Shares of footwear and apparel products provider Foot Locker (NYSE:FL) are trending lower at the time of publishing today after the company announced first-quarter numbers.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Revenue dropped 11.5% year-over-year to $1.93 billion, missing estimates by $60 million. Further, EPS at $0.70 too fell short of expectations by $0.08. During the quarter, comparable store sales declined by 9.1% and the company is taking markdowns to boost demand and manage inventory.

The macroeconomic backdrop remains challenging and Foot Locker has lowered its financial outlook as a result. It now expects fiscal year 2023 sales to drop in the range of 6.5% and 8% as compared to the earlier expected decrease between 3.5% and 5.5%.

EPS for the year is now anticipated between $2 and $2.25. This is a significant scaleback from the earlier expected range of $3.35 and $3.65.

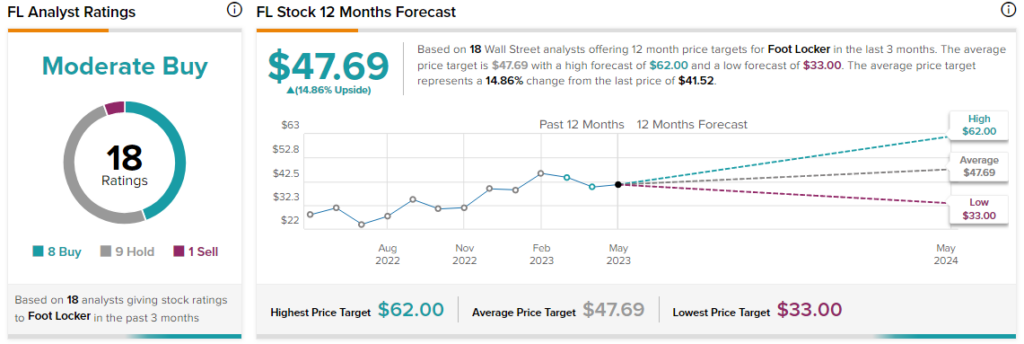

Overall, the Street has a $47.69 consensus price target on Foot Locker alongside a Moderate Buy consensus rating. Short interest in the stock currently stands at nearly 12%.

Read full Disclosure