In perhaps most contexts, Disney (NYSE:DIS) engaging in a bitter dispute with Florida Governor Ron DeSantis would not be perceived as ideal. However, it’s also possible that the Magic Kingdom could be a discounted buying opportunity, in my opinion, until July 2024. That’s the time when the Republican National Convention will occur. I am bullish on DIS stock’s future because certain evidence points to DeSantis not winning the GOP’s nomination for president.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A Brief Background

Before diving into the reasons why DIS stock looks attractive amid the political backdrop, readers require basic context. Last year, Governor DeSantis signed the Parental Rights in Education Act, which prevents classrooms from discussing certain sensitive topics. However, Disney eventually voiced opposition to the bill, which the governor found distasteful, as TipRanks contributor Steve Anderson mentioned.

DeSantis decided to hit the House of Mouse in the pocketbook, “revoking its special rights over the massive spread of real estate on which Walt Disney World sits,” wrote Anderson. However, in a bit of legal gamesmanship, Disney passed restrictive covenants that removed DeSantis-appointed board members’ control to manage certain aspects of Disney World.

Last month, Disney upped the ante, filing a lawsuit against DeSantis, alleging that he violated the “Takings Clause, the Contracts Clause, the Due Process Clause, and even the Constitution’s First Amendment.” The drama continues, but the main point is that it’s a mess for DIS stock.

True, Disney shares gained nearly 3% on a year-to-date basis. However, during the same period, the benchmark S&P 500 index (SPX) returned nearly 10%. Therefore, a basket of large but boring securities has beaten DIS stock. That’s not exactly a ringing endorsement.

Nevertheless, astute investors may want to shrewdly leverage this weakness to pick up DIS stock on the cheap. Fundamentally, circumstances appear doubtful that DeSantis will make much progress politically.

DIS Stock is an Enticing, Politically-Inspired Idea

DeSantis appears to have adopted a straightforward approach to politics, reminiscent of the style demonstrated by former President Donald Trump. This similarity could lead to comparisons between the two, which may have an influence on conservative voters. With Trump himself running for president in 2024, it’s conceivable that dedicated conservative voters might lean toward him. That’s bad news for DeSantis and good news for DIS stock.

In addition, DeSantis – by refusing to let the Disney matter go – walked into a trap. By causing such a public uproar, along with jeopardizing a critical business enterprise in his home state, he’s inviting Trump’s criticism. In other words, Trump may possibly claim that he could handle the matter much better, which would most likely resonate with his audience.

Indeed, Trump already lashed out about DeSantis and him being “absolutely destroyed” by Disney. Without even getting into what the Democrats might say about the governor, he already has his hands full with Trump. That’s another point to DIS stock representing a discounted opportunity as DeSantis’ chances for the presidency fade away.

Finally, DeSantis must realize that while one can win 100% of the ultra-conservative vote, it does not necessarily guarantee wider electoral success. As well, with the governor constantly talking about his battle with Disney, it clouds other talking points he may have.

The shame of it is that DeSantis might have great ideas for America. However, taking down one of Florida’s biggest employers for a political disagreement appears impudent. Likely, such a strategy will not win over centrist Democrats and independents. However, that’s great news for DIS stock.

Disney Needs to Hold On

To be sure, the DeSantis matter isn’t entirely a counterintuitive positive for DIS stock. As Anderson mentioned in another article, Disney shares slipped after the company reported soft results for its second quarter of Fiscal Year 2023.

Earnings per share of 93 cents and revenue of $21.82 billion were basically in line with analysts’ respective targets. Further, while the company’s Disney+ streaming platform delivered reasonably solid subscriber metrics, the average revenue per customer (ARPC) for Disney+ Hotstar fell to 59 cents from 74 cents.

Also, Hulu, which is offered by Disney, saw its ARPC drop to $11.73 from $12.46, mainly due to “a combination of lower advertising and more subscribers going multi-product,” writes Anderson.

To be sure, the financial results aren’t bad, but they just need some work. However, in the long run, that shouldn’t be that big of a problem.

Is Disney Stock a Buy, According to Analysts?

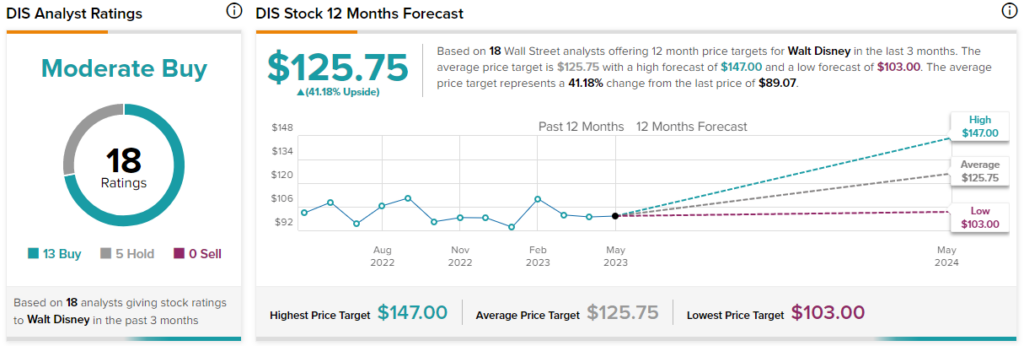

Turning to Wall Street, DIS stock has a Strong Buy consensus rating based on 13 Buys, five Holds, and zero Sell ratings. The average DIS stock price target is $125.75, implying 41.2% upside potential.

Takeaway: The DeSantis Headwind Should Fade

For the moment, Ron DeSantis’ attacks against Disney represent a major distraction. Further, it’s coming at a sensitive time for the Magic Kingdom. However, DeSantis likely committed glaring political mistakes that I believe make him unlikely to win the presidential nomination. Therefore, shrewd investors can consider owning shares of DIS at a discount.