Among the popular UK stocks, FTSE 100-listed Rolls Royce Holdings PLC (GB:RR) has garnered a bullish review from investment bank Jefferies, which sees more upside for the stock. Jefferies views Rolls-Royce as one of the “whatever the weather” winners, suggesting significant advantages that the company has over its competitors in the long term.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Analyst Chloe Lemaire from Jefferies has a Buy rating on RR stock with a price target of 470p, which implies an upside of 15.56%.

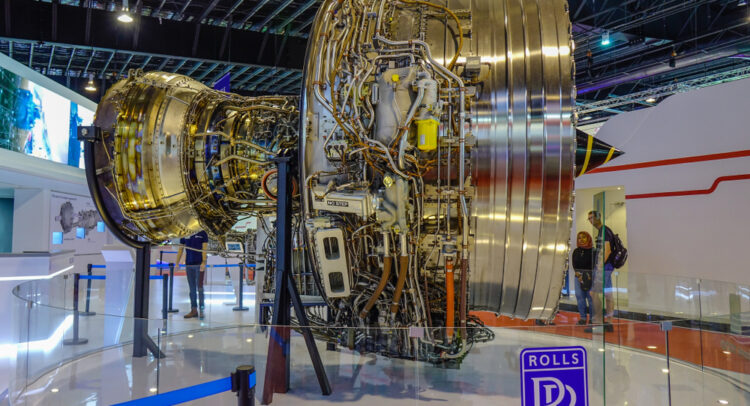

Rolls-Royce specializes in designing engines and power systems for the aerospace and defence industries globally.

Jefferies’ Bullish Case

Lemaire expects a multi-year recovery for the company based on three factors. Firstly, the end of repricing of the company’s services contract commenced last year. Secondly, the company is expected to gain from its dominant market share. Rolls-Royce holds 35% of the installed base of wide-body aircraft and 50% of the current backlog. Moreover, only 16% of the company’s fleet is over 15 years old. Lastly, Jefferies sees a long-term potential for the company to re-enter the narrow-body airline market.

Overall, Lemaire expects the company’s EBIT and free cash flow to double by 2027, driven by further recovery in its operations. The icing on the cake is that the stock is trading at a discount compared to its competitors, adding further appeal to investors.

Is Rolls-Royce Stock a Buy?

Rolls-Royce shares gained a stellar 193% in 2023, securing the top position on the FTSE 100 index for the year. The solid recovery in air travel post-COVID-19, rising geopolitical tensions, and increased defence expenditures have greatly strengthened the company’s operations and boosted its share price. Year-to-date, the stock has gained 38%.

According to TipRanks, RR stock has received a Strong Buy rating based on a total of 12 recommendations, of which 10 are Buys. The Rolls-Royce share price forecast is 473.6p, which is 17% higher than the current trading level.