Oil and gas giant Exxon (NYSE:XOM) will release its first-quarter 2024 earnings on Friday, April 26. Lower price realizations could hurt its Q1 earnings. Nonetheless, the ongoing shift in its product mix towards higher-value and higher-margin performance products and structural cost reductions are expected to cushion its bottom line.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Against this background, let’s look at Wall Street’s estimates for XOM’s Q1.

Exxon – Q1 Expectations

Wall Street expects Exxon to report revenue of $79.59 billion, down about 8% from $86.56 billion in the prior-year quarter. Reduced upstream production volume and lower average price realization could pressure its top line in the first quarter.

Analysts expect Exxon to deliver earnings of $2.09 per share in Q1, down about 26% year-over-year. The earnings are expected to be negatively affected by lower revenues and increased scheduled maintenance activities. However, product mix improvements and disciplined cost management will likely cushion its bottom line.

Is Exxon a Buy, Sell, or Hold?

Exxon stock has gained over 22% year-to-date, reflecting a tightening supply and an expected increase in oil prices. Nonetheless, Wall Street analysts are cautiously optimistic about Exxon’s prospects.

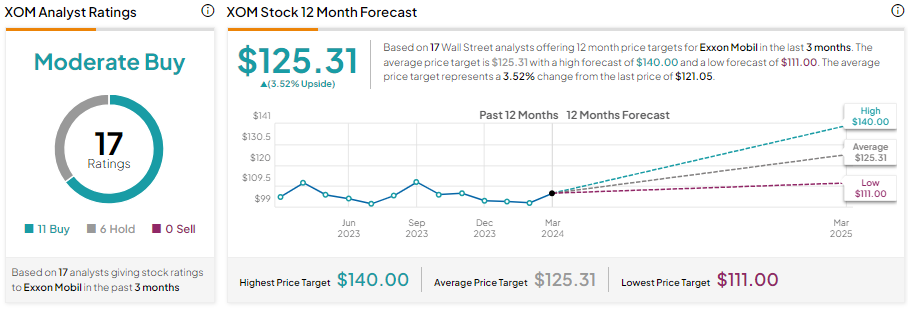

Exxon stock has 11 Buy and six Hold recommendations for a Moderate Buy consensus rating. The average price target on XOM stock is $125.31, implying a limited upside potential of 3.52% from current levels.

Insights from Options Trading Activity

It’s worth noting that options traders are pricing in a +/- 1.98% move on earnings, greater than the previous quarter’s earnings-related move of -0.41%.

The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Exxon’s top and bottom lines are expected to decline in Q1, reflecting lower price realization and higher scheduled maintenance activities. Nonetheless, the company’s focus on reducing costs and improving product mix augurs well for long-term growth.