For the first time since the backend of 2021, Bitcoin has crossed the $60,000 mark. The rally has been fueled by the long-awaited approval of spot Bitcoin ETFs, signaling institutional adoption is here.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

That has been one meaningful catalyst for the asset’s appreciation but there is another one coming up. Every 4 years or so, the Bitcoin mining rewards are slashed in half, resulting in less bitcoins coming into circulation, thereby raising demand as the asset becomes more scarce. The next such event is due to take place in April.

That is good news for investors but makes operations more difficult for the Bitcoin miners as it offers them less of a reward for their mining activities. That said, assuming prices stay flat to higher from here, Needham analyst John Todaro thinks that BTC’s price should remain above public miners’ total cash breakeven costs post the Halving.

“We estimate major publicly traded miners will be mining bitcoin at cash costs below where the price of bitcoin currently is,” the 5-star analyst elaborated. “While breakeven costs would theoretically double at the Halving, we note efficiency gains in new rigs as well as higher bitcoin prices are providing a healthy margin cushion.”

But as with any sector, there are better plays than others and Todaro has been taking a closer look at two of the most prominent BTC miners out there – Riot Platforms (NASDAQ:RIOT) and Marathon Digital (NASDAQ:MARA) – and has come down in favor of one over the other. So, let’s find out which one that is. With assistance from the TipRanks database we can also see if the rest of the Street agrees with Needham’s analysis.

Riot Platforms

First up, Riot Platforms, a vertically integrated Bitcoin mining firm, headquartered in Castle Rock, Colorado. The company primarily focuses on mining Bitcoin to support the Bitcoin blockchain. Additionally, Riot offers comprehensive infrastructure for institutional-scale Bitcoin mining at its facilities located in Rockdale, Texas (referred to as the Rockdale Facility) and Navarro County, Texas (the Corsicana Facility). The company touts its Rockdale Facility as the largest single Bitcoin mining facility in North America based on developed capacity, with plans underway for potential expansion. Moreover, Riot is in the process of developing the Corsicana Facility, which is projected to have a capacity of approximately one gigawatt upon completion.

The company’s operations are split into three segments: Bitcoin self-mining, data center hosting for miners, and manufacturing equipment for mining, such as electrical components and immersion cooling tech.

As of the end of last year, the Bitcoin mining business showed 112,944 miners in circulation, displaying a total hash rate capacity of 12.4 exahash per second (EH/s), a 28% increase on the 9.7 EH/s as of the end of 2022. The company mined 6,626 bitcoins throughout the year, amounting to a 19.3% uptick vs. the 5,554 Bitcoin mined in 2022. By the end of 2024, the company expects to have roughly 28 EH/s of total hash rate in operation.

All the above resulted in full-year revenues of $280.7 million, a year-over-year increase of 8.3%, although that figure missed the consensus estimate by $7.66 million. However, FY GAAP EPS of -$0.28 came in ahead of expectations by $0.69.

Assessing this miner’s prospects, Todaro outlines 3 reasons why he is bullish on RIOT: “1) Low-cost provider: we estimate RIOT is one of the lowest cost bitcoin miners in the public markets today, with power costs around 4 c/kWh. 2) Clean balance sheet: RIOT has no corporate debt and maintains the largest cash & cash equivalent position among publicly traded mining peers, in addition to having one of the largest BTC positions relative to peers. 3) RIOT’s shares traded at a premium as the sector was beaten down: RIOT is the lowest-cost provider that has executed on facility deployment targets while maintaining a clean balance sheet; this contrasts with many peers who scaled at all costs.”

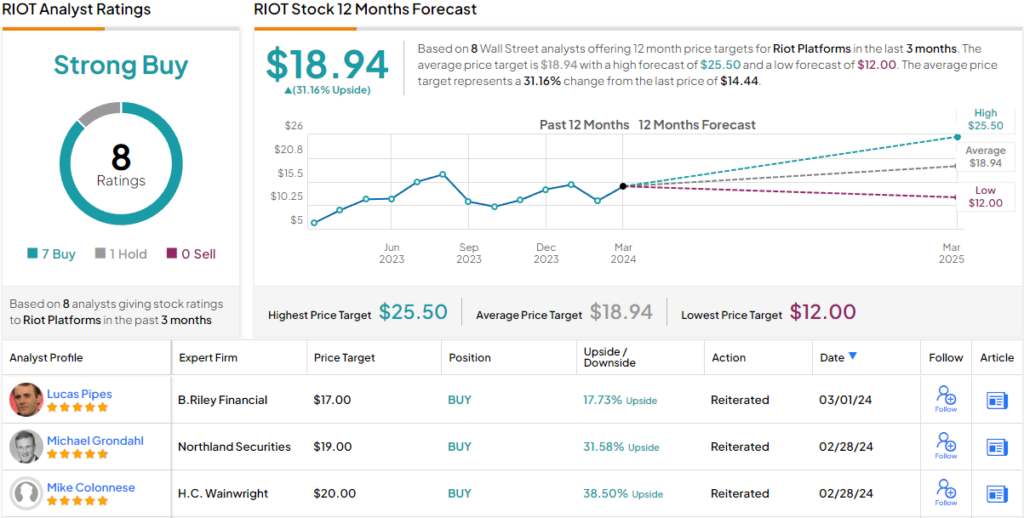

Quantifying his bullish stance, Todaro rates Riot shares a Buy, while his $18 price target implies the stock will gain ~25% over the next year. (To watch Todaro’s track record, click here)

Most analysts agree. Barring one skeptic, all 6 other reviews are positive, making the consensus view here a Strong Buy. Going by the $18.94 average price target, a year from now, shares will be changing hands for a 31% premium. (See RIOT stock forecast)

Marathon Digital

Next up, Marathon Digital, the largest U.S. Bitcoin miner by hash rate and also the biggest by market cap, which currently stands at almost $6 billion. The company started its crypto asset mining in Canada in 2017, moving to the U.S. in 2020. Since then, operating mainly via an asset-light model by making use of third-party data center hosts, its mining rigs are located on 11 sites across three continents.

As of the end of 2023, Marathon operated ~210,000 mining rigs with respective installed and energized hash rates of approximately 25.2 EH/s and 24.7 EH/s. This year, the company anticipates its hash rate will reach 35 to 37 exahash, and 50 by the end of next year, around twice as much as the present capacity.

Marathon also holds the most bitcoins amongst miners, and as of the end of January, held a total of 15,741 unrestricted BTC. That said, it is not averse to selling its holdings to fund operating costs. To do exactly that, in Q4 it sold 56% of the bitcoin it produced during the period.

That quarter’s total mining haul reached 4,242 bitcoins, above the 3,490 mined in Q3 and a 172% increase on the 1,562 coins generated in the same period last year. For the full year, the firm mined 12,852 bitcoins, representing a 210.1% uptick compared to 2022.

As for the Q4 headline numbers, the company generated revenue of $156.7 million, amounting to a huge 451.4% year-over-year increase and outpacing consensus by $11.27 million. However, adj. EPS of -$0.02 fell short of expectations by $0.04.

Despite its leading credentials on several metrics, Needham’s Todaro takes a more measured view of Marathon’s prospects as the Halving approaches.

“Marathon grew to become the largest bitcoin miner by hash rate over the last two years. During this period, MARA benefited from the company amassing a large bitcoin balance and its historical valuation premium to peers, which we credit in part to the company’s comparatively high degree of balance sheet liquidity,” Todaro said. “We believe the upcoming bitcoin Halving represents a disruption risk to higher cost miners such as MARA. Given this, we believe there is limited upside from here until after the 2024 Halving, as we think the elevated near-term risk will weigh on the premium investors are willing to pay for MARA’s shares.”

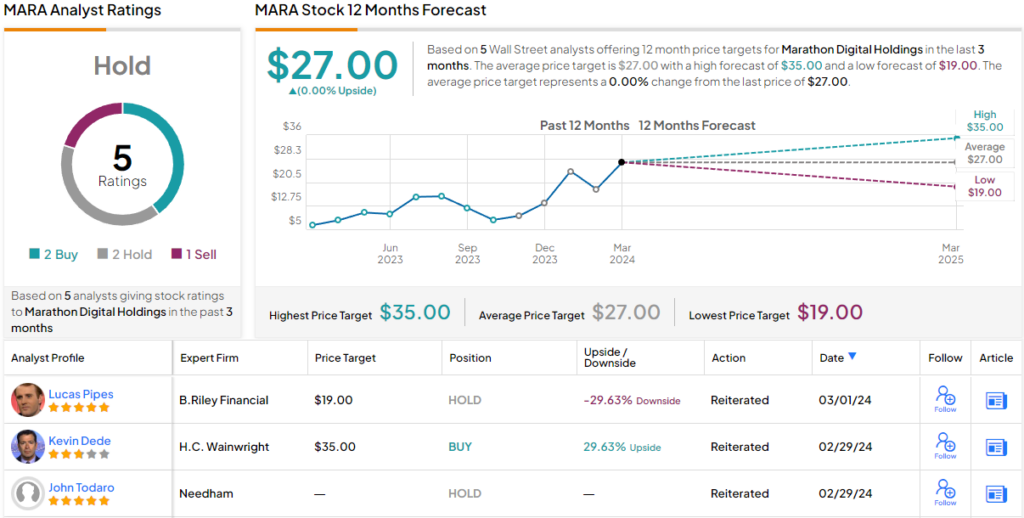

Accordingly, Todaro remains on the sidelines with a Hold (i.e., Neutral) rating and no fixed price target in mind.

Looking at the consensus breakdown, with an additional 2 Buys and 1 Hold and Sell, each, the stock claims a Hold consensus rating. Going by the $27 average price target, the analysts expect the shares to remain rangebound for the time being. (See MARA stock forecast)

Pulling back and looking at both reviews, it’s clear that Needham sees Riot Platforms as the superior bitcoin stock for right now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.