To advance its podcasting business, Luxembourg-based Spotify Technology S.A. (NYSE: SPOT) has acquired two podcast technology companies, Podsights and Chartable. The financial terms of the deal have been kept under wraps.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Benefits of the Acquisition

Podsights, a podcast advertising measurement service, will aid marketers to measure the impact of their ads. Over a period of time, Spotify plans to complement these capabilities beyond podcasts and include audio ads within music, video ads and display ads.

Meanwhile, podcast analytics platform Chartable will provide the perception of the audience, which will help podcast publishers in measuring the success of their growth campaigns. As per the terms of the deal, Chartable’s tools, SmartLinks and SmartPromos, will be integrated into the podcast and ad platform, Megaphone, which was bought by Spotify for $235 million in 2020.

Official Comments

The Head of ads business marketing at Spotify, Khurrum Malik, said, “Our acquisitions of podcast technology players Podsights and Chartable are helpful in our pursuit of up leveling digital audio measurement insights.”

“We’re really excited about bringing this service to advertisers across the United States. But then we want to expand their coverage to international markets,” Malik added.

Background

Since 2020, Spotify is making investments to develop podcast advertising. It launched the Streaming Ad Insertion feature, followed by the introduction of an audio-first ad marketplace, the Spotify Audience Network. Recently, the company launched call-to-action cards.

According to eMarketer, annual U.S. digital audio advertising revenue is likely to hit $8 billion, including $2.7 billion for podcast advertising, by 2025.

Analysts’ Recommendation

Recently, Guggenheim analyst Michael Morris maintained a Buy rating on the stock but decreased the price target to $200 (22% upside potential) from $250.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 16 Buys, 6 Holds and 1 Sell. The average Spotify price target of $246.55 implies 50.39% upside potential. Shares have lost 48.74% over the past year.

Website Traffic

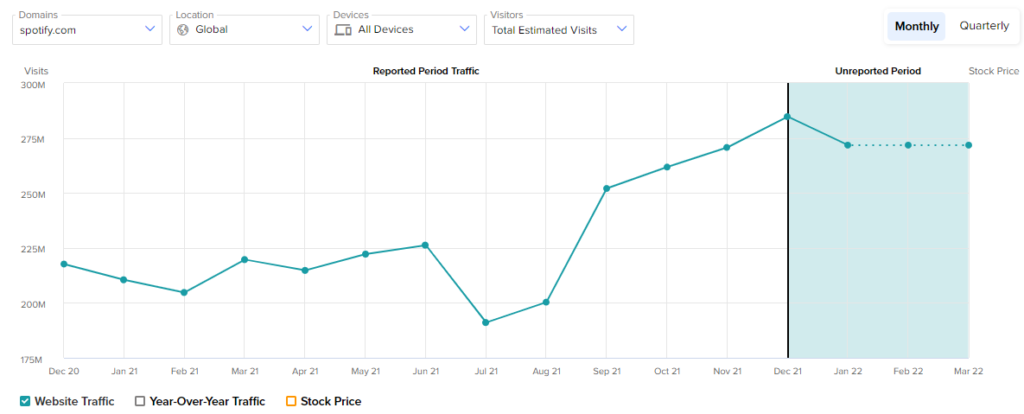

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Spotify’s performance in January.

We could notice a website traffic downtrend on the tool. In January, there was a decrease of 4.55% in traffic to the overall Spotify website from total estimated visits, on a global basis.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Virgin Galactic Pops 32% After Offering Future Spaceflight Reservation

ContextLogic Introduces ‘Wish Clips’ Feature; Shares Jump Over 18%

Toast Posts Greater-than-Expected Q4 Loss; Shares Decline Over 15%