Renowned automaker, General Motors Company (GM) struck a deal with MP Materials (MP) to source alloys and magnets that are used in the manufacturing of its electric vehicles (EVs).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

MP Materials is one of the largest producers of rare earth (RE) materials that are used to power the traction motors found in EVs, robotics, wind turbines, drones, and other advanced motion technologies.

Beginning in late 2023, MP will supply U.S.-sourced RE materials, alloys, and finished magnets for several GM EV models in a phased manner.

General Motors will use these magnets sourced from MP’s Fort Worth facility to manufacture its GMC HUMMER EV, Cadillac LYRIQ, Chevrolet Silverado EV, and more than a dozen models based on GM’s Ultium platform.

Recently, MP announced the construction of its first RE facility in Fort Worth, Texas, in which it has invested roughly $700 million. MP boasts an annual magnet production capacity of 1,000 tons that can be used in manufacturing approximately 500,000 EVs. Through the plant, MP hopes to restore America’s RE magnetic supply chain.

Commenting on the supply agreement, GM’s Executive Director, Global Purchasing & Supply Chain, Anirvan Coomer, said, “The new MP Materials magnetics facility in Fort Worth, Texas, will play a key role in GM’s journey to build a secure, scalable, and sustainable EV supply chain.”

Analysts’ View

Ahead of GM’s Q1FY22 results scheduled for April 26, Deutsche Bank analyst Emmanuel Rosner cut the price target on the GM stock to $56 (37.6% upside potential) from $75, while reiterating a Buy rating.

Rosner believes GM may beat the quarterly estimates, but will eventually call for a reduction in its full-year outlook. His view stems from the commodity-related headwinds that could hurt the company’s profitability.

Moreover, the analyst believes that the underlying demand would witness a step back, resulting in the lowering of new and used car prices, further hurting GM’s margins.

The other analysts on the Street are highly optimistic about GM stock, with a Strong Buy consensus rating based on 14 Buys and three Holds. The average General Motors price target of $69.94 implies 71.8% upside potential to current levels.

Website Traffic

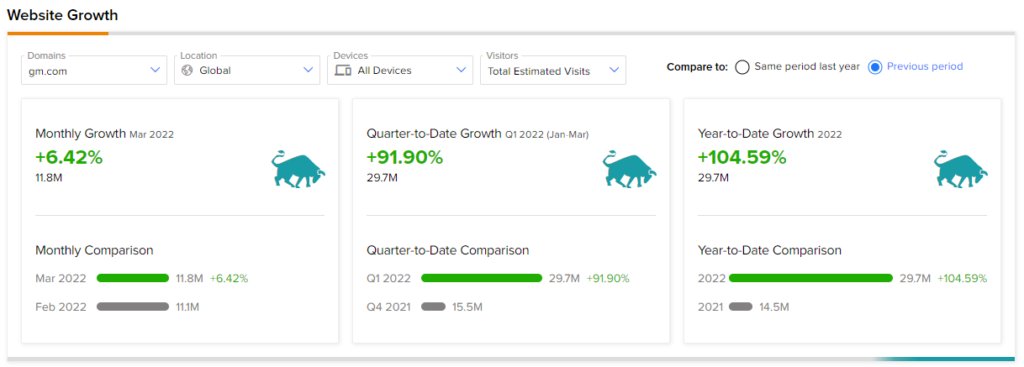

Additionally, TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers positive insight into GM’s performance.

In March, General Motors website traffic recorded a 6.42% year-over-year increase in monthly visits. Similarly, year-to-date website traffic growth increased by a massive 104.59% compared to the same period last year.

Conclusion

General Motors is one of the oldest and most popular auto companies, which is also well-positioned to benefit from the EV shift. Analysts’ optimism, coupled with a positive trend in the website traffic visits, indicates that the company is set to perform well in the future. With its shares down 33.5% year-to-date, the current price may seem like a good entry point for investors eyeing the auto sector.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

American Airlines Flies Through Q1 & Expects Upbeat Q2

Twitter Faces Jack Dorsey’s Criticism

United Airlines Stock Takes Off on Solid Q2 Projections