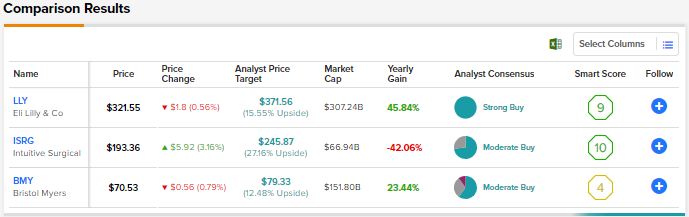

Major U.S. indexes have declined for three straight quarters due to stubbornly-high inflation and rising interest rates. The fear of an economic downturn is rising among investors. The healthcare sector is not completely immune to recessionary conditions. Nonetheless, it is generally more resilient compared to other sectors. Supply-chain issues and inflation have hurt the performance of several healthcare companies over recent quarters. That said, there are healthcare companies that have solid growth potential and could fetch attractive long-term returns. Here, we will discuss Eli Lilly (NYSE:LLY), Intuitive Surgical (NASDAQ:ISRG), and Bristol Myers Squibb (NYSE:BMY) and use TipRanks’ Stock Comparison Tool to pick the healthcare stock that could generate the most attractive returns from current levels.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Eli Lilly Stock (LLY)

Eli Lilly is widely known for its strong portfolio of diabetes drugs, which accounted for nearly 53% of the overall revenue in the second quarter. The company’s diabetes portfolio received a further boost in May with the U.S. Food and Drug Administration’s (FDA) approval of Mounjaro for type 2 diabetes. Eli Lilly’s portfolio also includes medications for other things like oncology, immunology, and neuroscience.

Last month, the company’s Retevmo drug won the FDA’s approval for the treatment of advanced or metastatic solid tumors with a RET gene fusion. Also, Eli Lilly’s alopecia areata medication Olumiant was approved in the U.S., European Union, and Japan in June. Other recent favorable developments include the FDA acceptance with Priority Review designation for Alzheimer’s drug donanemab and for pirtobrutinib to treat mantle cell lymphoma.

Eli Lilly’s weak Q2 results reflected the impact of macro challenges, lower prices of insulin Lispro products, and the decline in revenue from the cancer drug Alimta due to competition from generics. However, recent approvals and the company’s strong pipeline are driving positive investor sentiment for LLY stock, which is up 16.4% year-to-date.

Is LLY a Good Stock to Buy?

Last week, Argus analyst Jasper Hellweg increased his price target for Eli Lilly stock to $360 from $315 and reiterated a Buy rating. Hellweg highlighted the progress in the company’s pipeline, including the FDA priority review for donanemab and the aforementioned recent approvals.

The analyst expects these approvals to drive increased sales and earnings and push Eli Lilly’s stock higher over the next year. However, the analyst trimmed his FY22 earnings per share estimate by $0.40 to $7.95 and FY23 outlook by $0.25 to $9.30 to reflect the company’s revised outlook.

Eli Lilly earns the Street’s Strong Buy consensus rating backed by 10 unanimous Buys. At $371.56, the average Eli Lilly stock price target suggests 15.6% upside potential.

Intuitive Surgical Stock (ISRG)

Intuitive Surgical is the pioneer in the robotics-assisted surgical systems market. Its Da Vinci systems have gained strong acceptance over the past few years in performing robotic-assisted minimally invasive surgeries. As per Reanin Research & Consulting, Intuitive Surgical holds a whopping 71% market share of the global surgical robotics market, while Stryker (NYSE:SYK) is the second-largest player with a nearly 15% market share.

A major portion of Intuitive’s revenue is recurring in nature and is derived from the sale of instruments and accessories and also includes service revenue as well as operating lease revenue. In Q2 2022, recurring revenue accounted for 81% of the overall top line.

Supply-chain snarls, the lockdowns in China, and lower spending by hospitals amid a tough macro backdrop weighed on Intuitive’s Q2 performance. These headwinds might continue to be a drag over the near term. Nonetheless, the company is well-positioned for long-term growth based on its leadership position, continued innovation, and a huge total addressable market.

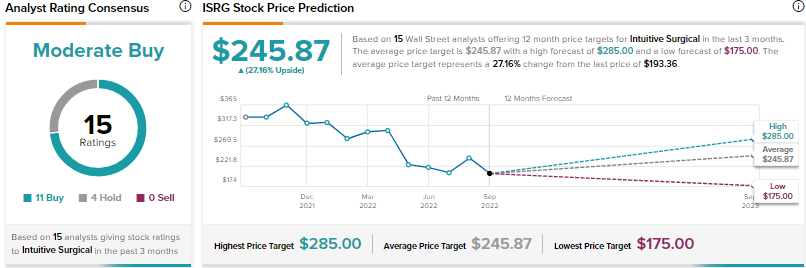

Is ISRG Stock a Buy, Sell, or Hold?

Recently, Stifel analyst Rick Wise increased his 2023 sales and EPS estimates for Intuitive to reflect more-detailed modeling for the company’s recurring revenue. Wise also highlighted that the acceptance of Ion, the company’s robotic lung biopsy system, is consistent with his “most-aggressive” preliminary estimates.

In line with his investment thesis, Rick raised his price target for ISRG stock to $260 from $250 and reaffirmed a Buy rating.

With 11 Buys and four Holds, the consensus among analysts is a Moderate Buy rating for ISRG stock. The average Intuitive Surgical stock price prediction of $245.87 implies 27.2% upside potential. Shares have plunged 46.2% year-to-date.

Bristol-Myers Squibb Stock (BMY)

Bristol-Myers Squibb stock has advanced 13.1% so far this year, faring significantly better than the broader market. Last month, the company announced two favorable updates – the FDA’s approval of Sotyktu for the treatment of moderate-to-severe plaque psoriasis and the approval of antibody combination Opdualag in the European Union for the treatment of advanced melanoma.

BMY has a strong portfolio of immunology, oncology, and cardiovascular drugs. However, there are concerns about the loss of exclusivity of the company’s blockbuster drugs, including Revlimid, Eliquis, and Opdivo.

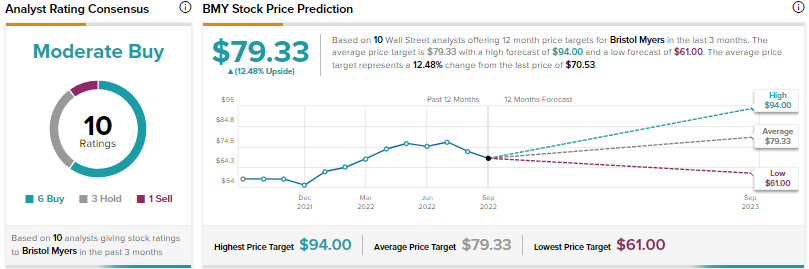

Is BMY Stock a Buy?

In mid-September, Berenberg analyst Luisa Hector downgraded BMY stock to a Hold from Buy. Hector contended that while the company appears “largely immune” to the drug price reforms under the Inflation Reduction Act, its blood thinner drug Eliquis faces risk in the first round of price negotiations in September. Furthermore, BMY also faces a significant level of Part D exposure in the new launch schedule for drugs like deucravacitinib (Sotyktu), repotrectinib, and milvexian.

Hector lowered the price target for BMY stock to $76 from $82, stating, “Following share price outperformance this year, we pause for breath as the focus shifts to delivery of sales through the launch phase.”

All in all, the Street has a Moderate Buy consensus rating for Bristol-Myers stock based on six Buys, three Holds, and one Sell. The average Bristol-Myers Squibb stock price target of $79.33 implies 12.5% upside potential.

Conclusion

Eli Lilly and Bristol-Myers have significantly outperofmed Intuitive Surgical stock year-to-date. That said, several analysts see the pullback in Intuitive Surgical stock as an attractive opportunity to build a long-term position in this market-leading surgical robotics maker. Wall Street estimates higher upside potential from current levels in Intuitive stock than Eli Lilly and Bristol-Myers. Intuitive scores a ‘Perfect 10‘ as per TipRanks’ Smart Score System, implying that the stock could outperform the market averages, going forward.