Shares of Seattle-based coffee giant Starbucks (NASDAQ: SBUX) have been quite constructive over the past few months, now significantly off those June lows. With new CEO Laxman Narasimhan and a compelling reinvention plan, Starbucks now has the means to march higher, even as the world tilts into a recession in 2023.

Founder Howard Schultz seems to have found the right man for the job with Narasimhan, the former COO of PepsiCo (NASDAQ: PEP), who brings in a wealth of beverage industry experience. Though the coming Fed-induced economic downturn could derail Starbucks stock’s current upside momentum, I think Starbucks will be in a position to rise out of the market funk in a much stronger position.

A new leader, a sound growth plan, and a commitment to reinvent the in-store experience are all factors that could allow shares to turn a corner, even as markets continue digesting the interest rate hikes to come.

Undoubtedly, today’s Fed meeting didn’t sit well with investors, as Fed chair Jerome Powell admitted that soft-landing plans still entail “pain.” Starbucks shares fell more than 2.4% after the tense Fed meeting, even though the firm now looks to have found its way.

I remain incredibly bullish on Starbucks stock after the modest pullback and think it will be tough to stop the firm’s comeback from oversold territory.

Starbucks: Technological Innovation Could Be Key to Reinvention

Howard Schultz previously admitted that Starbucks lost its way before he stepped in for his third (and likely final) stint. Amid a plethora of issues, ranging from unionization to COVID-related woes, Schultz was able to clear the air for investors with a plan and a new leader who’s more than capable of getting the job done. Under the rein of Narasimhan, we could see Starbucks evolve with intriguing technological innovations, paving the way for a new kind of experience.

New innovations will not only lead to increased store traffic and sales but also help Starbucks pad its operating margins. In prior pieces, I noted that automation efforts would help the firm tackle labor woes while also delivering a permanent boost to operational efficiencies.

Indeed, Starbucks has been improving the in-store tech used in its stores to help lessen the workload of baristas. Moving forward, I’d look for Starbucks’ partnership with e-commerce titan Amazon (NASDAQ: AMZN) to pay even larger dividends, as cashier-less stores reveal the benefits of increased autonomy.

Today, there are two Amazon-Starbucks stores, both based out of New York City, that leverage Amazon’s “just walk out” tech. Over time, we could see such hybrid stores popping up across dense urban environments across America. Eventually, Starbucks may team up with the likes of a Chinese convenience retailer to bring similar stores to China.

Undoubtedly, China is a huge growth market for Starbucks. Just ask Howard Schultz, who sees China and its booming middle class as a bigger needle mover than the U.S. in the future. With around 9,000 new stores to be open by 2025, Starbucks is well on its way to fueling the caffeine appetite of the Chinese consumer.

What to Expect from Starbucks Stores of the Future

Such new stores are likely to be specced out with many high-tech features that Starbucks envisions in its stores of the future. Faster orders via mobile apps and less friction at the till are just some of the benefits to be had from Starbucks’ investments in tech. Not only will such efforts help improve Starbucks’ bottom line, but they’ll also enhance the customer experience and help Starbucks evolve in an era where it will need to do a little more to beckon remote workers into stores.

Beyond automation efforts, Starbucks has an opportunity to further improve its loyalty app to get closer to the consumer.

Indeed, there’s a lot to love about Starbucks’ new reinvention program. Management was confident enough to increase its long-term financial forecast to reflect improvements from its program. The firm is looking to average 10-15% in EPS (earnings per share) growth over the next three years, higher than the prior 10-12% EPS growth estimate.

What is the Price Target for SBUX Stock?

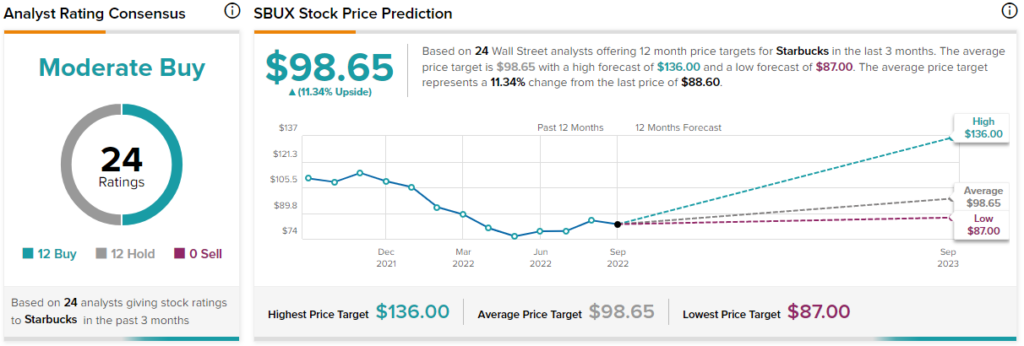

Turning to Wall Street, SBUX stock comes in as a Moderate Buy. Out of 24 analyst ratings, there are 12 Buys and 12 Holds.

The average Starbucks price forecast is $98.65, implying upside potential of 11.3%. Analyst price targets range from a low of $87.00 per share to a high of $136.00 per share.

Conclusion: SBUX Stock Still Seems Cheap

Starbucks is embarking on a journey to reinvent itself for the new-age consumer. Even after a nice bounce off the bottom, shares of SBUX still seem too cheap to pass up at 25x trailing earnings and just 3.2x sales, given its double-digit EPS growth prospects.

Recession or not, Starbucks and its new chief are likely to continue moving forward, even as consumer balance sheets take a bit of a hit from a coming Fed-induced recession.