Shares of BJ’s Wholesale Club (NYSE: BJ) surged 7.4% on Thursday, May 19, as the company reported stellar results for its fiscal first-quarter despite cost pressures. In contrast, stocks of major retailers continued to decline on Thursday as investors were spooked by the disappointing earnings reported by retail giants Walmart (WMT) and Target (TGT) earlier in the week.

BJ’s Wholesale operates membership-based warehouse clubs in the Eastern U.S. The company’s network currently comprises 229 clubs and 159 BJ’s Gas locations in 17 states.

Q1 Results in Detail

For Q1 FY22 (ended April 30, 2022), BJ’s revenue grew 16.2% year-over-year to $4.5 billion, ahead of the analysts’ estimate of $4.24 billion. The top line gained from a 16.3% rise in net sales to $4.4 billion, driven by strength in the grocery and perishable categories. Meanwhile, digital sales growth was 26%.

The quarter’s revenue also benefited from an 11.9% increase in membership fee income to $96.6 million. Memberships grew 5% year-over-year to 6.5 million.

Comparable store sales were up 14.4% supported by higher gasoline prices and higher traffic. Excluding gasoline sales, comparable store sales growth came in at 4.1%, beating the Street’s consensus of 3.9%.

Further, adjusted EPS grew 20.8% to $0.87 and crushed analysts’ expectations of $0.72. Despite higher supply chain and labor costs, earnings increased due to robust sales, the company’s cost management efforts, and a lower share count.

Outlook and Other Highlights

BJ’s continues to expect its FY22 EPS to be flat compared to last year. Explaining the company’s unchanged outlook on the earnings call, CFO Laura Felice stated, “…we believe our first quarter excess gas profits will be largely offset by heightened margin pressures driven by growing supply chain costs.”

Meanwhile, the company continues to expand its store footprint. It intends to open 11 new clubs this year and an additional 10 in FY23.

Also, BJ’s recently completed its acquisition of perishable goods distribution centers from Burris Logistics. The company expects this acquisition to generate EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) of nearly $20 million and EPS of $0.07 this year.

Wall Street’s Take

Following the print, Gordon Haskett analyst Charles Grom raised the price target on BJ’s Wholesale stock to $75 from $65 and retained a Buy rating.

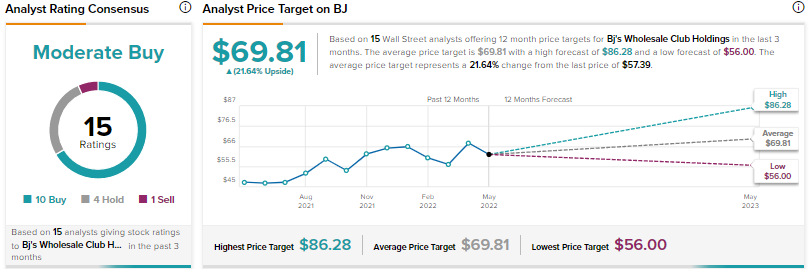

Overall, the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys, four Holds, and one Sell. The average BJ’s Wholesale price target of $69.81 implies 21.6% upside potential from current levels. Shares have declined 14.3% year-to-date.

Conclusion

BJ’s Q1 FY22 performance was impressive given how several retailers struggled to thrive in a challenging macro environment. The company might continue to see strong sales as customers generally prefer to shop at discount retailers amid a high inflation environment.

What’s more, BJ’s Wholesale scores 8 out of 10 on TipRanks’ Smart Score system, indicating that it is more likely to outperform the market.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Did Cisco Sink 13.6% in Thursday’s Pre-Market?

Target Stock Bleeds after Earnings Miss; Dismal Website Visits Hinted at It

Home Depot Hits Home Run with Solid Q1 Results

Questions or Comments about the article? Write to editor@tipranks.com