Intel (NASDAQ:INTC) is set to release its first-quarter results on April 25, after the market closes. The company’s quarterly performance might have benefited from the recovery in PC sales and strong demand for AI (artificial intelligence) chips. Nevertheless, analysts prefer to remain on the sidelines on INTC stock, giving it a Hold consensus rating as they remain wary of losses in the Intel Foundry Services segment.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

INTC is a technology company that designs and manufactures semiconductor chips and related technologies for computing and data processing.

INTC – Q1 Expectations

Currently, analysts expect revenue to rise by 9.2% from the year-ago quarter to $12.8 billion. Also, Intel is expected to post earnings of $0.14 per share in Q1 against a loss of $0.041 per share reported in the prior-year period.

INTC is expected to have witnessed a rise in orders for its processors and microprocessors, driven by a recovery in demand for PCs.

Analysts’ Ratings

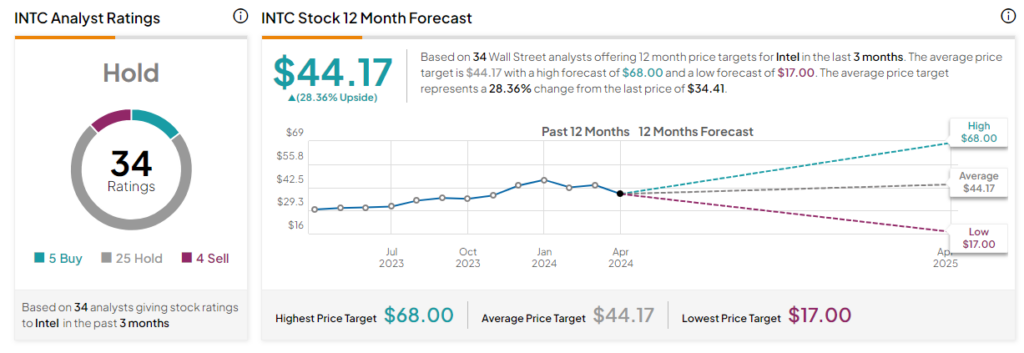

Ahead of the company’s Q1 results, seven analysts have rated Intel stock a Hold in the past two weeks.

Among them, one analyst, Christopher Rolland from Susquehanna, lowered his price target on Intel to $40 (16.3% upside) from $42. The five-star analyst believes that strong demand for PCs will be offset by lower production of Meteor Lake processors and weakness in the server market.

Another Top analyst, Christopher Danely from Citi, believes that losses in the foundry business will continue to hurt investor sentiments. However, he expects that a rebound in notebook CPUs will support Intel’s performance in the short term.

What Is the Price Target for Intel?

Overall, Intel has a Hold consensus rating based on five Buy, 25 Hold, and four Sell ratings. After a year-to-date drop of 31.3% in its share price, the analysts’ average price target on INTC stock of $44.17 implies a 28.4% upside potential from current levels.

Insights from Options Trading Activity

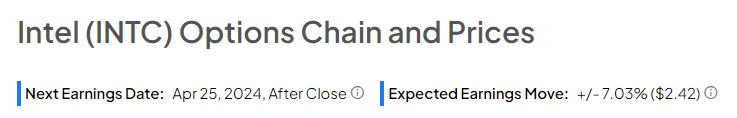

While analysts are sidelined about INTC stock, options traders are pricing in a +/- 7.03% move on earnings, smaller than the previous quarter’s earnings-related move of -11.9%.

Learn more about TipRanks’ Options tool here.

Concluding Thoughts

Intel’s focus on increasing AI adoption, efforts to introduce new products, and recovery in PC sales keep the company well poised for long-term growth. During the Q1 earnings call, investors are likely to pay attention to management’s update about the company’s foundry business and 2024 outlook to gauge INTC’s ability to regain its position in the semiconductor market.