Australia-based Zip Co Ltd. (AU:ZIP) announced that it is in talks with tech giant Apple (AAPL) to integrate its BNPL (buy now, pay later) products in the U.S. Additionally, the company released its full-year results for FY24, with higher revenue and earnings. Following the announcement, Zip’s stock fell sharply and lost over 8% as of writing.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Year-to-date, Zip shares have gained an impressive 230% in trading, driven by its strong operational performance. Also, Apple discontinued its BNPL service, Apple Pay Later, in June, in the U.S. This boosted positive momentum for Zip’s stock, given the increased growth potential in the U.S. market.

Zip Co is a global digital financial services company with operations in Australia, New Zealand, and the U.S.

Zip Negotiating BNPL Integration with Apple

Zip is looking to implant its BNPL installment-payments product in Apple’s offerings in the U.S. The company is also exploring strategic alliances with other payment providers and is expected to announce additional deals in the U.S. in the September quarter. Earlier this month, Zip revealed that U.S. merchants utilizing Stripe can now provide Zip as a payment option to their customers.

The company further stated that it is focusing on capital-light strategies as it aims to boost earnings and operating margins over the next two years.

Zip Reports FY24 Results

In FY24, ZIP reported a 28.2% year-over-year growth in its revenues of AU$868 million. Meanwhile, the group’s cash EBTDA (earnings before tax, depreciation, and amortization) grew by 243.2% to AU$69 million.

Regionally, Zip Americas registered a record performance with a total transaction volume (TTV) of AU$6.5 billion, up 40% from FY23. Its cash EBTDA reached AU$77.2 million, a 420% increase compared to FY23.

However, investors were perhaps disappointed with the 2.9% decline in Zip’s active customer numbers to 6 million in FY24.

Is Zip Stock a Good Buy?

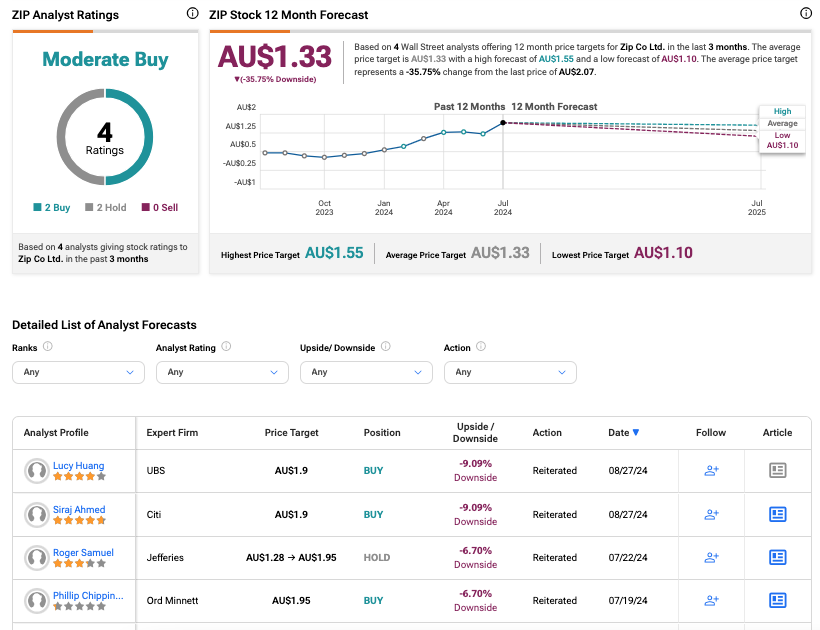

According to TipRanks, ZIP stock has received a Moderate Buy rating based on two Buy and two Hold recommendations. The Zip Co share price target is AU$1.33, which is 36.06% below the current trading level.