Following 2020’s depressed levels of brick and mortar retail success vs. the outsized gains of the ecommerce space, 2021 offered a reversal of fortunes. The softlines retail segment made a comeback while ecommerce growth slowed down.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

That could have been somewhat expected with the economy reopening following 2020’s pandemic-driven lockdowns. However, Well Fargo analyst Brian Fitzgerald says it’s clear that the COVID-19 pandemic “pulled forward 4-5 years of ecommerce penetration.”

“Despite those slowing ecomm trends last year,” the analyst went on to say, “we expect the shift to ecommerce is likely to stick’ and Amazon (AMZN) —as the #1 apparel retailer in the country—remains the 800-lb gorilla in the space, with clear ambitions to take ongoing share in the category.”

With third-party sales included, Fitzgerald estimates U.S. apparel/ footwear sales on Amazon are now more than $65 billion, which is almost double that of Walmart, the nearest rival. This amounts to a “highly impressive” ~15% share of all U.S. apparel sales. Even more impressively, it amounts to a 35-40% share of all online apparel sales. “We currently estimate AMZN will surpass $73B in apparel/footwear sales in 2022,” the analyst added.

And going by the latest Wells Fargo survey, Amazon’s dominance looks set to keep on growing. Amongst 1,000 U.S. Amazon shoppers surveyed, in Apparel/footwear categories, Amazon made a ~100bps YoY share gain in 2021 to reach 15% while also showing a~400bps gain compared to pre-pandemic levels.

Moreover, over the last year, consumers’ appetite for fashion apparel items such as jeans and dresses on Amazon has significantly increased. Compared to the 9th spot it held last year, fashion apparel has become a “top 3 category.” This points to the “headway Amazon has made towards becoming a destination for fashion apparel in the eyes of the consumer.”

Down to the nitty-gritty, what does this all mean for investors? Fitzgerald reiterated an Overweight (i.e., Buy) rating along with a $4,250 price target. Investors are looking at 12-month returns of 36%, should the forecast work out as planned. (To watch Fitzgerald’s track record, click here)

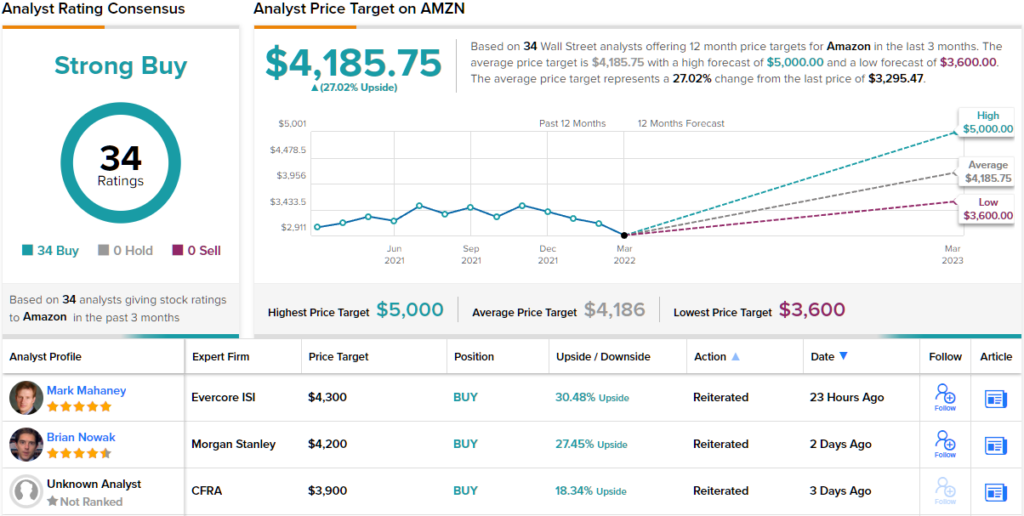

The rest of the Street is in full agreement here. Based on Buys only – 34, in total – the analyst consensus rates this stock a Strong Buy. The average price target is only slightly lower than Fitzgerald’s; at $4,185 and change, the figure is set to generate 12-month returns of 28%. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.