AMD (AMD) stock has surged 48% over the past 12 months, driven by strong tailwinds within artificial intelligence (AI) and data centers. The company, however, hasn’t enjoyed Nvidia’s (NVDA) pace of growth, whose stock is up 200% over the past year, but its time may come with strong forecasts and an improving full-stack offering. That’s why I’m still bullish on AMD.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

AMD’s Rapid Growth in Data Centers

Let’s start by acknowledging that AMD is by no means as large as Nvidia in the data center and AI segment. The former is less than one-tenth of the latter’s size. Nvidia’s graphics processing units (GPUs) were the catalyst for this revolution in AI, and the firm’s head start in broad application GPUs is over a decade old.

In some respects, AMD is playing catch-up, both in terms of its technological offering and in sales. In Q2 2024, the company’s data center segment registered a remarkable 115% year-over-year increase in revenue, reaching a record $2.83 billion. This was driven by the steep ramp of AMD Instinct™ GPU shipments and strong growth in fourth-generation computer processing unit (CPU) sales.

However, this was accompanied by a 59% fall in revenue from the gaming segment and a 41% fall in sales in the company’s embedded segment. This points to the fact that tailwinds are not being felt throughout the business and AMD’s decision to pump more resources into its data center division.

Can AMD Sustain its Data Center Growth?

To answer this question, we must examine two aspects: AMD’s offering in the data center segment and the size and growth of the segment.

AMD’s technological development takes two forms – from the outside at least. Firstly, the company’s chips are becoming more advanced, and management claims it can compete with Nvidia. For example, in some cases, AMD’s Instinct MI325X AI chip is said to have better inference performance than Nvidia’s H200.

The MI325X will enter production before the end of 2024, and AMD hopes it will be received as a genuine rival for Nvidia’s Blackwell chip. The company has also committed to speeding up its innovation cycle and will introduce a new AI-focused chip every year.

The company has also invested in delivering what is known as a full-stack offering. This means it’s been developing the software to accompany the hardware. AMD’s recent acquisitions, including ZT Systems, which cost $4.9 billion, Nod.ai, and Silo AI, are part of a strategic effort to enhance its end-to-end AI capabilities, covering software, model development, and infrastructure expertise in servers and storage.

While the ZT Systems acquisition isn’t expected to be completed until late 2025, it could have a long-term impact on the attractiveness of AMD’s product offering in this space.

Strong Industry Trends

When moving on to industry trends, we find another element that supports the bullish proposition; Taiwan Semiconductor Manufacturing Company (TSM) recently reported exceptional third-quarter results, beating estimates and causing a surge in its stock price.

This positive performance has had a ripple effect across the semiconductor industry, with companies like Nvidia, and AMD all seeing stock price increases. This is because TSMC is the foundry for many of these big chip companies.

The demand for advanced process technologies is a key trend, with TSM’s 3nm process contributing 20% of total wafer revenue and 5nm accounting for 32%. This shift towards more advanced nodes is driven by the increasing need for high-performance computing, especially in AI applications.

AMD and TSMC are working together to produce next-generation chips using TSMC’s 3-nanometer process technology. AMD CEO Lisa Su said the company will use 3-nanometer, 2-nanometer, and beyond.

Another bullish trend is the substantial increase in capital expenditure within the industry. TSM expects its 2024 Capex to exceed $30 billion, with even higher investments planned for 2025. This aggressive investment strategy reflects the industry’s confidence in future demand and the need to expand capacity for cutting-edge technologies.

Is AMD Stock Still Good Value?

All of these prospects result in an expensive valuation. The company is currently valued at 46.2x forward earnings, representing an 89% premium to the internet technology sector. However, AMD is expected to grow earnings at a staggering CAGR of 41% annually over the medium term, resulting in a price-to-earnings-to-growth ratio of 1.1. Impressive numbers each way you look at them.

Is AMD Stock a Buy According to Analysts?

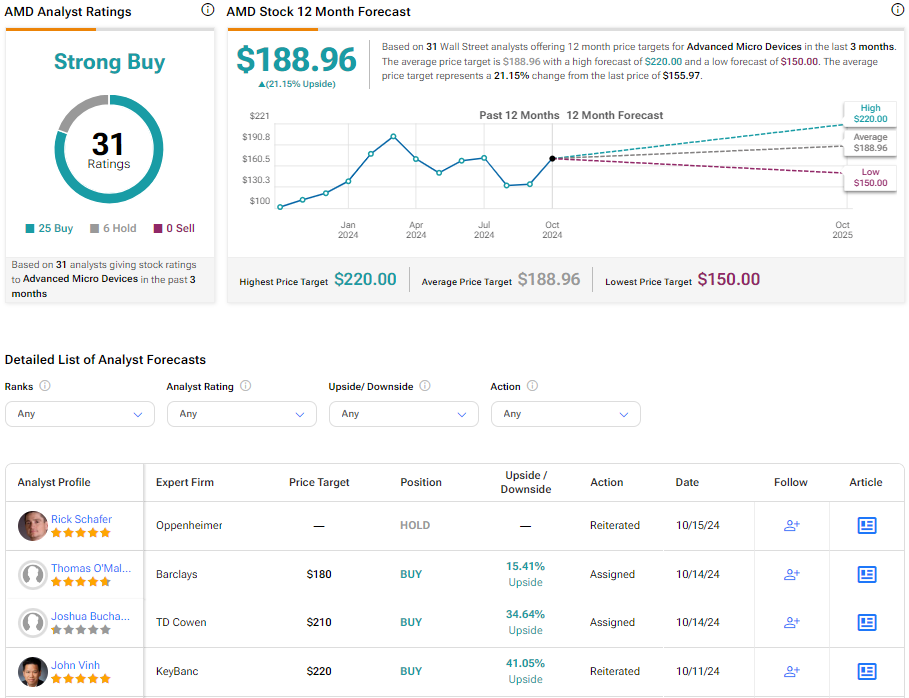

On TipRanks, AMD is a Strong Buy based on 25 Buys, six Holds, and zero Sell ratings assigned by Wall Street analysts in the past three months. The average AMD stock price target is $188.96, implying a more than 21.15% upside potential.

The Bottom Line on AMD Stock?

AMD is a very compelling option for investors according to its growth potential. The company is a major player in the AI and data center segment, but as the market cap figures suggest, it’s only a fraction of the size of Nvidia. However, noting the release of its latest AI chip and its investments in software, AMD could be well-positioned for future sales growth, with analysts expecting this to translate to a staggering CAGR of 41%. With all that in mind, I am bullish on AMD.

(I have shares in AMD)