Strong growth momentum is building up for Tesla (NASDAQ:TSLA) on the back of favorable government policies to boost EV space, robust demand, strong company plans, ramped-up production, and successful cost control initiatives, to name a few.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stock has been trending higher, up 7% in the last five trading days. This is despite the stock’s decline of 4% yesterday, which was due to weak market sentiments created by a worse-than-expected inflation report.

No wonder the Wall Street community is voting for Tesla to be added to the list of MATANA stocks, a term that could replace FAANG.

MATANA is the abbreviation for six top stocks, which include Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG).

Tesla’s in the Fast Lane

Earlier this week, Tesla laid out impressive five-year plans at the Goldman Sachs tech conference held in San Francisco.

The company has achieved ways to reduce the cost of production for its EVs by more than half in the past year. The production cost of an EV has come down from $86,000 in 2017 to $36,000 currently.

Tesla has already achieved 1,000 units of production in a week for its Model Y electric crossover. Further, the company aims to produce 5,000 units a week at its Giga Berlin plant in Brandenburg, Germany, by the first quarter of Fiscal 2023.

To bolster its electric-vehicle battery production, Tesla is on the lookout to build a first-of-its-kind, battery-grade lithium hydroxide refining facility in Texas.

Yesterday, Twitter’s (NYSE:TWTR) shareholders approved the proposed $44-billion bid by Tesla CEO Elon Musk to take Twitter private. However, it is highly likely that the deal, which is facing legal trials, may fall apart.

Is Tesla a Strong Buy?

As per TipRanks, the Street is cautious but optimistic about Tesla stock. Tesla commands a Moderate Buy consensus rating, which is based on 19 Buys, five Holds, and six Sell. Tesla’s average price forecast of $309 implies 5.77% upside potential from the current levels.

On September 12, Mark Delaney from Goldman Sachs reiterated a Buy rating on Tesla with a price target of $333.33 (14.1% upside potential), following the Goldman Sachs Technology Conference.

Delaney was impressed with the long-term supply/demand backdrop laid out by Tesla, an improving semiconductor and battery-cell supply environment, and lowered production costs.

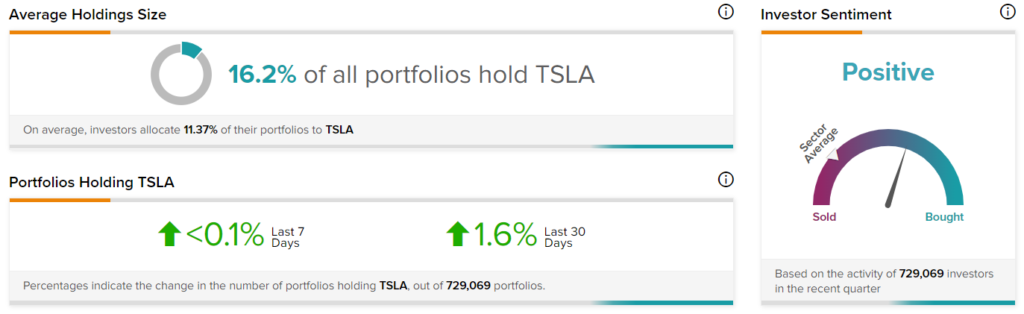

Further, based on 729,069 investor portfolios analyzed by TipRanks, the investor community looks Bullish on Tesla.

Key Takeaway

Despite some near-term hiccups, including the Fed rate hikes, Tesla’s long-term growth potential is expected to remain intact. Investors may want to make the most of the stock price weakness in the coming weeks.

Read full Disclosure