The volatile stock market scenario makes it prudent to invest in defensive investment options, such as healthcare stocks. Among these stocks, Medtronic (NYSE:MDT) and Abbott Laboratories (NYSE:ABT) stand out due to their status as Dividend Aristocrats (companies that have increased their dividends for over 25 consecutive years). Interestingly, hedge fund managers have been increasing their holdings in these two stocks.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let’s take a closer look.

Medtronic Plc.

MDT has increased its dividend for 45 consecutive years. The company’s strong financials and leadership position within the medical device industry support its impressive dividend growth history. In addition, the company is focusing on digital technology adoption and cost-saving measures, with a target of achieving $1 billion in savings by 2025.

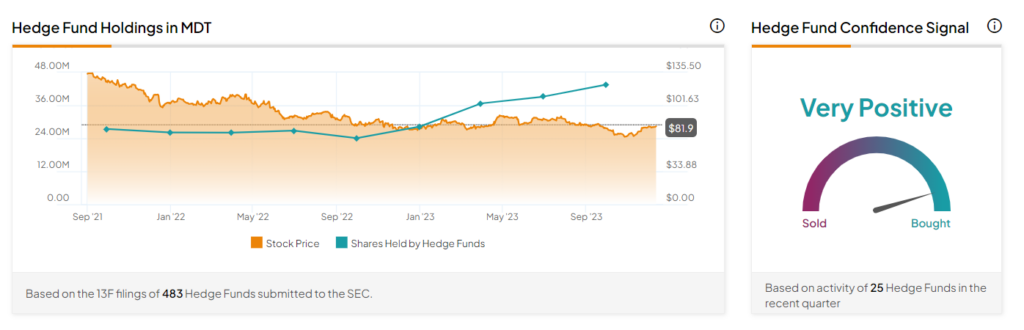

Furthermore, MDT stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. Per the tool, hedge funds bought 4.4 million shares of this healthcare giant last quarter. According to the tool, popular hedge fund managers, including Fisher Asset Management’s Ken Fisher and Morningstar Investment Management’s Kunal Kapoor, increased their positions in Medtronic stock.

What is the Price Target for MDT?

Following the company’s announcement to terminate the acquisition of wearable insulin patch maker EOFlow last week, two analysts rated the stock a Buy, while two assigned a Hold.

Overall, MDT stock has received six Buys, 10 Holds, and one Sell recommendation for a Moderate Buy consensus rating. Meanwhile, the average MDT stock price target of $88.20 implies 7.7% upside potential from current levels.

Importantly, MDT has an Outperform Smart Score of “Perfect 10” on TipRanks, which suggests that it can beat the overall market from here.

Abbott Laboratories

ABT has raised its dividend payout for 51 consecutive years, making it a perfect choice for income investors. The company’s well-diversified range of products, including diagnostics, medical devices, and pharmaceuticals, supports its growth in earnings and dividends.

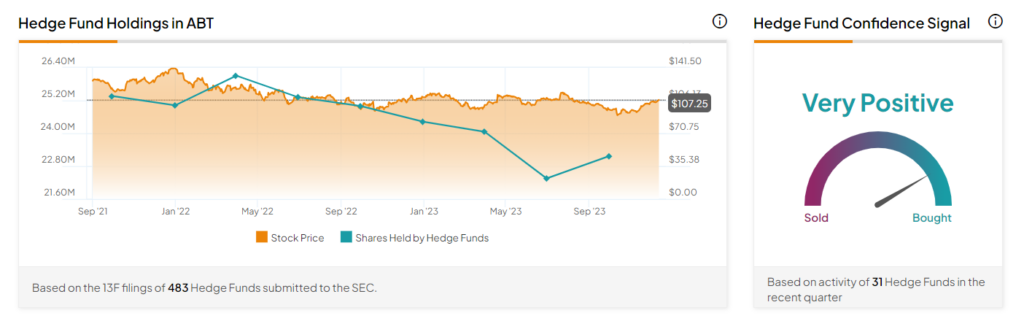

Furthermore, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 819,300 shares of this healthcare company in the last quarter. Our data shows that Echo Street Capital Management’s Greg Poole and Bridgewater Associates’ Ray Dalio were among the hedge fund managers who increased their exposure to ABT stock.

What is the Future of ABT Stock?

This week, two analysts have reaffirmed a Buy rating on the stock, including Citi analyst Joanne Wuensch. The analyst expressed cautious optimism for MedTech in 2024, citing a stable macro backdrop and historical election-year performance.

ABT stock has received 10 Buy and three Hold recommendations for a Strong Buy consensus rating. The average Abbott stock price target of $118.46 implies 10.5% upside potential from the current level.

Ending Thoughts

Both ABT and MDT stocks have a proven track record of dividend growth. This makes them attractive to investors seeking reliable income and long-term portfolio stability. Additionally, the bullish view of hedge fund managers helps instill further confidence in these stocks.