Toronto-Dominion Bank (TSE: TD) (NYSE: TD) has disclosed net-zero aligned 2030 interim financed emissions targets for two high-emitting sectors, namely energy and power generation.

Climate Goals

TD’s 2021 ESG Report, 2021 TD Ready Commitment Report and 2021 Climate Action Plan: Report on Progress and Update on TCFD illustrate the bank’s continued commitment to meeting the stakeholders informed of progress on ESG issues.

TD is among the global banks that have committed to establishing and disclosing their interim Scope 3 funded issuance targets.

In a new paper (Advancing Our Climate Action Plan: Methodology for TD’s Interim Financed Emissions Targets), the bank outlined its method for tracking progress on its journey to achieve net-zero greenhouse gas (GHG) emissions by 2050.

Management Commentary

“As one of the largest banks in North America, we can play a critical role in helping to create a more inclusive and sustainable future. This is core to our purpose as an organization and while not new to us, as we confront the pressing challenges presented by climate change, the importance of this work is amplified,” said Norie Campbell, Group Head and General Counsel, TD, and Chair of the Bank’s ESG Senior Executive Forum.

“Our interim Scope 3 targets represent a significant step forward, turning our commitments into action to support the ambitious climate goals we have set.”

Wall Street’s Take

On March 7, National Bank analyst Gabriel Dechaine downgraded TD to Hold from Buy with a C$100 price target. This implies 1.5% upside potential.

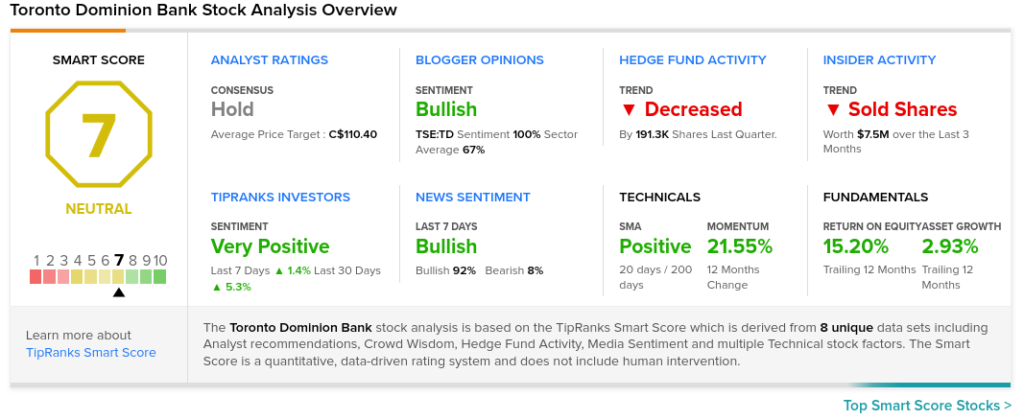

Overall, TD scores a Hold rating among Wall Street analysts based on three Buys, seven Holds, and one Sell. The average Toronto-Dominion Bank price target of C$110.40 implies 12% upside potential to current levels.

TipRanks’ Smart Score

TD scores a 7 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to be in line with the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.