When Mark Zuckerberg—CEO of social media giant Meta Platforms (META)—starts talking about an economic downturn, it’s clear something is amiss.

Worse yet, when Zuckerberg starts backing up the talk about the economic downturn with plans to cut its hiring, it’s clear that the company is putting its money where its mouth is.

Perhaps not surprisingly, I’m bearish on Meta Platforms. There are certainly some paths to victory for the social media titan. However, too many of them depend on corporate spending to really succeed.

The last 12 months in Meta stock are marked by a plateau, then a decline. A fairly rapid decline at that; while Meta spent most of 2021’s latter half around $350 a share, February saw share prices drop from around $323 to around $238 in the space of a day. That drop continued, albeit more slowly, to this very day. Meta has lost about half its value just since February.

The latest news for Meta Platforms won’t help matters. During a recent question and answer session with Meta CEO Mark Zuckerberg, Zuckerberg revealed that the company cut its engineer hiring plans. It’s dialing back from its original intention of hiring 10,000 engineers in 2022 to merely hiring 6,000 to 7,000 new engineers.

Zuckerberg then noted the reason for the cutback. Zuckerberg advised employees watching the session to prepare for a deep economic downturn. He then referred to it as possibly being “…one of the worst downturns that we’ve seen in recent years.” As a result, the stock is currently down 2%.

Wall Street’s Take

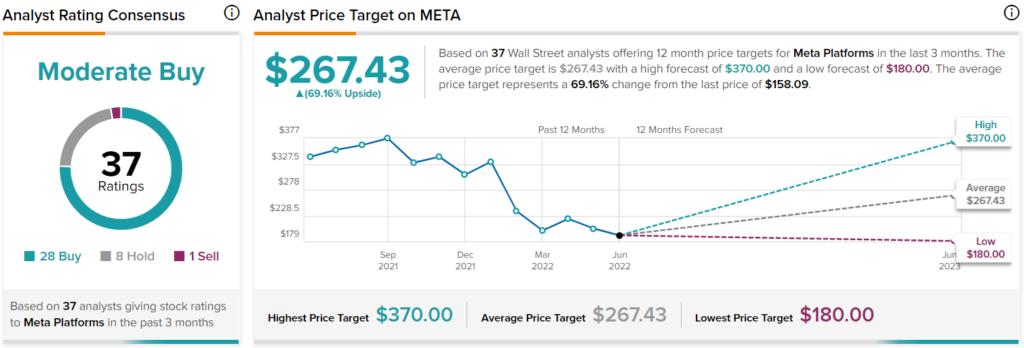

Turning to Wall Street, Meta Platforms has a Moderate Buy consensus rating. That’s based on 28 Buys, eight Holds, and one Sell assigned in the past three months. The average Meta Platforms price forecast of $267.43 implies 69.2% upside potential.

Analyst price targets range from a low of $180 per share to a high of $370 per share.

Investor Sentiment Looking Mixed

While Mark Zuckerberg is frantically warning about an economic downturn, investor sentiment doesn’t look all that put off by it. In fact, on TipRanks, Meta Platforms currently has a Smart Score of 8 out of 10. That’s the lowest level of “outperform,” suggesting it’s more likely than not that Meta will do better than the broader market.

Hedge fund involvement, as measured by the TipRanks 13-F Tracker, is certainly not expecting a downturn. Hedge funds bought the dip in a big way, picking up an extra 9.1 million shares of Meta last quarter. This is the first time that hedge funds have increased their positions since June 2021.

However, Meta insider trading is pretty heavily Sell-weighted. In the last quarter, Meta insiders sold $6.6 million worth of shares. Looking back to the full year, Meta insiders couldn’t get out fast enough, with Sell transactions outstripping Buy transactions by 169 to 33.

Retail investors, meanwhile—or rather those who hold portfolios on TipRanks—are largely unfazed by economic doom pronouncements. The number of TipRanks portfolios holding Meta Platforms stock increased just under 0.1% in the last seven days and 0.4% in the last 30 days.

Meta also offers no dividend, though some believe it’s only a matter of time until it does due to its improving cash flow.

Zuckerberg is Right about an Economic Downturn

Let’s take a moment to address the elephant in the room: Zuckerberg’s projections for economic doom afoot. Yes, he’s right. He’s absolutely right in every particular because he expressed it in such a fashion that Scott Adams himself should be proud of this level of corporate weasel-speak.

Zuckerberg expects “one of the worst downturns we’ve seen in recent years.” Any downturn would qualify under this statement, as we haven’t actually seen a downturn since the “Great Recession” cut out back in June 2009.

Some here might include the Pandemic Recession of 2020, but that started in February, ended in April, and, by and large, was artificially induced by government responses to COVID-19.

On average, recessions in the U.S. take place every three-and-a-quarter years, a Kiplinger report notes. So, given that the last serious recession hit the United States almost 13 years ago, frankly, we’re due.

So then, so what? Zuckerberg is right that a recession is likely. It’s also likely to be a pronounced one at that, simply because there hasn’t been an actual one for so long. This will also be a fundamentally different beast, especially since so much of normal macroeconomics is wildly skewed.

It’s hard to recall a recession in which there was this big of a supply-chain problem still ongoing. It’s also hard to remember a recession that featured so many “help wanted” signs on every business’ door. Normally businesses are firing during a recession. Zuckerberg’s own plans call for cutting back on new hires.

However, what is likely to be normal about an upcoming recession is that it will likely hit Meta Platforms hard. Businesses will cut back on their marketing spending. That means less advertising on Facebook and Instagram, which is a problem for Meta’s bottom line.

Meta might be able to make at least some of it up with its virtual reality trade. After all, vacations are one of the first things to go in a serious recession. That’s particularly true when the recession features $5 per gallon gas prices. A virtual vacation takes the concept of a “stay-cation” and turns it into a much more appealing alternative.

However, with Meta cutting back on engineering hires, its time-to-market will increase significantly. Your virtual vacation may not even hit in this recession. If you can even afford—or find, with the chip shortage—the necessary computing power to make it happen.

Concluding Views

There are paths to victory for Meta Platforms. However, most of these are speculative in nature and require several key points to go just right. The virtual vacation concept could work out quite well, but there are still quite a few developments that need to work out. Threading that needle will be a challenge.

Meta is trading well below its lowest price targets, and the hedge fund interest looks like it might keep Meta shored up for some time to come. Insider sentiment is distressing, to say the least, however. The comparatively tepid response from retail investors doesn’t help.

That, plus a macroeconomic environment that ensures advertising and shopping will be somewhat flat for a while, if not declining outright, doesn’t bode well. These factors all add up to me being bearish on Meta.

There’s likely still quite a bit more downward movement to follow, and you may be able to get quite a bargain ahead of the post-recession recovery – when that hits, that is.