In this environment, let us take a look at two natural gas names, Golar LNG and New Fortress Energy, which have already more than doubled in 2022 alone and could rise even further.

Are LNG Stocks a Good Investment?

Stocks in the LNG production and transport space have been flying high this year as natural gas prices continue to stay elevated owing to buoyant demand, hot weather, and the ripples from the Ukraine-Russia conflict. After already lowering volume from the Nordstream pipeline, Russia is set to halt gas flows for three days this month for maintenance.

While natural gas futures prices are up nearly 143% in 2022 alone, the U.S. is rushing to supply gas to an energy-starved Europe. This year, nearly three-fourths of LNG shipments from the U.S. have headed to Europe. Last year this figure was close to one-third of the shipments.

Golar LNG (GLNG)(GB:0HDY)

Golar operates via shipping and Floating Liquefaction Natural Gas (FLNG) verticals. In its FLNG business, the company is seeing multiple engagements from new clients, along with robust development in its existing FLNG growth projects in integrated and tolling-based projects.

In the Floating Storage Regasification Unit (FSRU), Golar has signed two contracts with Italy’s energy infra company Snam. Additionally, on the ESG front, Golar has invested in Norway’s Aqualung Carbon Capture. The latter is developing a carbon capture and separation membrane system, which could be deployed on FLNG units in the future.

Is Golar Energy Stock a Buy?

Evercore ISI’s Sean Morgan has reiterated a Buy rating on the stock while increasing the price target to $38 from $33. This indicates a 34.13% potential upside in the stock, on top of the 115.6% price gain so far this year. Overall, the Street has a Strong Buy consensus rating based on five Buys and one Hold assigned in the past three months. The average Golar price target is $31.25, implying 10.3% upside potential.

Along with Wall Street, hedge funds are also positive on Golar. Indeed, hedge funds have increased their holdings in GLNG stock by 415,700 shares in the last quarter.

New Fortress Energy (NFE)

The second name on our list is a global energy infrastructure player that operates natural gas and LNG infrastructure, as well as ships and logistics to deliver turnkey energy solutions.

Fortress is aiming to generate $1.5+ billion in adjusted EBITDA for 2023 and is taking strides to achieve this goal. It has expanded FLNG deployment opportunities from one Gulf of Mexico location to three and is closer to completion of its Barcarena and Santa Catarina terminals in Brazil. It has also begun construction of the 605MW Barcarena power plant.

Further, in Europe, it has made advances on permits in Ireland and has leased an FSRU to a terminal in the Netherlands. Fortress also expects its multiple green and blue hydrogen projects to progress in the coming periods. This month, Fortress has also teamed up with Plug Power (PLUG) (GB:0R1J) to develop a 120 MW green hydrogen plant in Texas. The plant is touted to be one of the largest operations of its type in North America and can also be scaled up to 500MW.

Finally, under its $2 billion joint venture with Apollo (APO) (GB:0A72), Fortress has set up a platform that owns and operates 11 LNG infrastructure vessels. The JV provides critical infrastructure for the delivery, storage, and regasification of LNG to serve countries globally.

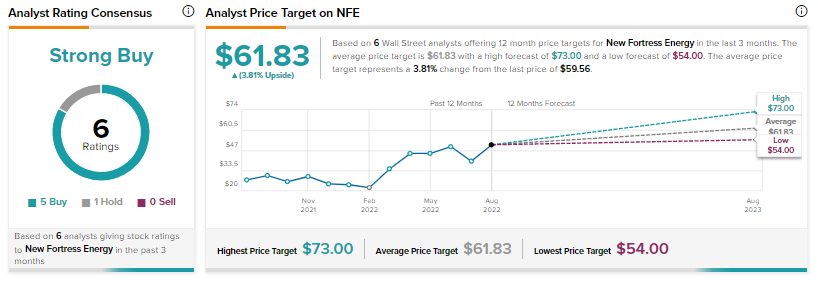

Is New Fortress Energy a Good Stock to Buy?

Turning to Wall Street, Fortress has a Strong Buy consensus rating based on five Buys and one Hold. The average NFE stock price target is $61.83. JMP Securities’ Brian McKenna is even more optimistic about Fortress, with a Buy rating and a price target of $70. This implies a 17.53% potential upside after the stock’s nearly 138% price gain so far in 2022.

As with Golar, hedge funds are positive about Fortress stock as well and have increased holdings in the stock by 144,500 shares in the last quarter.

The Future Seems Bright for GLNG and NFE Stocks

With natural gas futures prices expected to rise further in the coming periods, both Golar and Fortress are poised to gain big. These two companies are making significant progress that puts them in good stead for the long haul as well.

At the same time, other names in this space are flying high too. You also might want to check out this LNG Carrier that has jumped nearly 60% so far this year.