In a mega deal, oil and gas giant Exxon (NYSE:XOM) may acquire Pioneer Natural Resources (NYSE:PXD) for $60 billion, as reported by the Wall Street Journal. Per the report, a deal could be announced soon. Earlier, it was reported that Exxon held preliminary talks with PXD’s leadership in April.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Pioneer is a leading oil and gas exploration and production company, boasting industry-leading acreage in the oil-rich Permian Basin. Thus, the acquisition is set to bolster Exxon’s presence in the lucrative oil-producing area of the U.S.

Exxon’s integrated portfolio, ability to significantly improve its cost structure, and higher average oil and gas prices have enabled the company to grow profitably, improve earnings, and fortify its balance sheet. This, in turn, provides the company with the flexibility to explore growth opportunities through acquisitions.

Exxon is focusing on increasing its production from Permian operations by leveraging technology and the large scale of its integrated operations. The acquisition of Pioneer Natural Resources will empower the company to expand its production capabilities within the Permian region. As Exxon strengthens its foothold in this oil-rich area, let’s look at what the Street recommends for Exxon stock.

Is Exxon Stock Expected to Rise?

Exxon Mobil stock has gained from the rally in oil and gas prices following the easing of COVID-19-led restrictions. However, the tough year-over-year comparisons have limited the upside potential in XOM stock year-to-date.

Although the company’s preliminary Q3 estimates show sequential improvement, XOM’s valuation appears expensive compared to peers, noted Goldman Sachs analyst Neil Mehta. He reiterated a Hold on Exxon stock on October 4.

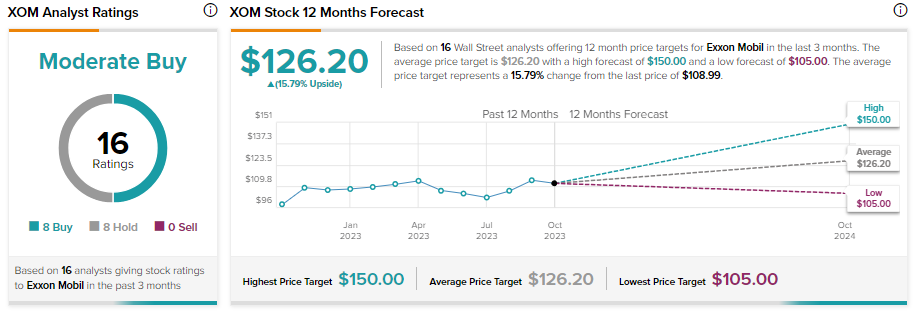

With eight Buy and eight Hold recommendations, Exxon stock has a Moderate Buy consensus rating on TipRanks. Meanwhile, analysts’ average price target of $126.20 shows a limited upside potential of 15.79% over the next 12 months.