Advanced Micro Devices (AMD) is a major supplier of computer microprocessors and graphics processors. The company’s chips are used in desktops, notebooks, data centers, and other consumer markets.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Due to the recent tech sell-off, AMD has lost approximately 43% of its value year-to-date. However, AMD continues to expand rapidly. New product releases and strategic acquisitions (like Xilinx and Pensando) are bolstering the company’s portfolio.

When it comes to the fourth-quarter earnings report, Advanced Micro Devices delivered strong numbers. The top and bottom lines both surpassed Wall Street consensus forecasts. Revenues of $4.83 billion climbed by 49% year-over-year, while earnings per share increased by 77% to $0.92.

Next week, on May 3, the firm will release its Q122 earnings. Let’s take a look at how the business is projected to do in the upcoming quarter.

Will Earnings Growth Momentum Continue?

According to analysts, AMD is projected to report adjusted earnings of $0.91 per share in the first quarter. This represents a year-over-year increase of 75%.

During the Q4 earnings call, AMD CEO Dr. Lisa Su expressed confidence in the company’s growth in 2022. She said, “We expect another year of significant growth in 2022 as we ramp our current portfolio and launch our next generation of PC, gaming, and data center products.”

For the first quarter, AMD anticipates revenues of $4.9 billion to $5.1 billion. The corporation expects $21.5 billion in revenue for full-year 2022. Meanwhile, analysts estimate $5.52 billion in revenue for the first quarter.

Recent Developments

AMD agreed to buy Pensando for $1.9 billion earlier this month. Pensando is a leader in the field of distributed computing. The acquisition should be completed by the second quarter of 2022 and will help AMD improve its data center offerings in the face of fierce competition.

Apart from the Pensando deal, AMD recently completed the $50 billion acquisition of Xilinx. The deal is projected to boost margins, EPS, and cash flow immediately.

The acquisition should strengthen AMD’s footprint in critical areas such as data centers, as well as in the telecommunications, industrial, and defense markets.

Wall Street’s Take

Ahead of the Q1 results, analyst Chris Caso of Raymond James is bullish on AMD’s fundamentals and expects the firm to gain market share in the data center space.

Caso writes, “As we have become more concerned about cycle risks given the potential for slowing consumer demand and elevated inventory levels at customers, we favor those semi companies with strong secular drivers, more muted cyclical exposure, and attractive valuations, for which AMD appears well-positioned.”

He further adds, “We have strong confidence regarding AMD’s position and share gains in the data center market.”

As a result, Caso maintained a Buy rating on the stock and a price target of $160 per share. This implies 88.4% upside potential from current levels.

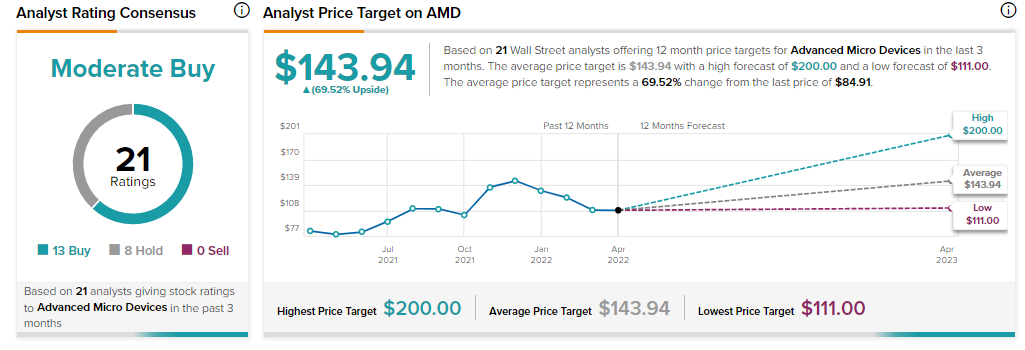

On TipRanks, AMD stock commands a Moderate Buy consensus rating based on 13 Buys and eight Holds. As for price targets, the average AMD price target of $143.94 implies almost 70% upside potential from current levels.

Bottom Line

Advanced Micro Devices is expected to benefit from the strength in the data center market and new product releases. The recent buyout of Xilinx should also help the company’s top-line growth. Furthermore, with double-digit upside potential and bullish analyst commentary, the stock appears to be a good bet.

However, the slowing PC market, as well as increased rivalry from Intel Intel (INTC) and Nvidia (NVDA), could be a source of concern in the quarter.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure