Tech stocks have been on a roller-coaster ride this year. The first half of the year saw major sell-offs, with recovery seen only in the beginning of the second half. However, the stocks are again on a downward spiral due to concerns over another round of interest rate hikes by the Fed later this month. Given the current scenario, we will take a look at three tech stocks, Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Meta Platforms (NASDAQ:META), and understand Wall Street’s take on them.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Now, with the help of the TipRanks Stock Comparison tool, let’s determine which stock could be a better buy for your investment portfolio.

Microsoft Corp. (MSFT)

Microsoft is a technology company, which offers a wide range of software, services, solutions, and devices like personal computers, tablets, and gaming consoles to its users. MSFT stock has lost over 20% so far this year.

According to UBS analyst Sundeep Gantori, “AI, big data and cybersecurity are at an inflection point that should see faster adoptions in the next few years.”

He believes that demand will remain robust on the back of strong momentum in the automation, analytics, and security space.

What Is the Future of MSFT Stock?

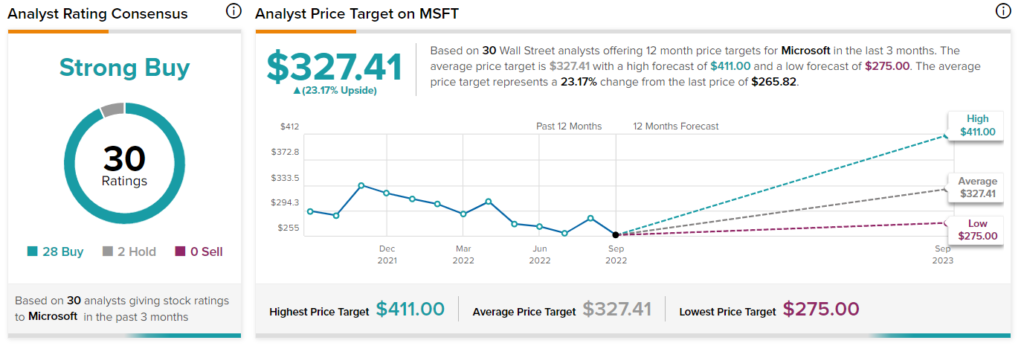

Analysts are unanimously optimistic about Microsoft’s prospects. The stock commands a Strong Buy consensus rating based on 28 Buys and two Holds. Also, MSFT’s average price forecast of $327.41 suggests 23.2% upside potential.

Gantori highlights that Microsoft’s “valuation is still attractive compared to its large-cap peers on a free-cash-flow basis.”

Further, hedge funds seem to be very positive about the prospects of MSFT stock and have collectively increased their holdings in the company by 12.7 million shares in the last quarter.

Apple, Inc. (APPL)

Apple designs, manufactures, and sells smartphones, personal computers, tablets, wearables, and accessories. It also offers a range of related services. Its products include iPhone, Mac, iPad, Apple TV, Apple Watch, Beats products, HomePod and AirPods.

Apple stock has been more resilient compared to its tech peers, gaining about 8% over the past six months. However, the stock is down more than 5% over the last 30 days.

Last week, Apple launched new versions of its iPhone, Apple Watch, and AirPods Pro. Despite inflation and an uncertain macro backdrop, demand for its products, especially the new iPhone 14, looks robust.

Are Apple Shares a Good Buy?

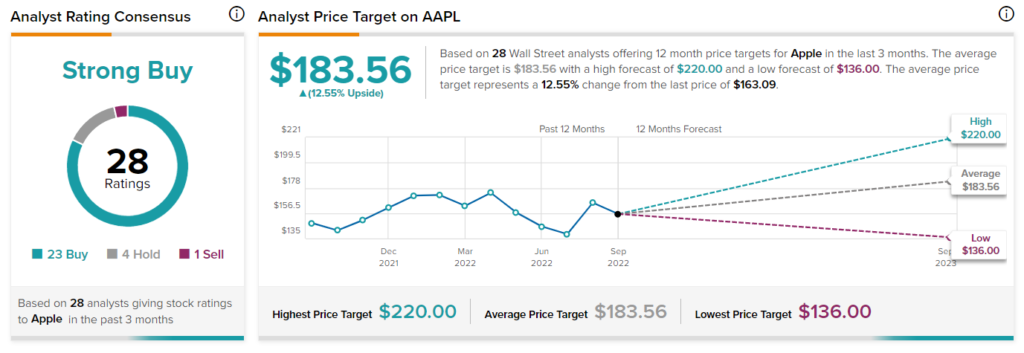

Turning to Wall Street, the analyst consensus is also optimistic about Apple stock, with a Strong Buy rating based on 23 Buys, four Holds, and 1 Sell. Apple’s average price target of $183.56 indicates upside potential of 12.6%.

Wamsi Mohan from Bank of America Securities highlights that the preliminary iPhone pre-order data looks positive for Apple.

Further, Apple boasts a “Perfect 10” Smart Score on TipRanks, implying that the stock has a solid potential to outperform the market.

Meta Platforms (META)

Formerly known as Facebook, Meta Platforms is an American multinational technology company headquartered in California. The company’s product portfolio includes Facebook, Instagram, WhatsApp, and other products and services.

Meta stock has lost half of its market capitalization over the past year. It is trading near its 52-week lows at $169.

Trading at 14x P/E, the valuations look very compelling compared to its own five-year historical average of 25x. Furthermore, it is relatively cheaper than its tech peers that are trading at P/E multiples of over 25x.

Is META Stock Expected to Go Up?

Analysts on TipRanks are cautious but optimistic about the prospects of META, giving it a Moderate Buy consensus rating, which is based on 27 Buys, five Holds, and two Sells. Meta Platforms’s average price prediction of $223.70 implies 32.4% upside potential.

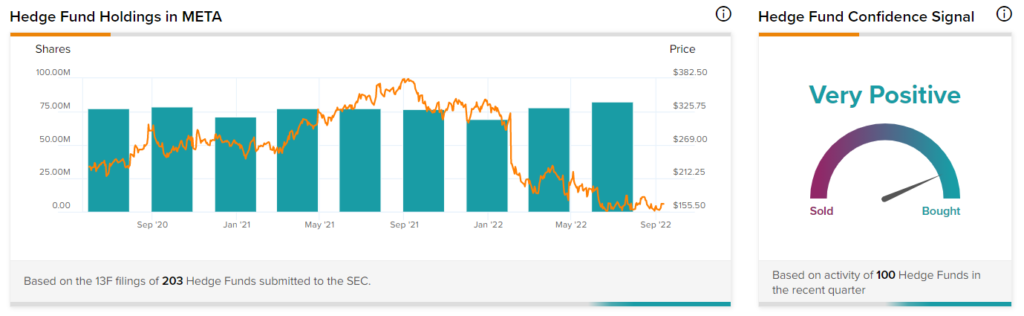

Markedly, making the most of the cheap valuation of Meta Platforms, hedge fund managers are buying its stock.

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence in META is currently Very Positive, as some of the top hedge funds that were active in the last quarter increased their cumulative holdings by 4.5 million shares.

Bottom Line

The current sell-off in the tech space has led to an erosion in the market capitalization of many big tech players. As a result, the current price levels present a good investment opportunity for investors to take positions in big tech names like Microsoft, Apple, and Meta Platforms.

Read full Disclosure