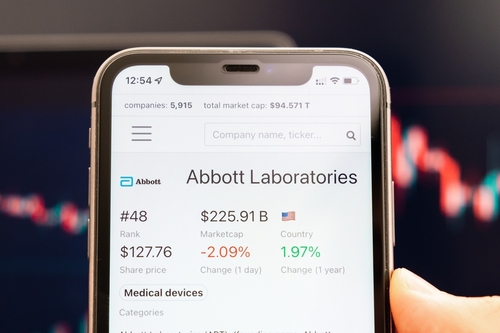

Barclays analyst Matt Miksic raised the firm’s price target on Abbott (ABT) to $149 from $143 and keeps an Overweight rating on the shares. The firm now expects Abbott’s share of the necrotizing enterocolitis liability to be closer to the low end of the expected range, or $1B-$3B. The company’s earnings growth, excluding a 5c-10c per year contribution from COVID, is projected to grow 11% growth between in 2024 and 2026, the analyst tells investors in a research note.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

Read More on ABT:

- Reckitt and Abbott Shares Rally on Baby Formula Lawsuit Win

- Morning Movers: Apple dips, Amazon gains after earnings

- Abbott, Mead Johnson secure win in infant formula trial, Reuters reports

- Raymond James says Edwards’ EARLY TAVR data also positive for Medtronic, Abbott

- Abbott initiates clinical trial of its CardioMems in advanced heart failure