Nvidia (NVDA) stock closed higher today despite a new AI update from rival chipmaker Advanced Micro Devices (AMD). Both stocks have performed well over the past year. But AMD recently announced that it will be reducing its workforce in an attempt to streamline focus on AI chip production.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

So far, few companies have been able to pose a threat to Nvidia’s dominance over the fast-growing AI market, driven by a fierce demand for its chips. But this raises a key question – is AMD finally emerging as a formidable Nvidia rival? The short answer is that it seems unlikely. But let’s take a closer look at AMD’s plans.

What’s Happening with Nvidia Stock Today?

While Nvidia stock dipped yesterday, shares were back in the green today as market momentum shifted in its direction. On the other hand, AMD stock fell. While AMD has been fairly volatile over the past quarter, NVDA has spent the same period trending upward, demonstrating 19.5% gains. The AI leader has proven that few things can keep it in the red for long.

Now AMD is changing course, which means laying off 4% of its workforce, roughly 1,000 employees. As TipRanks’ Radhika Saraogi reports, “The company plans to focus on developing artificial intelligence (AI) chips to better compete with industry giants such as Nvidia.” This comes after a disappointing Q3 earnings report, which sent AMD stock down.

While it is not unthinkable that AMD could potentially challenge Nvidia as the leading chipmaker, it will have to considerably scale operations before things change. Nvidia may be more worried about the looming threat posed by Amazon (AMZN), a larger company than AMD that is also working on developing its own brand of AI chips.

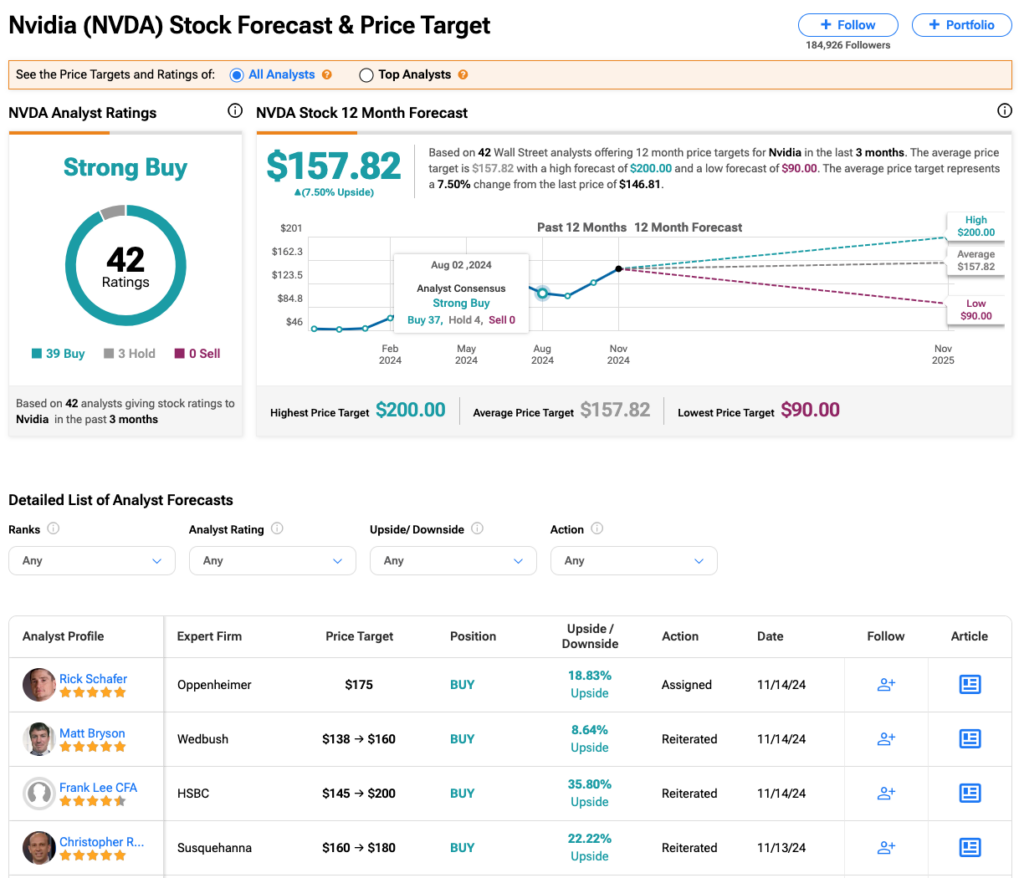

Wall Street Remains Highly Bullish on NVDA Stock

Overall, Wall Street is still highly bullish on Nvidia, even as AMD threatens its market share. Analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 200% rally in its share price over the past year, the average NVDA price target of $157.82 per share implies a 7.5% upside potential.