JD.com (NASDAQ:JD) is scheduled to release its third-quarter Fiscal 2023 results on November 15, before the market opens. The company’s performance might have been impacted by the slowdown in China’s economy. Additionally, an aggressive competitive pricing strategy is expected to have affected the company’s revenue performance.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

JD.com is a technology-driven e-commerce company. Its offerings include logistics, internet-based services, infrastructure asset management, and comprehensive property services.

Overall, the Street expects JD.com to post adjusted earnings of $0.81 per ADS in Q3, lower than the prior-year quarter figure of $0.86 per ADS. Meanwhile, analysts expect the company to report net revenue of $33.9 billion, down 4.5% year-over-year.

Analyst’s Take

Ahead of the Q3 earnings release, analyst James Lee of Mizuho Securities believes that uncertainty in China’s internet sector and subdued real estate market activity might have influenced JD.com’s Q3 performance to some extent.

However, the analyst is optimistic about the company’s long-term growth. The analyst expects strong international travel demand to support JD.com’s performance in the near future. Further, Lee is optimistic about the impact of the Double 11 annual sales event, China’s biggest annual shopping festival, held on November 11. As a result, Lee maintained a Buy rating on the stock but lowered the price target to $40 from $60.

What is the Future Price of JD Stock?

On TipRanks, the average JD.com price forecast of $44.34 implies 72.2% upside potential from current levels. Also, analysts have a Moderate Buy consensus rating on JD stock based on 13 Buy and six Hold recommendations.

Insights from Options Trading Activity

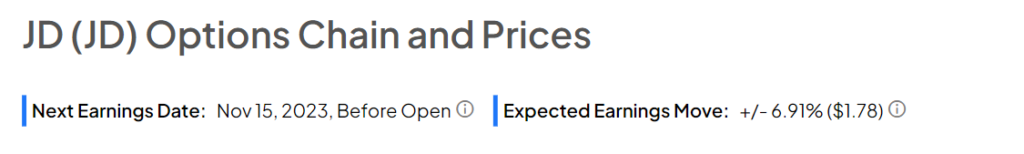

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 6.91% move on JD.com’s earnings. Interestingly, the stock gained 3.03% in reaction to Fiscal Q2 results released on August 16.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Note

China’s challenging macroeconomic conditions, including a slowing economy and ongoing real estate crisis, are expected to impact JD.com’s performance in the near term. Nevertheless, the company’s growing logistics business and focus on AI-based applications bode well for long-term growth.