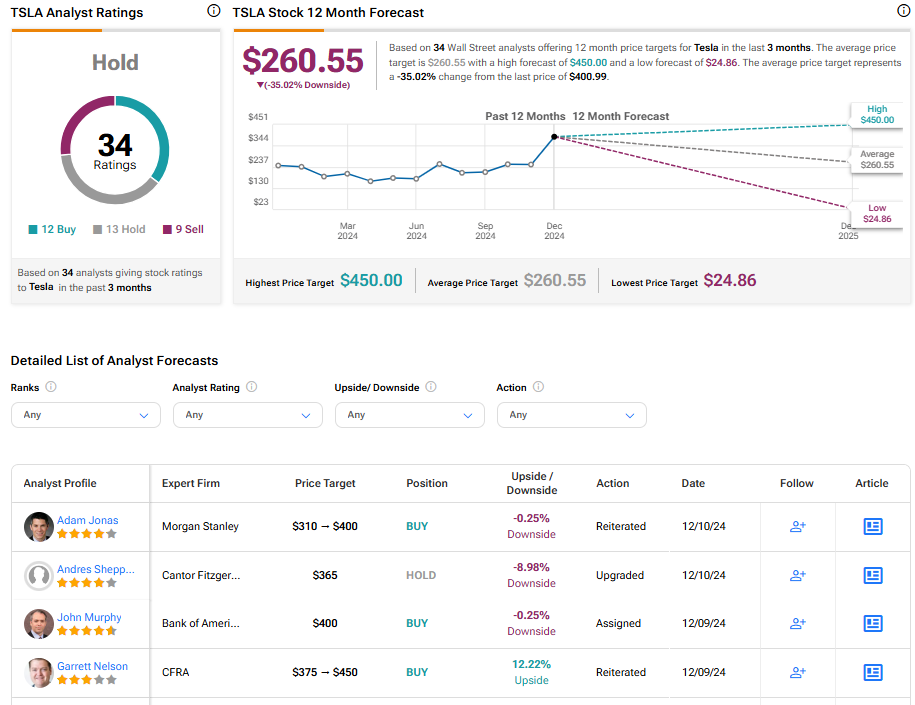

Turning to Wall Street, TSLA has a Hold consensus rating based on 12 Buys, 13 Holds, and nine Sells assigned in the last three months. At $260.55, the average Tesla price target implies a 35.02% downside potential. Shares of the company have gained 61.3% year-to-date.