After market close today, Salesforce (CRM) released its Fiscal Q2-2023 earnings results. Both revenue and earnings per share (EPS) beat analysts’ expectations. However, the company reduced its sales and earnings forecasts for the remainder of the year. As a result, the stock is trending lower in the after-hours session.

Salesforce’s revenue of $7.72 billion grew 26% on a constant-currency (CC) basis, narrowly beating the consensus estimate of $7.69 billion. Its non-GAAP EPS result was more impressive, as it came in at $1.19, easily beating the $1.03 estimate. However, this is much lower than last year’s EPS of $1.48.

Next, Salesforce’s Remaining Performance Obligation (RPO), calculated as a company’s backlog + deferred revenues, increased 19% on a CC basis, reaching $21.5 billion.

Salesforce Trims Its Q3 and Fiscal 2023 Outlook

What investors probably didn’t like, in particular, was its trimmed outlook. For Q3, CRM is projecting revenue of $7.82 billion to $7.83 billion (implying 18% growth on a CC basis) and non-GAAP EPS of $1.20 to $1.21 per share. Analysts were expecting those figures to come in at $8.07 billion and $1.29, respectively.

For Fiscal 2023, non-GAAP EPS is expected to be between $4.71 and $4.73, and revenue is projected to reach $30.9 billion to $31 billion (implying 20% growth). While this may sound good, it is less than the previous estimates of $4.74 to $4.76 in EPS and $31.7 billion to $31.8 billion in revenue.

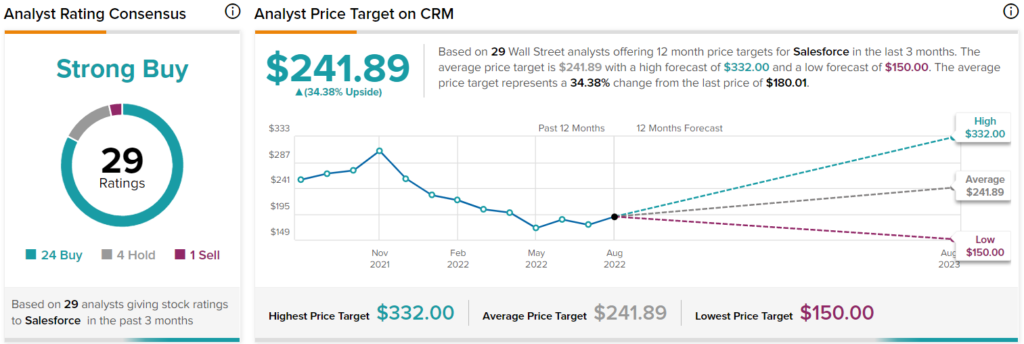

What is CRM Stock’s Price Target?

Turning to Wall Street, Salesforce stock earns a Strong Buy consensus rating based on 24 Buys, four Holds, and one Sell assigned in the past three months. The average CRM stock price target of $241.89 implies 34.4% upside potential.

Top TipRanks Investors are Bullish on CRM Stock

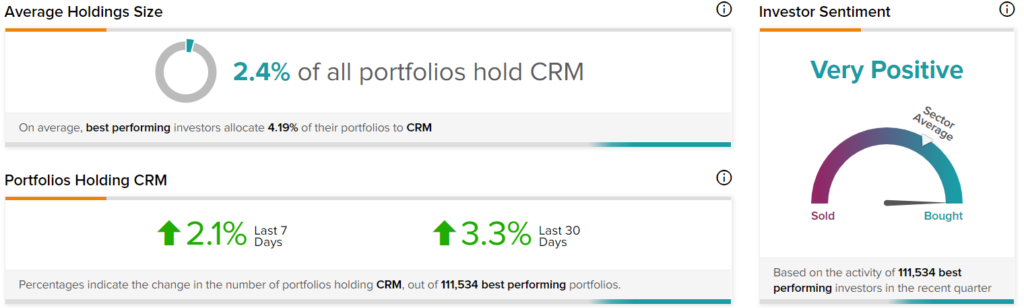

TipRanks currently tracks 557,672 investor portfolios that use the Smart Portfolio tool. The top investors, which amount to 111,534 portfolios, appear very bullish on CRM stock.

In the past 30 days, the number of top-performing TipRanks portfolios holding CRM increased by 3.3%, leading to 2.4% of portfolios holding the stock. In the past seven days, this number increased by 2.1%. Salesforce’s very positive investor sentiment is above the sector average, as shown in the image below:

Conclusion: Salesforce’s Mixed Q2 Leaves Investors Wanting More

While Salesforce beat Q2 estimates, it disappointed investors in terms of its forward guidance. This caused the stock to fall in the after-hours trading session. Nonetheless, CRM is still a highly-profitable company that has the backing of analysts and top TipRanks investors, making it worth a closer look.