The easiest gains to be had in the chip scene may already be in the books, but that doesn’t mean all semiconductor stocks are destined to trade sideways or lower from here. Numerous Wall Street analysts still view some of the biggest players in the space — like ASML, TSM, and CDNS — as Strong Buys.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Indeed, emerging tech trends, including the rise of generative artificial intelligence (AI), could keep the broader basket of semiconductor stocks going strong from here, even as the economy grinds to a slowdown.

Undoubtedly, many firms have already had opportunities to shed light on their AI plans. As these firms walk the walk (AI chatter is great, but eventually, firms will need plans to monetize the technology) after a year of taking the talk, AI may very well be the growth driver that helps semiconductor firms offset a sizeable portion of the macro headwinds to come.

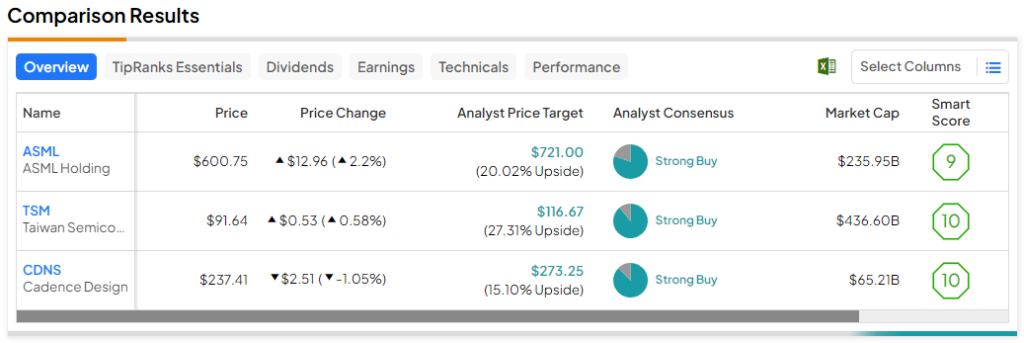

Therefore, let’s check in with TipRanks’ Comparison Tool to view the three aforementioned Strong-Buy-rated chip stocks that may still have room to rip higher over the year ahead.

ASML (NADSAQ:ASML)

First up, we have ASML, a company with a monopoly in its corner of the semiconductor space. The Netherlands-based company’s dominance in the extreme ultraviolet (EUV) lithography system market is remarkable. TipRanks contributor Nikolaos Sismanis recently drove home the point that the firm has one of the widest moats in the entire semiconductor scene, thanks to its legal monopoly.

Given how many semiconductor fabricators rely on the firm and its cutting-edge EUV systems, ASML is arguably one of the monopolies that can have its way with antitrust regulators. After all, nobody wants to introduce any unnecessary hurdles to the semiconductor supply chain, especially after witnessing the severe impact of the COVID-19 pandemic.

The major headwind weighing down ASML stock lies in regulations arising from elevating tensions between the U.S. and China. Indeed, ASML is such a critical player in the semiconductor world that U.S. export regulations would probably put China at a considerable technological disadvantage.

For ASML, such export controls could limit the firm’s sales for some time. It’s never good news if one of the largest markets on the planet is taken (mostly) offline. Such regulations could give rise to a sizeable Chinese competitor, but one that’s unlikely to wither away ASML’s wide moat.

Indeed, monopolies and wide moats are great traits to have for prospective investments. Given the recent slide in the stock, I believe investors are getting a dominant force in the semiconductor space for a pretty modest price of admission. As such, I am bullish on ASML.

At writing, the stock is down around 33% from its peak hit back in September 2021. Indeed, quite a bit of negativity is already baked in here, thanks in part to geopolitical risks and a recent downgrade from notable analyst Ming-Chi Kuo of TF International Securities, who foresees a “significant” EUV forecast downgrade in the cards.

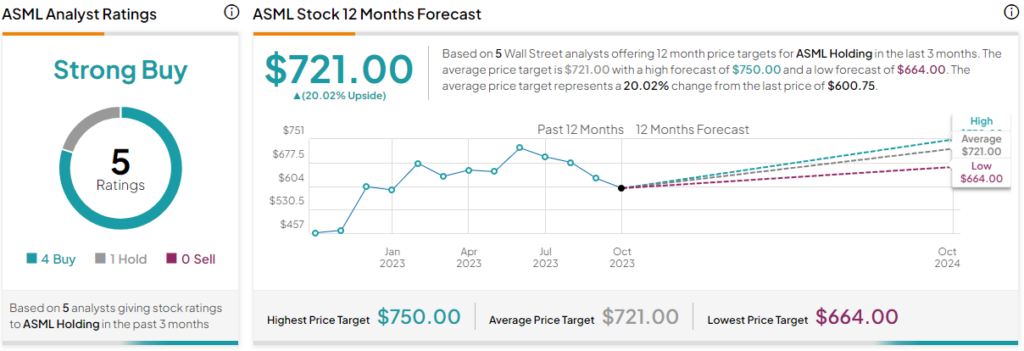

What is the Price Target for ASML Stock?

ASML is a Strong Buy, with four Buys and one Hold rating given in the past three months. Further, the average ASML stock price target of $722.20 implies 20% upside potential.

Taiwan Semiconductor (NYSE:TSM)

Taiwan Semiconductor is a semiconductor foundry behemoth that’s also been a roller-coaster ride over the past few years. Given its size, Taiwan Semiconductor’s influence on the global semiconductor market is profound. If it goes down, so too does the market. Given its location, an investment in the firm entails some degree of geopolitical risk. Indeed, a Chinese move into Taiwan is a low-probability event that would come with a massive negative impact. Despite the big risk, I remain bullish on TSM stock, mostly due to its valuation.

Over the years, the firm has effectively used its size to its advantage in a booming market. In many ways, Taiwan Semiconductor has many of the makings of a Warren Buffett company. In fact, Buffett’s Berkshire Hathaway briefly held the stock before selling most of its stake after considering geopolitical tensions between the U.S. and China.

Indeed, TSM stock seems to reek of value after its latest slip (down 35% from highs), with shares going for 16.4 times trailing price-to-earnings (P/E), well below the semiconductor industry average of 31.8 times. But how much of a discount is warranted due to geopolitical risks? Probably not as much as is currently being priced in, at least according to analyst views.

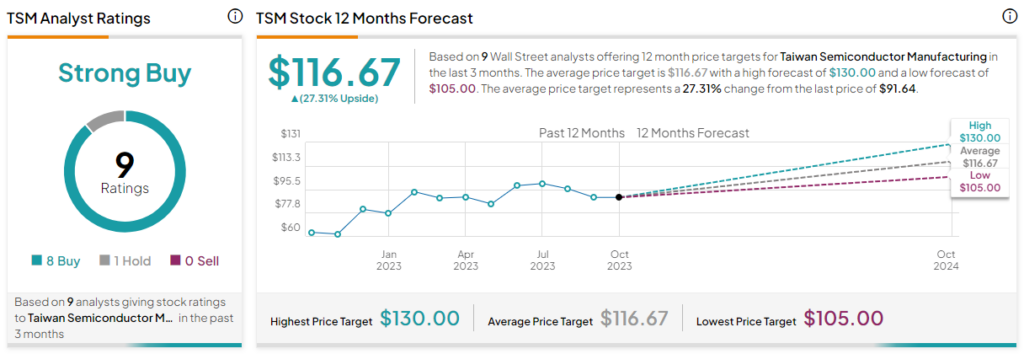

What is the Price Target for TSM Stock?

Taiwan Semiconductor stock is a Strong Buy, with eight Buys and one Hold given by analysts in the past three months. The average TSM stock price target of $116.67 entails 27.3% upside potential.

Cadence Design Systems (NASDAQ:CDNS)

Finally, we have Cadence Design Systems, a firm that sells various products used in the design of electronics. Unlike Taiwan Semiconductor or ASML, Cadence has been steadily hitting new all-time highs throughout the year.

At writing, shares are just 5% off their high and up nearly 50% year-to-date. With skin in the AI game and a strong second quarter in the books (earnings per share of $1.26 vs. the $1.20 consensus on $1.02 billion in revenue), it’s not a mystery as to why analysts view the stock in such a positive light. Though I’m in a similar boat, I can’t say I’m a big fan of the premium valuation on shares. As such, I’m inclined to stay neutral.

The company’s latest quarter saw 13.3% in sales growth, thanks to robust uptake for its hardware platforms (think Palladium Z2 and Protium X2). Moving ahead, its AI platforms (think Cerebrus and Verisium) could act as yet another growth driver for a firm that could keep its foot on the accelerator through a potential recession year. Cerebrus actually won Fast Company’s 2022 Next Big Things in Tech Award for its use of AI in chip design.

Despite a strong line-up of solutions, the 67.8 times trailing price-to-earnings multiple is a very rich premium to the industry average. Cadence deserves a premium, but the current premium seems excessive, in my opinion. For now, I’d be more inclined to wait for a pullback — perhaps to an area of support in the $180-189 range (current price is over $237) — before I’d consider initiating a position.

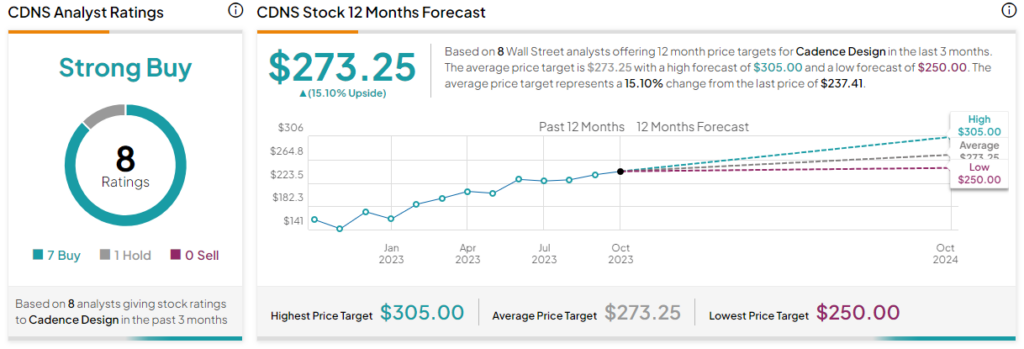

What is the Price Target for CDNS Stock?

Cadence sits at a Strong Buy, with seven Buys and one Hold rating. The average CDNS stock price target of $273.25 implies upside potential of 15.1%.

The Takeaway

There’s still plenty of upside to be had in the chip stocks, at least according to many big-name Wall Street analysts. AI is a potential growth driver that could help firms navigate through an economic rough patch. However, investors should also be aware of the potential geopolitical risks that some of the chip names entail. Of the three stocks covered in this piece, analysts see the most upside potential (~27%) from TSM.