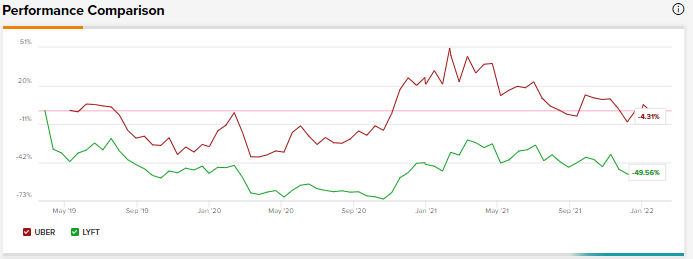

Ride-sharing services like Uber and Lyft had a rough 2021 as the COVID-19 pandemic and driver shortages proved to be a double whammy for these companies. However, looking at their recent Q4 results, it seems that people are back to sharing rides and business is looking up.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

According to a MarketsandMarkets report, the global ride-sharing market is expected to be worth $185.1 billion by 2026.

Against this background, let’s compare these two major competitors, Uber and Lyft, using the TipRanks stock comparison tool, and examine what Wall Street analysts are saying about these stocks.

Uber Technologies (NYSE: UBER)

Uber brushed away fears of the new Omicron variant impacting its business and emerged strong from the fourth quarter, as evidenced by its Q4 results.

Dara Khosrowshahi, CEO of Uber commented that in the fourth quarter, “more consumers were active on our platform than ever before, Delivery reached Adjusted EBITDA profitability, and Mobility Gross Bookings approached pre-pandemic levels. While the Omicron variant began to impact our business in late December, Mobility is already starting to bounce back, with Gross Bookings up 25% month-on-month in the most recent week.”

Indeed, Uber’s delivery business reported its first quarter of adjusted EBITDA profit of $25 million from an adjusted EBITDA loss of $145 million in the same period a year back. What’s more, the company’s management stated on its earnings call that Uber Eats was quickly becoming “the fastest-growing delivery player in America.”

With a positive adjusted EBITDA in Q4, Uber’s management expects that the Delivery business will be able to invest more when it comes to its growth in the areas of grocery, retail and local commerce and still generate a “significant EBITDA profit.”

Overall, for Uber, adjusted EBITDA soared by $540 million year-over-year to $86 million in Q4. In Q1, the company anticipates adjusted EBITDA to land between $100 million and $130 million.

For FY22, Uber is projecting incremental EBITDA margin as a percentage of gross bookings to be around 10% for its Mobility business and more than 5% for Delivery.

When it comes to Uber’s ride-hailing or mobility business, gross bookings jumped 67% year-over-year to $11.3 billion, with December gross bookings recovering to pre-pandemic levels and approaching an annual run-rate of $50 billion in the first few weeks of December.

The company defines gross bookings as “the total dollar value, including any applicable taxes, tolls, and fees, of: Mobility rides; Delivery orders (in each case without any adjustment for consumer discounts and refunds); Driver and Merchant earnings; Driver incentives and Freight revenue.”

Ride-sharing businesses like Uber and Lyft had faced driver shortages early last year as many drivers left their networks due to lack of incentives or other benefits. Besides for that, these companies have also been involved in numerous legal proceedings in both U.S. and abroad regarding the classification of drivers as independent contractors instead of as employees, workers, or quasi-employees.

However, in Q4, around 325,000 drivers and couriers started to work at Uber, bringing its global driver or courier base to 4.4 million, “the largest it’s been since the second quarter of 2020.”

This was a result of Uber’s efforts to quickly onboard more drivers and couriers and more targeted marketing.

Wedbush analyst Ygal Arounian, one of the top-rated analysts on TipRanks, was upbeat about the above takeaways from Uber’s Q4 results, including the improvement in driver supply. The analyst thinks that adding more drivers could result in a drop in Uber’s cost per ride, especially in the U.S., and will be a tailwind for the company through 2022.

The analyst commented on the company’s Q4 results as a “big step in the right direction for Uber which should give investors incremental confidence in the recovery story thesis for 2022.”

As a result, Arounian has a Buy rating and a price target of $57 (41.8% upside) on the stock. But the analyst is likely to update his price target following Uber’s Investor Day today, where he expects to get more clarity on the company’s financial metrics and targets.

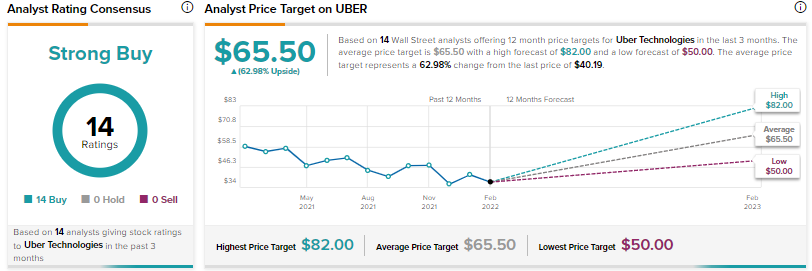

The rest of the analysts echo Arounian and are also bullish about the stock, with a Strong Buy consensus rating based on 14 Buys. The average Uber stock prediction of $65.50 implies upside potential of approximately 63% to current levels for this stock.

Lyft (NASDAQ: LYFT)

Lyft also delivered solid fourth-quarter results, achieving its first year of adjusted EBITDA profit of $92.9 million in FY21 versus an adjusted EBITDA loss of $755.2 million in FY20. The company’s revenues in FY21 were up 36% year-over-year to $3.2 billion, with revenue per active rider in the fourth quarter reaching a new all-time high of $51.79.

Moreover, Lyft’s Q4 contribution margin of 59.7% exceeded the company’s guidance of 59%, while adjusted EBITDA of $74.7 million was at the high end of Lyft’s outlook of between $70 million and $75 million.

The company calculates contribution margin by dividing “contribution for a period by revenue for the same period.”

Elaine Paul, the newly appointed CFO of Lyft, stated that the all-time highs for the above financial metrics were driven by “improving service levels and higher ride volumes in our marketplace. Despite short-term headwinds from omicron, we remain optimistic about full-year 2022.”

However, it was the active rider figure that had Needham analyst Bernie McTernan concerned. While active riders jumped 49% year-over-year to 18.7 million, on a sequential basis, this figure saw a decline of 1 percentage point.

Moreover, Lyft expects that the Omicron variant will have an impact on ridesharing volumes and would be slightly down in Q1. As a result, the company anticipates revenues to decline quarter-on-quarter by 12% to 18% in Q1 to range between $800 million and $850 million.

Analyst McTernan thinks that in FY22, the company needs to exhibit rising growth. This could be either “from increased usage or the staying power of new use cases or maintaining elevated prices, or share gain.”

The analyst believes that gaining market share would be difficult for Lyft as its main competitor (most likely Uber) has revamped its platform and offers consumers both delivery and mobility (a more compelling value proposition) instead of just delivery.

Over the long term, McTernan remains hesitant about whether Lyft would gain market share when it comes to the mobility business and views other players in this universe as offering a “more compelling upside.”

As a result, the analyst is sidelined on the stock with a Hold rating.

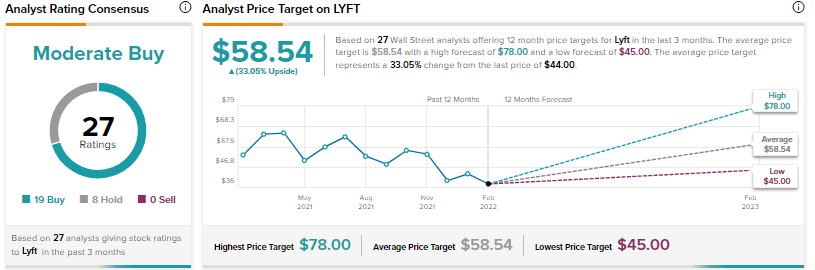

Other analysts, however, are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 19 Buys and 8 Holds. The average Lyft stock prediction of $58.54 implies upside potential of approximately 33.1% to current levels for this stock.

Bottom Line

Analysts are bullish about UBER and remain cautiously optimistic about Lyft. UBER is proving to be successful not only at its Mobility business but also its other growth initiatives, like advertising. Moreover, considering Uber’s upside potential over the next 12 months, it certainly seems to be a better Buy.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue