Tesla (TSLA) Chair Robyn Denholm cashed in on the surge in TSLA stock this past month through a strategic stock sale. Denholm earned over $35 million from the stock sale. Shares of TSLA have surged by more than 50% over the past month.

Denholm Exercised Stock Options as Part of Trading Plan

According to a regulatory filing, Denholm exercised 112,390 stock options on November 15, due to expire next year, and sold the shares. This transaction was a part of the Rule 10b5-1 trading plan adopted in July, a tool often used by U.S. company insiders to manage stock sales. This stock sale resulted in Denholm netting around $32.5 million.

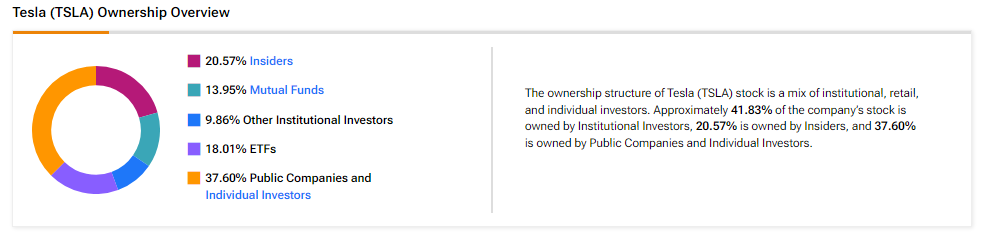

According to the TipRanks Ownership tool, institutional investors own more than 40% of TSLA stock, while company insiders own more than 10%.

TSLA Has Seen Its Stock Surge During the U.S. Election

The timing of this transaction coincided with a significant rally in Tesla’s stock price, which has surged since Donald Trump’s election victory. Given his prior support for the president-elect, investors appear to be betting on CEO Elon Musk’s potential advantages under the new administration.

What Is the 12-month Price Target for Tesla?

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on 11 Buys, 14 Holds, and nine Sells. The average TSLA price target of $232.64 implies a downside potential of 32.8% from current levels.