Shares of the FTSE 100-listed Rolls-Royce Holdings PLC (GB:RR) fell after the company warned of continued supply chain risks in 2024 in its Q3 trading update. The update didn’t go well with the investors, despite the company maintaining steady guidance for the full year 2024. As a result, RR stock fell nearly 4% as of writing.

Rolls-Royce specializes in designing engines and power systems for the aerospace and defence industries globally.

Rolls-Royce Sticks to 2024 Guidance

As per the update, Rolls-Royce stuck to its previous guidance for 2024 shared in August. It expects its underlying operating profit between £2.1 billion and £2.3 billion, with free cash flow ranging from £2.1 billion to £2.2 billion.

Among its segments, the company highlighted sustained high demand in the Civil Aerospace unit, with large engine flying hours up 18% year-over-year, reaching 102% of pre-pandemic levels. For the full year, flying hours are projected to be between 100% and 110% of pre-pandemic levels, with around 500 to 550 engine deliveries expected.

Rolls-Royce Flags Supply Chain Risks

Rolls-Royce flagged the persistent supply chain issues in the aerospace industry. Earlier in August, the company warned that delays in aerospace parts are likely to raise costs by £150 million to £200 million this year.

Moreover, the company faced criticism last month for causing multiple British Airways (GB:IAG) flight cancellations due to issues with its Trent 1000 engines, which power the airline’s Boeing (BA) 787 fleet.

Nevertheless, Rolls-Royce stated that it remains committed to improving its supply chain dynamics to cater to the increasing original equipment (OE) and aftermarket volumes. It has focused its efforts on 15 key suppliers, which has led to performance improvements.

Is Rolls-Royce a Good Stock to Buy?

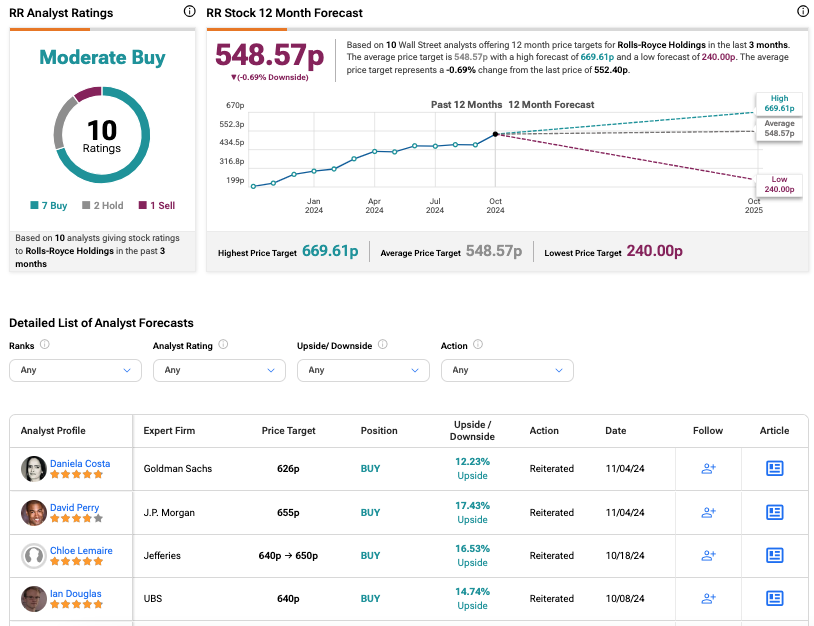

According to TipRanks, RR stock has received a Moderate Buy rating based on seven Buys, two Holds, and one Sell recommendation from analysts. The Rolls-Royce share price forecast is 548.57p, which is almost similar to the current trading level.

Year-to-date, RR stock has gained a solid 86% in trading.