Tesla (NASDAQ:TSLA) held its much-anticipated robotaxi event on Thursday evening, but investors were left underwhelmed by the lack of significant new details, leading to an 8% drop in the stock on Friday.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As expected, the star of the event was the Cybercab, a driverless taxi that runs without human input, lacking even a steering wheel or pedals with production slated to begin by 2026. Tesla also revealed a prototype of the larger Robovan, designed to carry 20 passengers or transport goods. Additionally, the company’s Optimus humanoid robot, already doing basic tasks, was showcased, with Elon Musk even claiming it could become “the biggest product ever, of any kind.”

In true Musk fashion, this bombastic statement seemed to be met with some skepticism on Wall Street, judging by the market’s reaction. However, one big TSLA fan remains unfazed.

Wedbush analyst Daniel Ives acknowledges that Musk and Tesla “should have spent more time on details around this strategic autonomous vision,” but despite that critique, Ives argues the negative reaction is unwarranted.

“We strongly disagree with the notion that last night was a disappointment as we would argue the opposite seeing Cybercab with our own eyes and the massive improvements in Optimus which we interacted with throughout the evening,” the analyst said.

More details will be forthcoming over the coming months, says Ives, and the vehicle is “now a reality and not just talk.” Likewise, Optimus has progressed beyond the prototype phase and is now in advanced pilot testing, “well ahead” of Ives’ expectations.

Despite the “negative noise from the Street,” Ives came out of the event even more bullish than before and tells investors to be “buyers on any weakness.”

No surprise, then, that Ives rates Tesla shares an Outperform (i.e., Buy), along with a $300 price target, implying gains of 26% are in the cards for the coming year. (To watch Ives’ track record, click here)

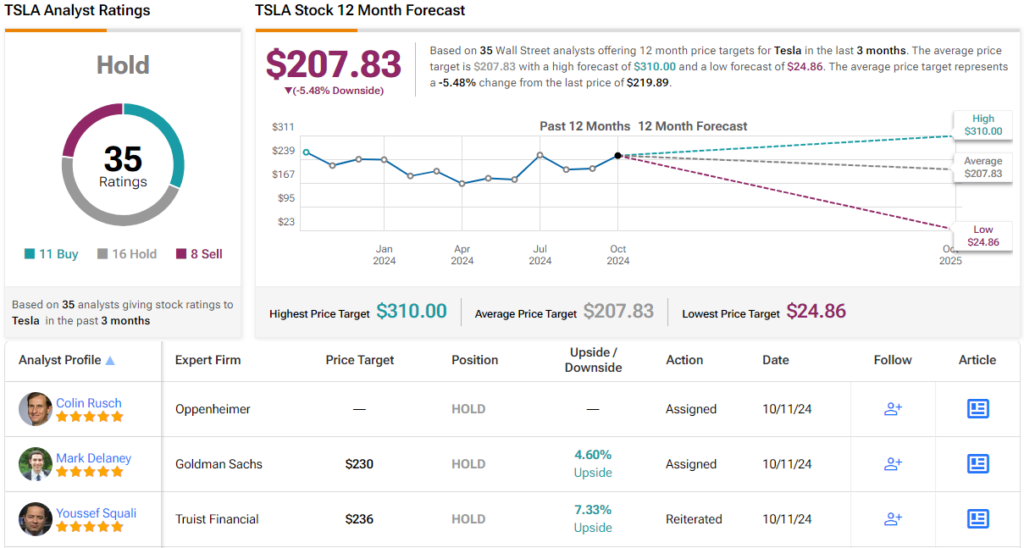

According to most of Ives’ colleagues, however, instead of gains, the stock will be shedding an additional 5.5% off it value over the next year given the average price target stands at $207.83. On the rating front, based on a mix of 16 Holds, 11 Buys and 8 Sells, the analyst consensus rates the stock a Hold. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.