Shares of China-based JD.com, Inc. (HK:9618) are poised for over 50% surge, according to analysts, after the company delivered strong results in Q3 2024. Analysts’ bullish outlook positions JD.com as an attractive investment opportunity in the Hong Kong market. Overall, the stock has a Strong Buy consensus rating on TipRanks.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

JD.com is an e-commerce platform in China that offers products such as electronics, home appliances, and groceries.

JD.com Delivers Impressive Q3 Numbers

In the third quarter, JD.com reported a 5.1% year-on-year increase in net revenues, reaching ¥260.4 billion. The solid growth was driven by strong performances across both product and service sectors. Net product revenues rose 4.8%, while service revenues increased 6.5% compared to Q3 2023.

Meanwhile, net income attributable to the company’s ordinary shareholders was ¥11.7 billion for Q3 2024, marking a 47.8% year-over-year increase.

Analysts Maintain a Bullish Outlook

Analyst Julia Pan from UOB Kay Hian predicts a 48.6% upside potential in JD.com shares. Pan is bullish on the stock, citing its strong performance and future potential. The analyst attributes the company’s growth to government stimulus, its active role in trade-in programs, and a user-centric strategy. The company’s significant participation in electronics trade-in subsidies, supported by various Chinese provinces, further strengthens its market position. These factors, combined with a positive outlook, support Pan’s Buy rating for JD.com.

Meanwhile, Sachin Mittal from DBS expects JD.com to benefit from improved consumer confidence and a gradual recovery in demand for electronics, supported by the government’s trade-in policies. Mittal predicts a CAGR (compound annual growth rate) of 5% in revenue from FY23 to FY26.

Additionally, Mittal projects JD.com’s adjusted earnings to grow at an 11% CAGR from FY23 to FY26, with adjusted net margins at 3.8%.

Is JD.com Stock a Good Buy?

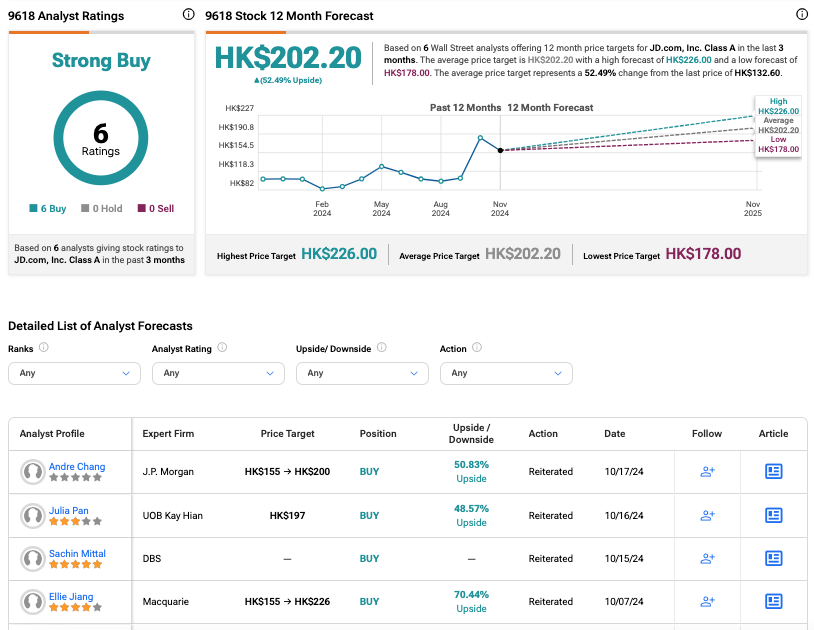

As per the consensus among analysts on TipRanks, 9618 stock has been assigned a Strong Buy rating based on six Buy recommendations. The JD.com share price target is HK$202.20, which implies an upside of 52.5% from the current price level.

Year-to-date, JD.com stock has gained 25.4% in trading.