Shares of Pinterest, Inc. (NYSE: PINS) gained up to 25% in the extended trading session on Thursday after the news of New York-based Elliott Management Corp. raising its stake in the company became public.

Elliott Management said that it has increased its stake in Pinterest in recent months to over 9%, The Wall Street Journal reported, citing people with knowledge of the matter.

According to the report, both companies have been in discussions over the last several weeks.

Meanwhile, numerous Pinterest executives have left the company in recent months, with the latest being the resignation of CEO and Founder Ben Silbermann last month. According to the company’s proxy filing in April, Silbermann holds around 37% stake in Pinterest. This could prevent Elliott Management from forcefully implementing changes.

The investment management firm has the image of first increasing stakes in companies and then forcing executive changes.

Hedge Funds Are Very Positive about Pinterest

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence in Pinterest is currently Very Positive, as the cumulative change in holdings across all 12 hedge funds that were active in the last quarter was an increase of three million shares.

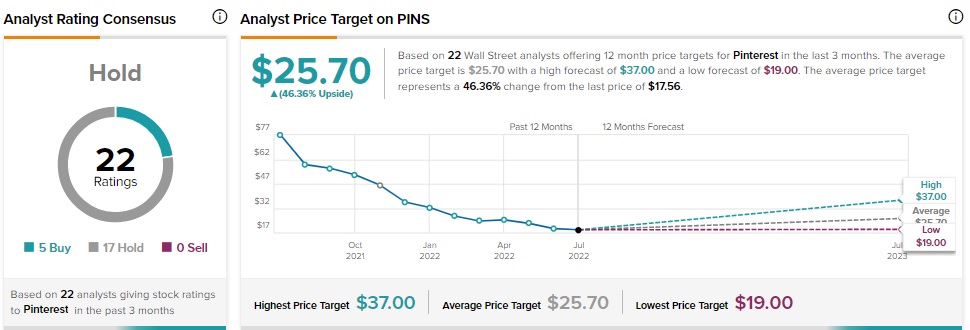

On TipRanks, PINS stock has a Hold consensus rating based on five Buys and 17 Holds. Pinterest’s average price target of $25.70 reflects an upside potential of 46.4% from current levels. Over the past year, shares of the company have lost almost 75%.

All Eyes Are Now on Pinterest’s Q2 Results

Pinterest’s business boomed during the COVID-19 pandemic as people spent most of their time online. This helped the company report its first annual profit last year. However, the happiness was short-lived and the social media company recorded a loss of $5 million in the first quarter of 2022.

Even though revenues increased 18% year-over-year, the number of global active monthly users declined 9% as COVID-19-related restrictions were lifted across the world and people started stepping out of their houses.

Investors are waiting for Pinterest’s second-quarter results eagerly, which are scheduled to be released on July 28, to see whether the company has been able to revive its user base. The Street anticipates earnings of $0.18 per share, lower than the year-ago figure of $0.25 per share.

Read full Disclosure