Online marketplace for freelance services provider Fiverr International Ltd. (NYSE: FVRR) reported mixed results for the second quarter, which ended on June 30, 2022. While earnings topped consensus estimates, revenues failed to surpass the same. Following the Q2 results, the company’s stock price soared 8.5% during the normal trading hours.

Q2 Earnings Snapshot

Fiverr reported quarterly revenues of $85 million, a growth of 13% from the previous year’s quarter. This growth can be attributed to the 14% and 60% year-over-year growth witnessed in spend per buyer and buyers with an annual spend of over $10K, respectively. However, the figure missed the consensus estimate of $87.74 million.

Earnings per share (EPS) of $0.13 surpassed the consensus estimate of $0.06 per share but declined by 40.9% from the previous year’s quarter.

Meanwhile, Fiverr’s operating loss widened by a whopping 411.2% from the year-ago quarter to $42.7 million. The company’s adjusted EBITDA margin also declined to 5.4% from 9.8% in the previous year.

However, the take rate improved to 29.8% from 27.8% in the prior year’s quarter. Also, active buyers reported year-over-year growth of 5.6% to 4,220.

Guidance Lower than Street Expectations

Fiverr provided guidance for the third quarter and Fiscal Year 2022.

For the third quarter, the company expects revenues between $80.5 million – $82.5 million, which represents a growth of 8%-11% from the prior year. The consensus estimate for the same is pegged at $87.74 million.

For 2022, Fiverr forecasts revenue to be in the range of $332 million – $340 million, which denotes a growth of 12%-14% from the previous year’s quarter. The consensus estimate stands at $354.4 million.

Investors Remain Upbeat About Fiverr Stock

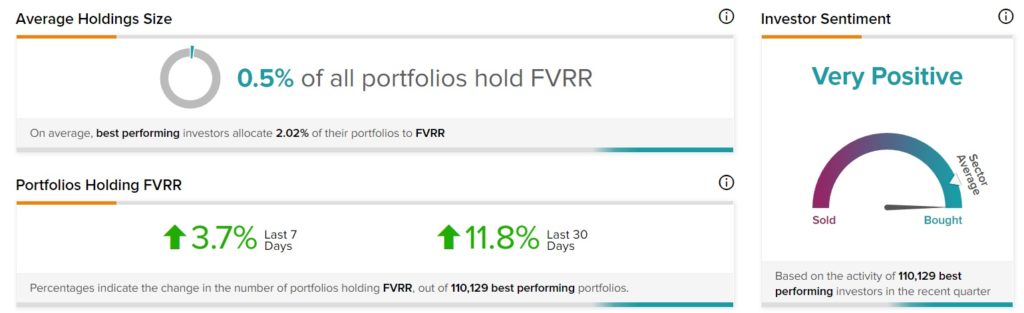

Top investors seem convinced of the management’s vision and are loading up on the company’s stock.

TipRanks’ Stock Investors tool shows that top investors currently have a Very Positive stance on FVRR. Further, 11.8% of the top portfolios tracked by TipRanks, increased their exposure to FVRR stock over the past 30 days.

Overall, the Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on three Buys and four Holds. The FVRR average price target of $40.29 implies the stock has marginal upside potential from current levels. Shares have declined 77% over the past year.

Key Takeaways

Even though Fiverr’s revenues came in lower than expectations, they increased from the year-ago quarter, reflecting strength in the company’s operations. Furthermore, improvement in some of the key operating metrics has given the company a strong footing.

However, dwindling profitability and widening operating losses continue to remain concerns for the company.

Read full Disclosure