Using the TipRanks database, we have identified two UK stocks, defence company Rolls Royce Holdings PLC (GB:RR) and banking giant Barclays PLC (GB:BARC), that have been rated as Strong Buy by analysts. A Strong Buy rating from analysts serves as a valuable indicator for choosing stocks primed for long-term returns. In terms of share price growth, RR stock offers nearly 15% upside potential, while analysts expect BARC stock to offer a comparatively higher upside of 27%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Here, we have used TipRanks’ Stock Screener tool for the UK market to narrow down these two stocks. This tool simplifies the process of selecting stocks within a specific market based on various parameters.

Additionally, both stocks have achieved a score of nine out of ten on the TipRanks Smart Score tool. This tool rates stocks on a scale of one to ten, assessing their potential to outperform the market. Stocks with scores of eight, nine, and ten are considered to have higher probabilities of exceeding market returns.

Let’s have a look at the details.

Rolls-Royce Holdings PLC

The British engine and power systems manufacturing company was the top performer of the FTSE 100 index in 2023, with stellar growth of more than 190%. The substantial rebound in air travel, growing geopolitical tensions, and the company’s turnaround efforts significantly bolstered its operations and drove the share price higher.

In 2023, Rolls-Royce’s underlying operating profit increased by £938 million to reach £1.6 billion. Underlying operating margins surged from 5.1% to 10.3% and the company generated a record free cash flow of £1.3 billion. Looking forward to 2024, the company’s guidance indicates continued advancement, with underlying operating profit projected to range between £1.7 billion and £2.0 billion and free cash flow expected in the range of £1.7 billion to £1.9 billion.

Analysts maintain a positive outlook, largely fueled by expected increases in defence spending and the company’s expertise in specialized power systems, particularly within sustainable energy sectors.

Is Rolls-Royce a Good Stock to Buy?

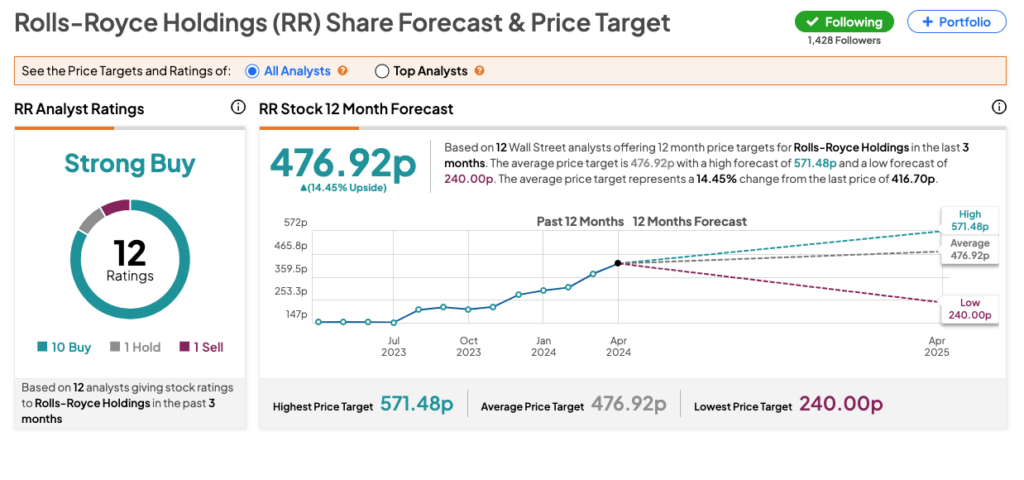

Since the release of its 2023 results in February, nine analysts have confirmed their Buy ratings. Overall, according to TipRanks consensus, RR stock has received 10 Buys, one Hold, and one Sell recommendation. The Rolls-Royce share price forecast is 476.92p.

Barclays PLC

Barclays ranks among the top four banks in the UK, serving approximately 48 million customers globally. Year-to-date, the stock has grown by 30%.

Recently, the bank announced its first quarter results for 2024, with a 12% year-over-year decline in its pre-tax profits of £2.3 billion. Barclays’ profits were mainly hit by reduced trading income and sluggish demand in the mortgage market.

Nonetheless, Q1 profits surpassed expectations of £2.2 billion, suggesting that the bank’s turnaround efforts were progressing as expected. In February, Barclays unveiled a strategic plan, targeting cost savings of £2 billion by the end of 2026. Additionally, the bank intends to return a minimum of £10 billion to shareholders between 2024 and 2026 through dividends and share buybacks.

Are Barclays Shares a Good Buy?

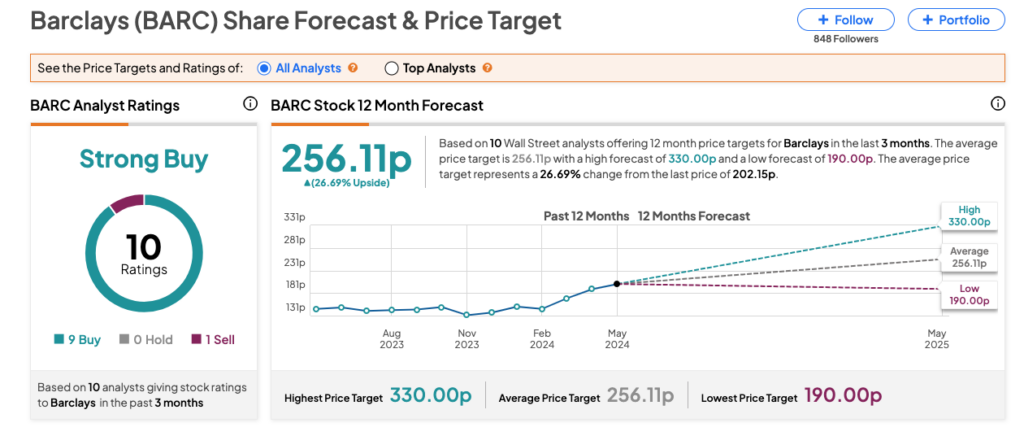

After the Q1 results, analysts reiterated their confidence in Barclays stock, with four analysts confirming their Buy ratings. On TipRanks, BARC stock has a Strong Buy rating based on nine Buys and one Sell recommendation. The Barclays share price target is 256.11p.

Conclusion

The Strong Buy ratings for RR and BARC suggest robust earnings growth potential for these companies. Barclays is set to benefit from the recovery of the UK economy, while Rolls-Royce is expected to continue to gain from the growing defence budgets amid the ongoing geopolitical tensions.