When you think of Tesla (TSLA), you immediately think of Elon Musk. The same thing happens when you think of SpaceX, making Musk synonymous with the companies he runs. This can benefit a company or hinder it. In the case of TSLA, it seems it’s benefiting the company more than stagnating, as investors tend to forgive Tesla even when it doesn’t deliver on its promises. The market did react negatively when Tesla’s anticipated release of its Robotaxis was delayed. Still, it’s not out of the realm to think that any other company would have paid a much greater cost than Tesla after its disappointing Robotaxis event, where the stock declined only 8% in the aftermath.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This means investors trust Musk to live up to his hype. Given Tesla’s extremely high valuation, trading at a multiple of 100, it’s fair to assume Musk’s reputation is priced in. However, another issue that needs to be clarified is its erratic stock behavior. TSLA stock has a beta of 2.03, which is pretty volatile for a company that belongs to the so-called Magnificent Seven, which is supposed to be one of the most profitable firms on Wall Street.

In recent developments, it seems that Musk is destined to have a huge role in Donald Trump’s new look administration (another persona synonymous with his companies), with a position aimed at easing government regulations and bureaucracy and making government as a whole more efficient or business-friendly. This could potentially give TSLA an advantage over its rivals in the autonomous vehicles industry and also help all commercialized industries: Transportation, Technology, Energy, and others. No wonder Wall Street reacted in such a positive manner after Trump’s reelection.

In other related news, Trump has already declared his intention to cancel the EV credits initiated by the Biden administration, which hands potential EV buyers a $7,500 discount when buying an electric vehicle. Canceling the EV tax credits could significantly slow the adoption of electric cars, making them less affordable for many consumers. This move might also challenge environmental progress and affect the competitiveness of relatively new EV manufacturers, but not Tesla, which has solidified its market position. U.S. manufacturers in the global market, reflecting a shift in policy priorities.

Let’s examine three talking points on TSLA’s current challenges and the potential impact of Musk’s new possible role in the Government:

- Stock Surge and Valuation Concerns: Tesla’s stock has been on an unstable ride, this time climbing 3.07% following Donald Trump’s re-election. This volatility is reflected in its Beta of 2.03, indicating significant price swings. Despite the rally, Tesla’s valuation remains an issue. It trades at 100x forward earnings, compared to the industry average of 21.68. For instance, Li Auto (LI) trades at 20.4x, BYD (BYD) at 21x, and General Motors (GM)at 5.5x forward earnings. With an annual compound annual growth rate (CAGR) of 14.6% over the next few years, Tesla needs to justify its rich valuation. However, maybe Musk’s new hat can help this cause.

- Elon Musk’s Potential Government Role: One of the most interesting talking points about Trump’s new look at the White House is the appointment of Elon Musk to a new role in charge of government efficiency. This position could give Musk leverage to influence policies that benefit Tesla. For Tesla, this could mean streamlined regulations for autonomous vehicles and Robotaxis, which is crucial for its future growth. Musk’s potential role could also help mitigate regulatory scrutiny from bodies like the National Highway Traffic Safety Administration (NHTSA), which has been investigating Tesla’s “Autopilot” and “Full Self-Driving” systems.

- Challenges and Opportunities in Autonomous Driving: Tesla faces stiff competition in the autonomous driving space. Companies like Waymo and Lyft (LYFT) are making significant strides, while Tesla’s Full Self-Driving (FSD) system has faced safety concerns. Despite ongoing claims, Tesla appears to be playing catch-up in the Robotaxi race. The market’s valuation of Tesla heavily relies on its prospects in self-driving vehicles, AI, and robotics. However, Musk’s potential government role could provide a strategic advantage, helping Tesla navigate these challenges and capitalize on growth opportunities.

What Is TSLA’s Price Target?

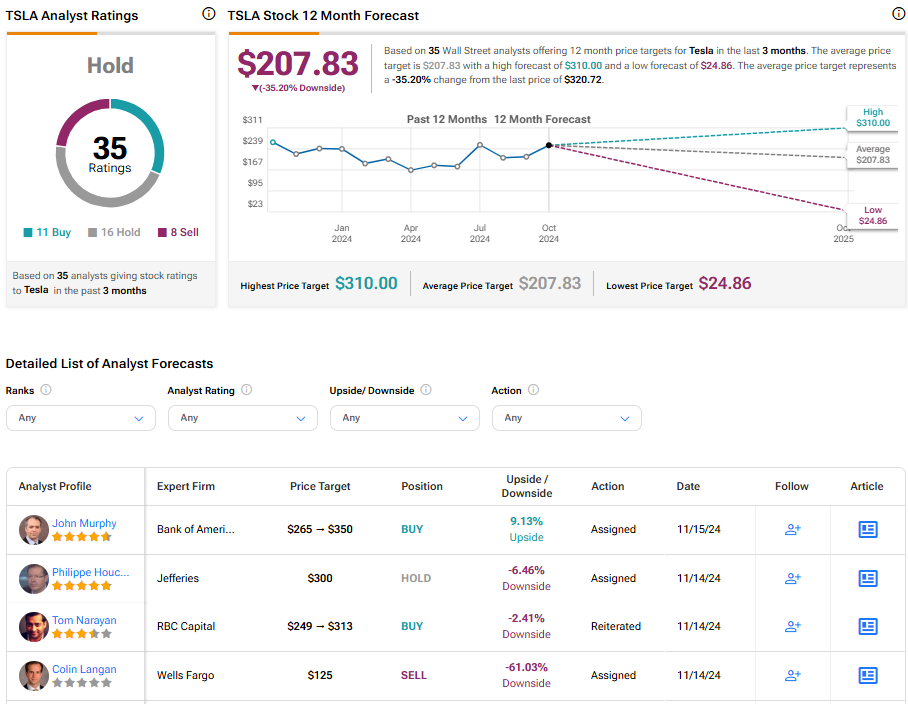

Tesla is a Hold on Wall Street, with 11 Buys, 16 Holds, and 8 Sell. The average price target for TSLA stock is $207.83, reflecting a -35.20% downside.

Final Word On TSLA

Elon Musk’s association with Tesla boosts investors’ confidence in TSLA and its prospects, even forgiving delays in its promises. Tesla’s high valuation is a problem, and so is the volatile nature of its stock, coupled with the growing competition in the autonomous industry. However, Musk’s potential role in Trump’s administration could streamline regulations and mitigate scrutiny, benefiting Tesla’s growth in autonomous vehicles and AI, whereas for now, it looks like the company is playing catch-up with its competitors. You can never bet against any of Musk’s operations. Still, as I ended my last piece on Tesla and Musk specifically, now is the time for the company to deliver on its promises.