Things are not looking too good for oil. The benchmark crude WTI (CM:CL) is trading at $79.40 today, down by nearly 7.5% over the past month. Oil’s slippery path comes amid a buildup of oil stockpiles in the U.S., sluggish demand in Asia, and the Fed once again sticking to its status quo on rates, which could possibly weigh on demand this year.

Tepid Demand

Crude oil imports in Asia contracted in April to 26.89 million barrels a day from roughly 27.33 million barrels a day in March. The lower imports in the globe’s highest-oil-importing region come amid tepid demand growth and a not-so-promising macroeconomic picture. Major emerging economies are feeling the ill effects of inflation, while China is trying to boost its economy after a property market slump and freefall in financial markets.

OPEC’s Next Move

At the other end of the spectrum, OPEC is expected to extend its output cuts of 2.2 million barrels a day beyond June, if the demand scenario does not improve, according to Reuters. The group is set to meet on June 1. OPEC’s voluntary production cuts, coupled with tensions in the Middle East, have largely supported oil prices in recent times. However, signs of easing tensions in the Middle East are rapidly eroding the war risk premium from oil prices.

U.S.’ Increased Activity Amidst Russian Gazprom’s Woes

Meanwhile, energy giant Exxon (NYSE:XOM) looks set to close its $59.5 billion acquisition of Pioneer Natural Resources (NYSE:PXD) after agreeing not to retain Pioneer’s former CEO, Scott Sheffield, on its board. Importantly, the Exxon-Pioneer deal is part of a broader consolidation in the energy sector in the U.S. While the U.S. energy sector teems with activity, Russia’s energy giant Gazprom has reported its first loss in nearly 24 years. The change of fortunes at Gazprom comes amid lower shipments to Europe, a decline in energy prices, and weak demand.

Is the Price of Oil Going Up or Down?

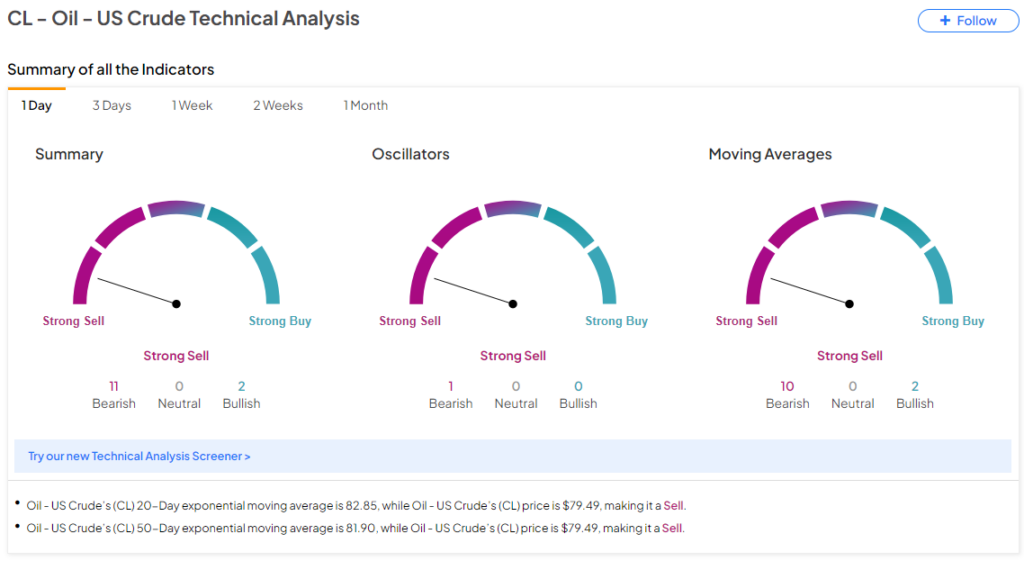

Amid this dynamic, the TipRanks Technical Analysis tool is flashing a Strong Sell signal for oil on a daily time frame.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure