Rocket Lab USA (RKLB) stock is soaring to new highs, with the company rivaling billionaire Elon Musk-founded giant SpaceX. On November 29, RKLB shares hit a new 52-week high of $28.05, bringing the stock up 393% year-to-date and nearly 500% over the past year. A series of good news is fueling investor enthusiasm and the stock price.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Thanks to successful rocket launches, government funding, solid results, and consecutive increases in analysts’ price targets, Rocket Launch USA seems to be on an upward trajectory of its own. The space startup’s rising popularity could be daunting for larger rival SpaceX, with the most important aspect being that RKLB shares are available to investors in contrast to SpaceX, which is a privately-held company.

Five Catalysts for RKLB’s Stock Surge

Successful Rocket Launches – Last week, Rocket Lab achieved the marvelous feat of sending two Electron rockets into the Earth’s orbit within just 24 hours. Incredibly enough, these launches were made from two widely separate launch sites: one based in Virginia, U.S., and the other from founder Peter Beck’s own country, New Zealand. Notably, the New Zealand launch marked the 56th orbit launch for the space exploration startup.

Larger Rocket Neutron – The company is on track to build its larger rocket called Neutron, which is expected to compete directly with SpaceX’s Falcon 9. RKLB’s Neutron rockets have already won customer contracts, with three space trips planned for 2026. The Electron rockets are designed to carry smaller payloads to space, while the Neutron promises to carry higher payloads such as satellites, space pods, and solar cells.

CHIPS Act Funding – Another positive news for smaller space company Rocket Lab USA is the winning of $23.9 million in CHIPS Act funding from the U.S. Department of Commerce. These funds could be used for manufacturing capacity expansion as well as for producing space-grade solar cells.

Solid Q3 FY24 Results – Furthermore, RKLB also reported a blockbuster top line for the third quarter of Fiscal 2024. Revenue jumped 55% year-over-year to $104.8 million, while a loss of $0.10 per share came in just one cent higher than the consensus.

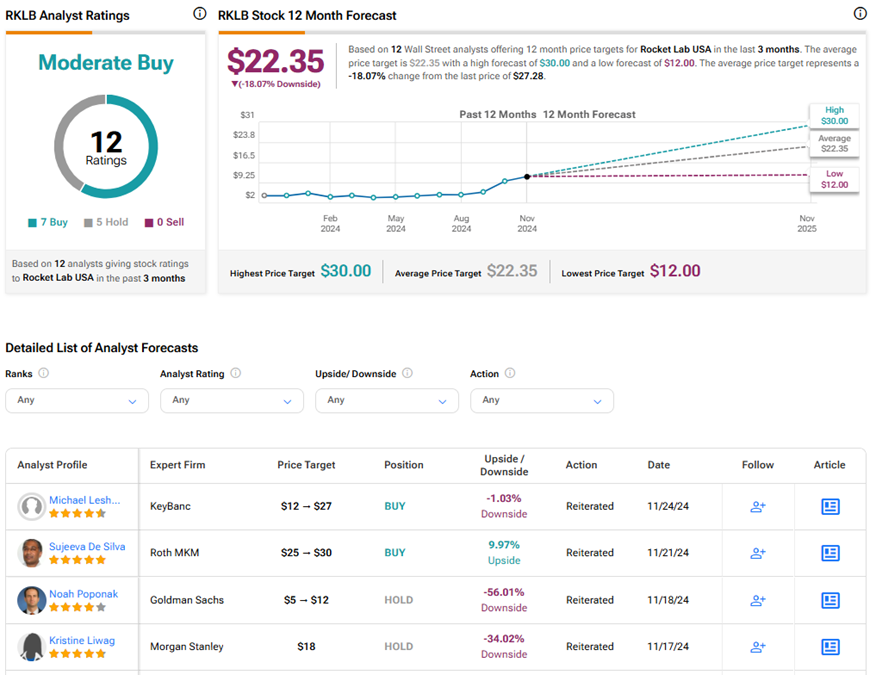

Increased Price Targets from Analysts – Recently, KeyBanc analyst Michael Leshock kept a Buy rating on RKLB stock and lifted the price target to $27 from $12. Similarly, Roth MKM analyst Sujeeva De Silva raised the price target to a new Street-High of $30 (10% upside potential) from $25, while maintaining a Buy rating. De Silva is highly encouraged by the signing of the first customer contract for Neutron and the expected ramp in interest from customers, given the “limited availability of medium-lift launch vehicle capacity.”

Is RKLB a Good Buy?

Currently, analysts remain cautiously optimistic about Rocket Lab USA stock, as the company has just started making headlines. On TipRanks, RKLB stock has a Moderate Buy consensus rating based on seven Buys and five Hold ratings. Also, the average Rocket Lab USA price target of $22.35 implies 18.1% downside risk from current levels.