Marking the first time Li Auto’s (NASDQ:LI) monthly deliveries eclipsed 40,000 units, the company just announced a record delivery haul for October. The Chinese EV maker delivered 40,422 cars during the month, amounting to a big year-over-year improvement of 302.1%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Those figures won’t make it into the financial statement when LI reports Q3 earnings next week (Thursday, Nov 9th, before the market opens) but they certainly will be pleasing for investors, particularly as fears of growing competition have come to the fore recently.

This is a fact acknowledged by Deutsche Bank analyst Edison Yu. “While demand for Li Auto’s premium EREV SUVs has remained robust, investor concerns around competition have increased especially around Huawei-backed AITO,” Yu explained. “Combined with already high volume expectations, we see some room to disappoint going forward especially around the upcoming BEVs where pricing will start quite high.”

That is further down the line, however. Meanwhile, for the upcoming print and guide, Yu offers a positive slant. With deliveries already announced at 105,108 units (above the high-end of the 100,000-103,000 guide) implying upside to margins, Yu expects a “solid quarter.”

On the back of a strong October and “minimal impact to the order book thus far” from the competition, Li also anticipates a robust Q4 outlook but believes the aforementioned concern “likely remains an overhang in near-term.”

By the numbers, Yu is calling for revenue of RMB34.9 billion ($4.77 billion), gross margins of 22.9% (22.5% vehicle margin), and adj. EPS of 2.72 ($.37). All are above respective consensus expectations of 32.6 billion, 21.9%, and 2.39.

Looking ahead to Q4, Yu reckons LI will guide for around 120,000 units, suggesting 360,000+ for the full-year (representing a 173% YoY increase) and translating to revenue of ~ RMB121 billion ($16.53 billion).

On balance, though, while Yu is of the opinion that the stock could recapture some of the recent losses (down by 25% since the August yearly peaks) should the AITO overhang ease, he sees a “balanced risk/reward situation,” and remains on the sidelines for now with a Hold (i.e., Neutral) rating. As for the price target, the figure is reduced from $42 to $40. There’s potential upside of 14% from current levels. (To watch Yu’s track record, click here)

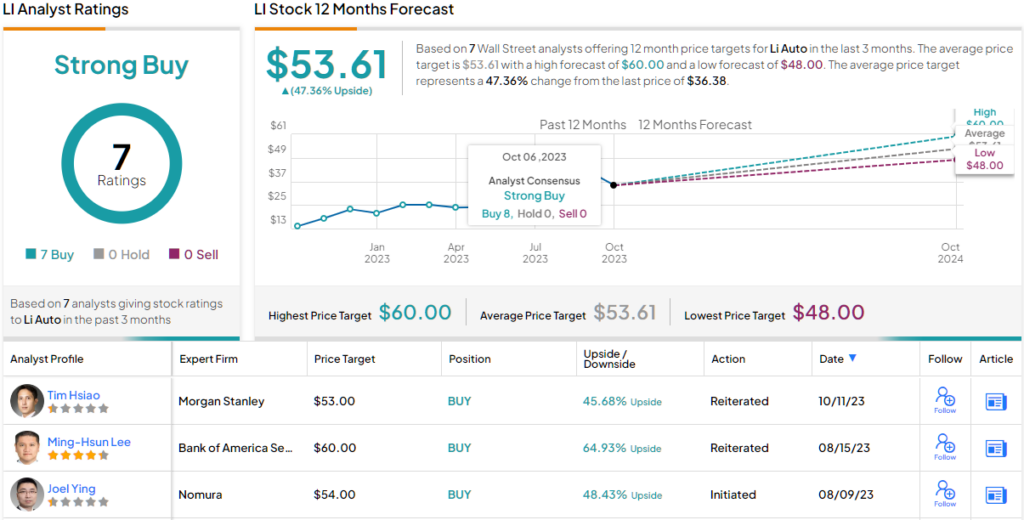

Yu, however, is currently out on his own with that skeptical take. All 7 other recent reviews are positive, making the consensus view here a Strong Buy. Going by the $53.61 average target, a year from now, shares will be changing hands for a 53% premium. (See Li Auto stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.