Although big-box retailer Target (TGT) may seemingly present a cheapened opportunity for discount divers, the overriding reality is that the consumer economy faces many challenges. Therefore, investors ought to be very careful before engaging Target or any other consumer-dependent company. I am, for the time being, bearish on TGT stock.

During the initial outbreak of the COVID-19 pandemic, analysts naturally had pessimistic views regarding economic viability. In April 2020, retail spending in the U.S. suffered a historic collapse, plunging a record 16.4%.

However, the retail sector enjoyed a surprising comeback. Dubbed “retail revenge” or “revenge shopping,” millions of consumers took to the streets as COVID-19 restrictions gradually relaxed and as more non-essential businesses started opening back up again.

As well, because the pandemic forced people to stay indoors, the personal savings rate skyrocketed. Later, government stimulus checks started to come in, emboldening households to open their wallets once circumstances started normalizing.

Of course, Target and big-box retail rival Walmart (WMT) took notice, ordering a massive amount of inventory in anticipation of a blistering holiday season in 2021. Plus, the global supply-chain crisis that impacted almost every industry forced retailers to aggressively acquire more inventory than they would normally be comfortable with.

Essentially, it was better to have products to sell than nothing at all. Unfortunately, Target is now paying for this understandably audacious decision.

Target’s Smart Score Rating Suggests Respectable Performance Ahead

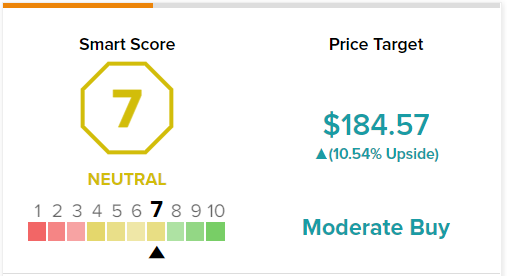

On TipRanks, TGT stock has a 7 out of 10 Smart Score rating. This indicates moderate potential for the stock to outperform the broader market.

TGT Stock and the Inventory Dilemma

For the quarter ended April 30, 2022, Target posted a days inventory metric of 71.6, well above the tally of 57.8 in the same period last year. Days inventory outstanding is the average number of days that a company keeps inventory before selling it. The lower the number, the better. In the April quarters of 2018 and 2019, the average days inventory count was 68.4.

However, the crux of the matter with big-box retailers isn’t just about the high levels of inventory. Rather, it’s a two-fold issue. First, storing a glut of products costs money. Second, companies like Target risk holding onto inventory that will never move, thus reducing space for the products that will.

Given this extraordinary circumstance, Target has been contemplating the unthinkable: asking customers to keep their unwanted products along with giving them their refunds. In other words, the company will pay its shoppers to store non-moving inventory.

While a difficult proposition to swallow, Target must do something drastic to get its broader financials in order. True, revenue in the most recent quarter was $25.2 billion, up 4% year-over-year. However, net income was down to $1 billion, down 52% from the prior-year quarter. Along with a decline in gross margin of about 420 basis points, Target’s operating margin also slipped by 45%, from 10% to 5.5%.

Until management resolves these core issues, TGT stock will likely be volatile.

Target Stock Receives an Analyst Upgrade

Early this month, Wells Fargo (WFC) analyst Edward Kelly upgraded TGT stock to “Overweight” from “Equal-Weight,” raising his price target to $195 in the process. Currently, the stock is trading at around $167 per share.

According to Kelly, TGT stock offers “an underappreciated earnings recovery at the right price.” For one thing, while Target did mess up regarding its forward demand projections (which led to the aforementioned inventory glut), it wasn’t the only retailer to do so. Indeed, Walmart has the same issues regarding historically high days inventory and noticeably waning operating margins.

Second, Target absorbed significant pain in profitability metrics early on in the retail sector. This implies that TGT stock can now get on the road to recovery, eventually leading to hearty gains for shareholders.

Finally, Wall Street may be too pessimistic about Target. While it did incur a beating – especially as consumers pivoted toward experience-based services rather than the accumulation of physical goods – investors and analysts must also appreciate that the COVID-19 crisis is likely a one-off headwind. Few companies responded well to this extraordinary circumstance.

Inflation as the Ultimate Arbiter

While no one can say that TGT stock is holistically a bearish idea because the underlying company is dependent on the consumer economy, the ultimate arbiter of where Target heads next could be the inflation rate. With June’s reading for the consumer price index set at a blistering 9.1%, the narrative isn’t exactly encouraging.

Furthermore, the rate of currency erosion is incredibly problematic for TGT stock and its ilk. In 2021, the purchasing power of the U.S. dollar declined by 6%. However, just in the first half of this year, purchasing power dipped by 5.3%. Put another way, the rate of acceleration in currency erosion almost doubled this year.

Not only that, the latest jobs report came in much hotter than expected, with the economy adding 528,000 jobs in July. In contrast, economists forecasted 258,000 new jobs. Unfortunately, this circumstance translates to wage growth – another way of saying higher inflation. Ultimately, that’s a net negative for TGT stock unless the Federal Reserve acts drastically to shift the paradigm.

What Do Analysts Think of Target Stock?

Turning to Wall Street, TGT stock has a Moderate Buy consensus rating based on 19 Buys, nine Holds, and no Sell ratings. The average TGT price target is $184.57, implying 10.5% upside potential.

Conclusion: Target’s Efforts May Not be Enough

Although Target deserves credit for doing whatever is necessary to address its present vulnerabilities, it just might not be enough. Unfortunately, the deciding factor may come down to the health of the consumer economy, something the big-box retailer has little control over. Therefore, investors ought to be extremely cautious before jumping on TGT stock.