Exxon Mobil (NYSE:XOM) and PepsiCo (NASDAQ:PEP) boast an impressive history of consistent dividend payments and growth. Investors looking for a reliable and steady income could consider these stocks, often referred to as Dividend Aristocrats (companies that have increased their dividends for over 25 consecutive years).

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

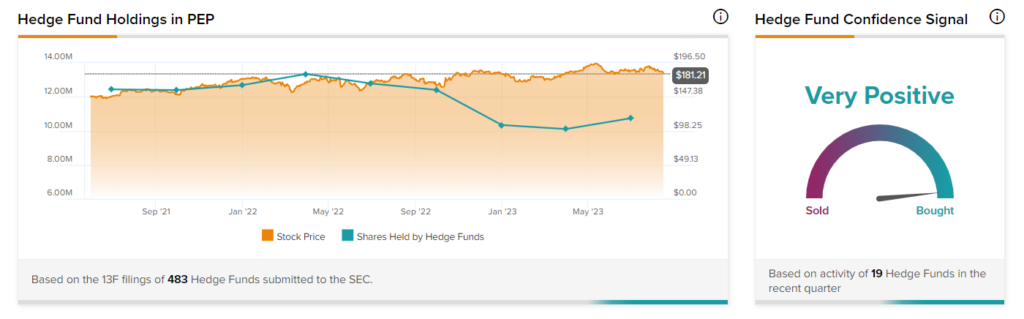

Also, recent data from TipRanks’ Hedge Fund Trading Activity tool, which offers hedge fund signals based on the latest Form 13F filings, indicates that hedge fund managers have been increasing their holdings in these stocks.

Let’s take a closer look at these two Dividend-Aristocrat stocks.

Exxon Mobil (NYSE:XOM)

Exxon Mobil has increased its dividend for 40 consecutive years, making it a dependable income stock. Furthermore, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 2.7 million shares of this integrated Oil and Gas Company in the last quarter.

Our data shows that Ken Fisher of Fisher Asset Management, Donald Yacktman of Yacktman Asset Management, and Henry Kwiecinski of Bishop & Co Investment Management were among the hedge fund managers who increased their exposure to XOM stock.

While hedge fund managers and corporate insiders show bullish sentiment, analysts maintain a cautiously optimistic outlook on XOM stock due to concerns surrounding commodity prices in a normalized economic environment. Exxon has received eight Buys and six Hold recommendations from analysts for a Moderate Buy consensus rating. XOM stock’s 12-month average price target of $124.25 implies 13.5% upside potential from current levels.

PepsiCo (NASDAQ:PEP)

PepsiCo has increased dividends for 51 consecutive years. In addition, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. Per the tool, hedge funds bought 642,500 shares of this beverage giant last quarter.

According to the tool, popular hedge fund managers Ken Fisher of Fisher Asset Management and Suncoast Equity Management’s Donald R. Jowdy increased their positions in PepsiCo stock.

Nonetheless, analysts are cautiously optimistic about PEP stock. While the company continues to gain market share across several businesses, including snacks, sodas, and sports drinks, intense competition from other players in the beverage industry remains a concern.

PepsiCo stock has a Moderate Buy consensus rating based on nine Buy and one Hold recommendations. Meanwhile, PEP stock’s 12-month average price target of $204.50 implies 13.3% upside potential from current levels.

Ending Thoughts

The Dividend Aristocrat status of XOM and PEP reflects their commitment to rewarding shareholders with regular and growing dividend distributions. This track record can be appealing to investors seeking reliable income and long-term stability in their investment portfolios. Additionally, the bullish view of hedge fund managers helps instill further confidence in these stocks.