AdTech stocks have struggled tremendously this year, but many of them have taken a much deeper hit than other tech stocks due to their reliance on advertising revenue. In this piece, we compared two AdTech stocks. While both Magnite (NASDAQ: MGNI) and PubMatic (NASDAQ: PUBM) are off dramatically year-to-date, Magnite has seen greater volatility. It lost half its value between January and November 9, but it’s up 73% over the last month, with all of that coming after November 9. It’s an entirely different story with PubMatic, so which AdTech stock is better? A closer look at valuations tells us that PUBM may be better.

Magnite (MGNI)

Magnite touts itself as “the largest independent sell-side ad platform,” covering “every channel, every format and on your terms.” The November 9 turning point was the company’s last earnings report, but it’s difficult to see what investors found so compelling. While overall trends are positive for Magnite, the recent surge in its valuation and the strong likelihood of a recession suggest a neutral view may be appropriate, at least for now.

Magnite’s market capitalization soared past $1.4 billion after its latest earnings report. While the company did beat estimates handily, the guidance is what Wall Street has been caring about in virtually every industry. Magnite’s guidance was also ahead of expectations at the midpoint, which is surely why its stock soared.

It’s possible the sudden, guidance-driven surge may be overdone, but hedge funds are bullish on Magnite, adding 2.2 million shares in the last three months. However, insiders haven’t bought or sold any shares recently, an indication that the stock could be fairly valued after the recent surge.

Another critical problem is that Magnite is not profitable at the moment, although it was in the past. With a price/sales multiple of around 2.7x on a trailing basis, the company is trading well below AdTech bellwether Trade Desk (NASDAQ: TTD) at a P/S ratio of around 16.5x.

While that discrepancy is leading many to argue that Magnite is dramatically undervalued, its lack of profitability should give pause, particularly at a time when Wall Street is widely punishing unprofitable companies in other industries.

Additionally, Magnite is trading at a higher P/S ratio than many profitable AdTech names, like Criteo (NASDAQ: CRTO) at 0.7x, Perion Network (NASDAQ: PERI) at 2x, and Digital Turbine (NASDAQ: APPS) at 2.4 times.

What is the Price Target for MGNI stock?

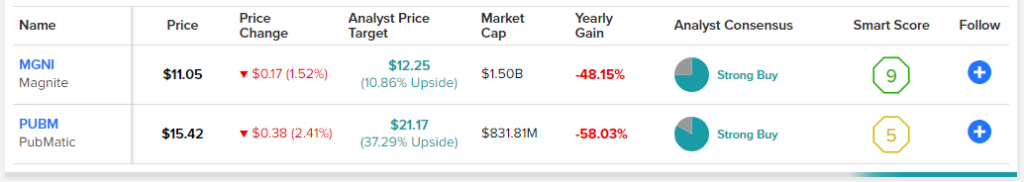

Magnite has a Strong Buy consensus rating based on three Buys, one Hold, and zero Sell ratings assigned over the last three months. At $12.25, the average price target for Magnite implies upside potential of 10.86%.

PubMatic (PUBM)

Unlike Magnite, PubMatic shares are down more than 7% over the last month, bringing their year-to-date decline to more than 50%. Wall Street is clearly unhappy with PubMatic’s guidance for only a 1% increase in revenue at the midpoint for the fourth quarter, but the company remains profitable, also unlike Magnite. A combination of factors suggests a long-term bullish view could be appropriate.

The big caveat with PubMatic is that the bull thesis for this company is going to take quite a while to play out. On the one hand, The Trade Desk looks overvalued, but on the other, PubMatic looks undervalued. It trades at a trailing P/S ratio of around 3.1x, putting it only slightly ahead of the unprofitable Magnite.

However, there’s no doubt that a recession would be bad for the AdTech space, and we’re already seeing declining revenue and earnings across the sector. As PubMatic is still profitable, it looks like one of the few potential plays in the space, but it’s ultra-risky in the near term due to the likelihood of a recession.

What is the Price Target for PUBM Stock?

PubMatic has a Strong Buy consensus rating based on five Buys, one Hold, and zero Sell ratings assigned over the last three months. At $21.17, the average price target for PubMatic implies upside potential of 37.3%.

Conclusion: Neutral on MGNI, Bullish on PUBM

There’s no denying that the AdTech sector is in trouble and will remain so until fears of a recession are passed. Even The Trade Desk has been unprofitable for the last 12 months, demonstrating danger in the AdTech sector. However, it’s important to realize that this is a temporary condition, so the time to pick potential winners is now when share prices are down.

Based on valuation and profitability, PubMatic looks better than Magnite, at least for now. Magnite could recover, which is why a neutral rating looks appropriate. Meanwhile, PubMatic appears to be holding its own in a challenging time for AdTech, so a bullish view looks appropriate, although it could take quite a while for this one to play out.