Chinese e-commerce giant Alibaba Group Holding Ltd. (NYSE:BABA) is set to release its second quarter Fiscal 2023 results on November 17, before the market opens.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Street expects BABA to post an adjusted profit of $1.68 per ADS in Q2, significantly lower compared to the year-ago quarter figure of $1.74 per ADS. Meanwhile, revenue is pegged at $29.34 billion, 5.8% lower than Q2FY21 revenue of $31.15 billion.

Factors Affecting Alibaba’s Performance

A slew of macroeconomic headwinds, including COVID-19-related lockdowns in China, intense competition, and sluggish growth, may have impacted Alibaba’s retail sales performance during the second quarter. At the same time, U.S. restrictions on chip exports to China stand to deteriorate Alibaba’s Cloud business.

Last month, the National Bureau of Statistics of China reported that the total retail sales of consumer goods (except automobiles) rose 1.2% year-over-year in September. Similarly, for the nine months ending September, the figure grew a modest 0.7%, indicating a slow but steady improvement in retail sales.

Additionally, the news that the figure for online retail sales of physical goods jumped 7.2% between January to October has pushed the shares of Chinese tech companies higher today. BABA stock is up 11.4% in pre-market trading on the news at the last check.

Moreover, an improvement in the global website traffic visits at Alibaba shows that the tides may be turning favorable for the e-commerce giant.

Is Alibaba Stock a Buy, Sell, or Hold?

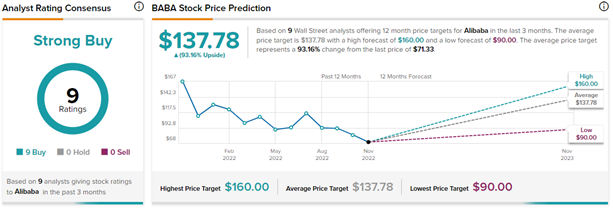

Despite the near-term challenges, analysts remain highly optimistic about Alibaba’s long-term potential. With nine unanimous Buys, BABA stock commands a Strong Buy consensus rating. Also, the average Alibaba price target of $137.78 implies an impressive 93.2% upside potential to current levels. Meanwhile, the stock has lost 40.8% so far this year.

Also, Alibaba currently trades at a relatively low Price/Sales ratio of 1.83x, reflecting that the stock is favorably positioned for a high upside swing once the headwinds are behind.

Ending Thoughts

Alibaba is reeling from the macroeconomic headwinds and regulatory challenges that are impacting the majority of Chinese stocks. Nonetheless, Alibaba boasts a solid moat and stands to benefit the most once the headwinds are cleared. Analysts, too, are extremely bullish about the stock’s trajectory going forward. Furthermore, a recovery in online retail sales, the re-opening of the Chinese lockdowns, and related supply chain easing will lead to a full-throttle recovery for Alibaba’s business.