Among Australian equities, Telstra Corporation Limited (AU:TLS) is a well-known income stock that offers a dividend yield of nearly 5% (4.74%), surpassing the sector’s average of 2.54%. In terms of capital appreciation, analysts hold a moderately bullish outlook on the stock, predicting a 15% upside. Year-to-date, the stock has lost 2.7% in trading.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Telstra Group provides a wide range of communication and technology services in Australia. Notably, its mobile segment stands as the largest in Australia, both in terms of user base and coverage.

TipRanks offers a variety of tools to help users identify dividend stocks that match their preferences. In this instance, we have used the TipRanks Best Australian Dividend Shares tool, which compiles a comprehensive list of high-dividend-paying companies, along with various other parameters for users to consider.

Telstra’s Dividend History

For the first half of FY24, Telstra declared a fully franked interim dividend of AU$0.09 per share, marking a 5.9% increase from the previous year. The total dividend paid in FY23 was AU$0.17 per share, marking a 3% increase over FY22. In 2023, the company returned AU$2 billion to its shareholders.

Investors have enjoyed an increasing dividend payout from the stock over the past few years. Moving ahead, the company aims to maximize its fully franked dividends over time as part of its capital management framework.

Telstra’s Recent Performance

For the six-month period that ended on December 31, 2023, Telstra’s total income saw a 1.2% uptick over the previous corresponding period. Underlying EBITDA also rose by 3.1% to AU$4.0 billion. The company’s mobile segment notably drove this growth, bolstering EBITDA by nearly AU$300 million, thanks to a surge in customer numbers, average revenue per user growth, and efficient cost controls.

On the flip side, the NAS (network applications and services) segment was a weak link, and as a result the company reduced the underlying EBITDA guidance range for FY24 to AU$8.2 and AU$8.3 billion, down from a prior range of AU$8.2 and AU$8.4 billion. However, the company stated that the mid-term outlook for NAS is positive.

Is Telstra a Buy or Sell?

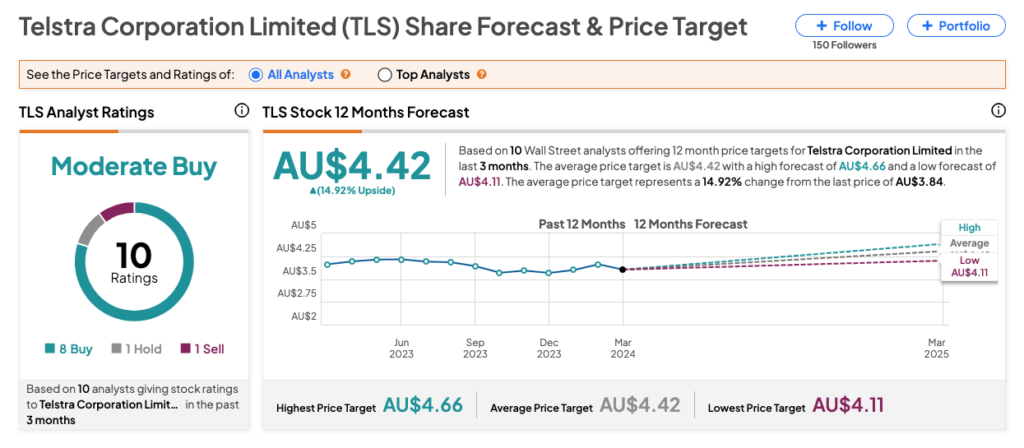

According to TipRanks’ rating consensus, TLS stock has received a Moderate Buy rating, based on a total of 10 recommendations. The Telstra share price target is AU$4.42, which is almost 15% above the current price level.